Where to from here? A couple of dirty dives and....

Announcement

Collapse

No announcement yet.

Wheat

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

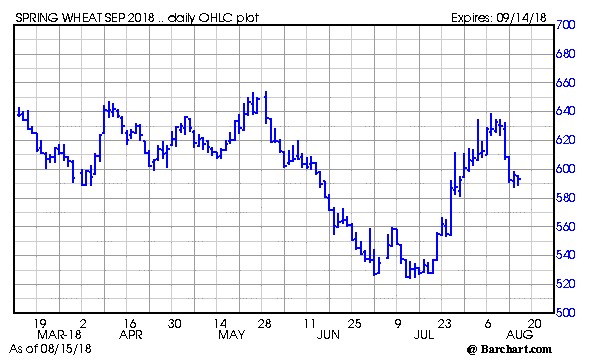

When you look at the Sept chart there was never really any extended period of sideways trading...it was either on its way up or down. Currently it seems to have paused and I wonder which direction it will take and what will drive it... fundamentals or specs.

101? Opinion... (and not of the crop or the fact we still swath)

Comment

-

-

Fundamentally world conditions are going to determine any prices advances, so Chicago wheat will lead prices. SF3 noted that there are forecasts out there for a much smaller Aussie crop than the latest WASDE.

At home harvest pressure is going to keep a lid on prices. Demand is decent right now. There was a 40 cent premium on for a few minutes yesterday. 7.25 for Aug del #1 13.5. Trendline prices going back over 2 years are around 6.80 avg for SK #1 13.5.

Pricing will be off Dec very shortly I expect.

The chart is saying "hold". MWZ could see a "sell" with a couple closes below 606.25.

The 6.12 I mentioned a bit ago is in the range every day yet. Have to wait and see. My sense is that I think the trade is ok with prices in this area and may not push it too much. It will take bullish news which is likely not going to pop up for a while. Have had quite a lot of bullish news in the last while and we already have the result

This is all very amateur. For a more professional analysis go here:

https://talk.newagtalk.com/forums/thread-view.asp?tid=799615&mid=6929342#M6929342 https://talk.newagtalk.com/forums/thread-view.asp?tid=799615&mid=6929342#M6929342

Comment

-

I'm cancelling my subscription to Weber Commodities and all other newsletters I subscribe to and going to follow "Pat".Originally posted by farming101 View PostFundamentally world conditions are going to determine any prices advances, so Chicago wheat will lead prices. SF3 noted that there are forecasts out there for a much smaller Aussie crop than the latest WASDE.

At home harvest pressure is going to keep a lid on prices. Demand is decent right now. There was a 40 cent premium on for a few minutes yesterday. 7.25 for Aug del #1 13.5. Trendline prices going back over 2 years are around 6.80 avg for SK #1 13.5.

Pricing will be off Dec very shortly I expect.

The chart is saying "hold". MWZ could see a "sell" with a couple closes below 606.25.

The 6.12 I mentioned a bit ago is in the range every day yet. Have to wait and see. My sense is that I think the trade is ok with prices in this area and may not push it too much. It will take bullish news which is likely not going to pop up for a while. Have had quite a lot of bullish news in the last while and we already have the result

This is all very amateur. For a more professional analysis go here:

https://talk.newagtalk.com/forums/thread-view.asp?tid=799615&mid=6929342#M6929342 https://talk.newagtalk.com/forums/thread-view.asp?tid=799615&mid=6929342#M6929342

Comment

-

NSW or east coast australia wheat hit $425 new season this week Barley $380

Drought looks like not abating until 2019

Comment

-

A little before 5 a.m. CDT, December Chicago wheat was quietly trading a few cents lower as it normally might, but a few minutes later, prices began to climb rapidly, following a surge of buying interest in Europe. Typically, U.S. markets don't trade that actively that early in the day, but Dow Jones later explained unconfirmed news that Russia's Ag Ministry may have mentioned curbing grain exports. Russia denies making such a statement so the status is unclear. Even so, the market's jumpy response shows how concerned traders are about the impacts of this year's dry weather. Here in the U.S., drought remains a concern in the Southern Plains for the next winter wheat crop, but the seven-day forecast does have rain on the way to help conditions before planting starts next month. December Minneapolis wheat closed up 12 cents Friday with the forecast still dry for the northwestern U.S. and western Canadian Prairie. With traders still showing concern about dry weather and this year's lower global production, the trends for all three U.S. wheats remain up. DTN's National SRW Index closed at $5.14 Thursday, 28 cents below the September contract and not far from its high in 2018. DTN's National HRW Index closed at $5.28 Thursday, also near its high in 2018.

Comment

- Reply to this Thread

- Return to Topic List

Comment