MacDon02

I hate quoting myself but here it goes...

"I am not the most astute grain marketer or market watcher and an even worse analyst....."

I understand and know the limitations and lack of knowledge I have regarding the above quote. My posts are opinions not anything anyone should use to market their grain. I do NOT have a firm handle on the market and the idiosyncrasies that will move it in whatever direction...speculatively or fundamentally.

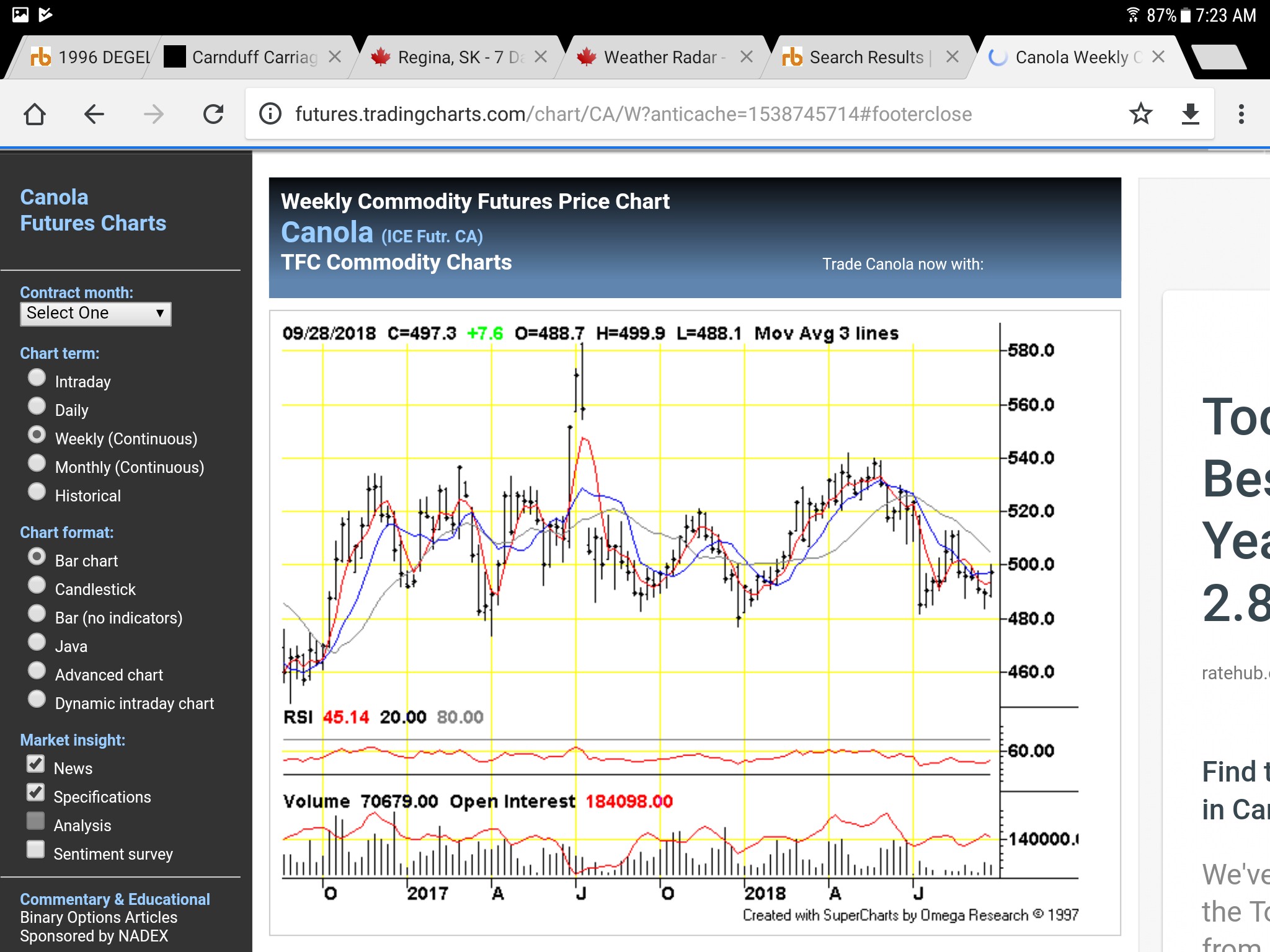

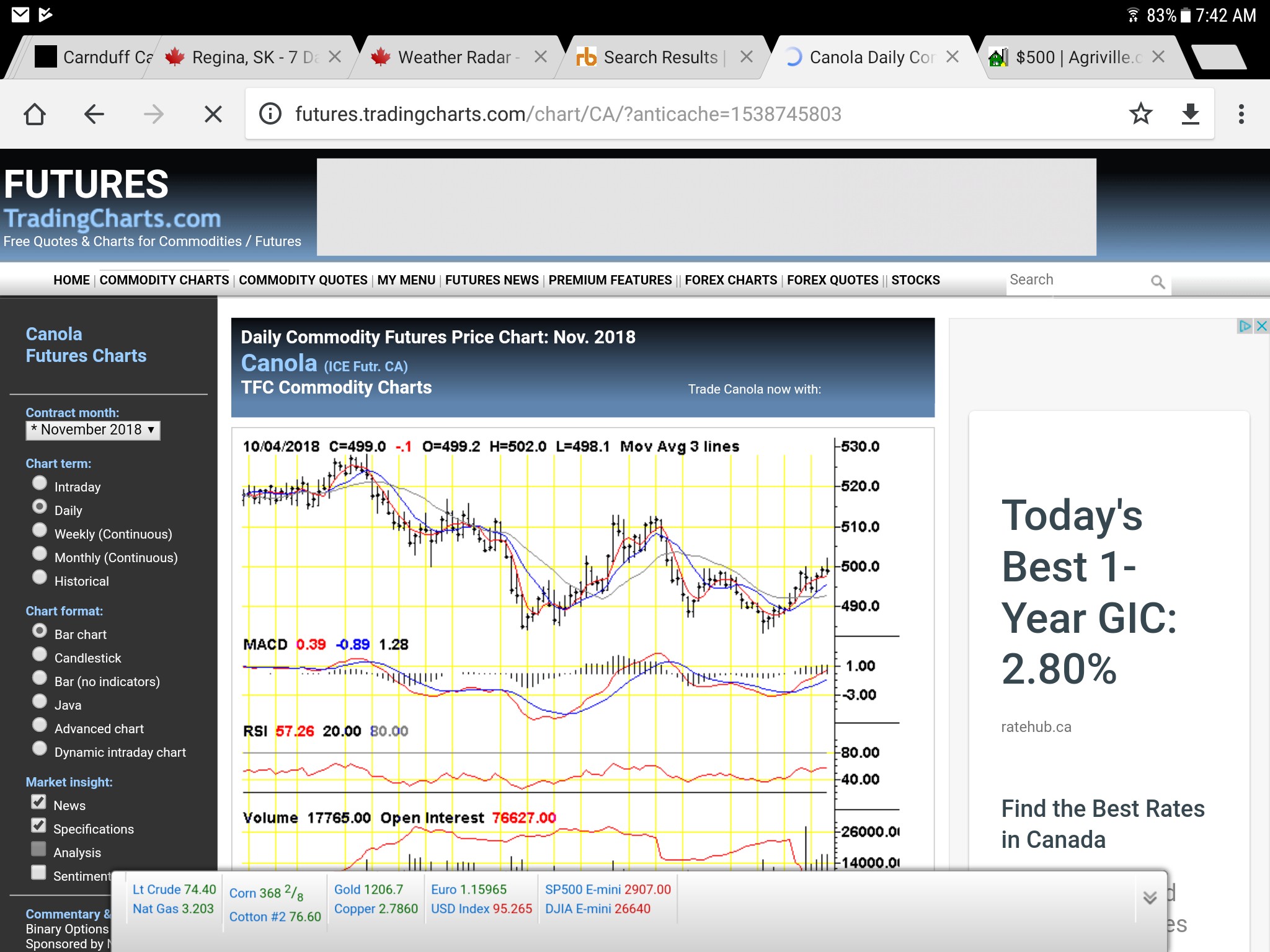

I just posted the historical chart to show $600 probably isn't out of the realm of possibilities given the current set of circumstances...

I won't even take advantage of the possibility with paper...probably just gamble with the physical in the bin.

I hate quoting myself but here it goes...

"I am not the most astute grain marketer or market watcher and an even worse analyst....."

I understand and know the limitations and lack of knowledge I have regarding the above quote. My posts are opinions not anything anyone should use to market their grain. I do NOT have a firm handle on the market and the idiosyncrasies that will move it in whatever direction...speculatively or fundamentally.

I just posted the historical chart to show $600 probably isn't out of the realm of possibilities given the current set of circumstances...

I won't even take advantage of the possibility with paper...probably just gamble with the physical in the bin.

Comment