Weekly Stats

Visible stocks increased to 1,503,000

Last week 1,453,000 MT

Deliveries

377,600 this week

429,600 last week

5,283,000 year to date

4,995000 MT year to date last year

Exports

165,200 this week

141,100 last week

2,389,000 MT Year to date

2,068,000 MT year to date last year

Crush

176,500 MTthis weeek

216,299 MT last week

2,157,000 MT year to date

2,251,000 MT year to date last year

We are shaping up to move at 19.5 to 20.0 mill mt pretty easy IMO. Viterra has been selling some vessels to China over the last few weeks. Demand still sounds to be strong from there.

Funds now long 15,000 contract.

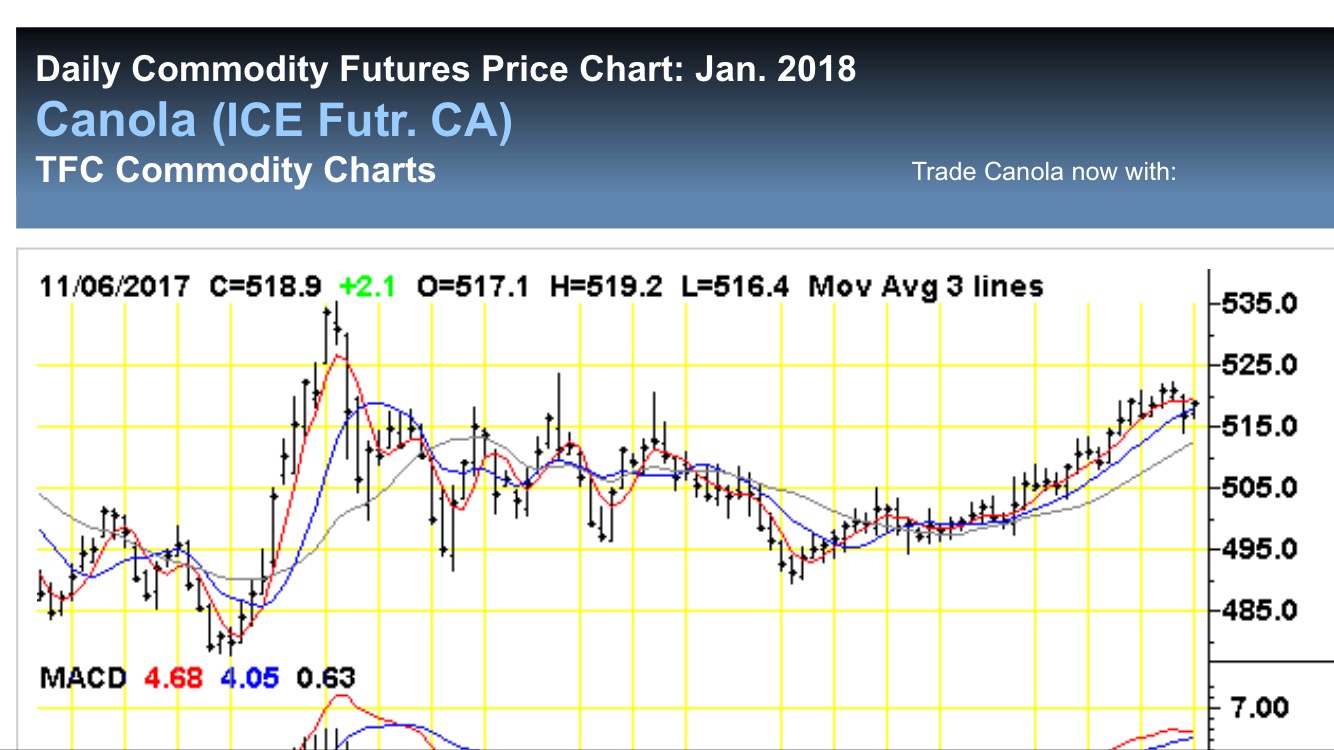

Another pretty good week in this market.

Seasonal charts showing canola usually starts to make a break down from mid Nov to Christmas but we also started our run higher 2 weeks earlier this year.

USA report next week. Later bean yields in the U.S. certainly have not be as good but remember they dropped their yields in their last report.

More people out there talking a 21 to 22 million tonne crop (I don't believe its that big but if someone starts trading that canola looks expensive today.)

Feels like a good time to take another slice of sales off here to get some grain moving throughout the winter.

I was able to book some 11.90 Feb and 12.01 March delivery canola in Southern MB this week.I hear there was some 11.50 Dec delivery as well at viterra for guys who want to open some bins before Christmas.

Long term still feel we are going to see 12.50 to 13.00 canola April forward. , but its time to take some risk off the table now IMO.

Visible stocks increased to 1,503,000

Last week 1,453,000 MT

Deliveries

377,600 this week

429,600 last week

5,283,000 year to date

4,995000 MT year to date last year

Exports

165,200 this week

141,100 last week

2,389,000 MT Year to date

2,068,000 MT year to date last year

Crush

176,500 MTthis weeek

216,299 MT last week

2,157,000 MT year to date

2,251,000 MT year to date last year

We are shaping up to move at 19.5 to 20.0 mill mt pretty easy IMO. Viterra has been selling some vessels to China over the last few weeks. Demand still sounds to be strong from there.

Funds now long 15,000 contract.

Another pretty good week in this market.

Seasonal charts showing canola usually starts to make a break down from mid Nov to Christmas but we also started our run higher 2 weeks earlier this year.

USA report next week. Later bean yields in the U.S. certainly have not be as good but remember they dropped their yields in their last report.

More people out there talking a 21 to 22 million tonne crop (I don't believe its that big but if someone starts trading that canola looks expensive today.)

Feels like a good time to take another slice of sales off here to get some grain moving throughout the winter.

I was able to book some 11.90 Feb and 12.01 March delivery canola in Southern MB this week.I hear there was some 11.50 Dec delivery as well at viterra for guys who want to open some bins before Christmas.

Long term still feel we are going to see 12.50 to 13.00 canola April forward. , but its time to take some risk off the table now IMO.

Comment