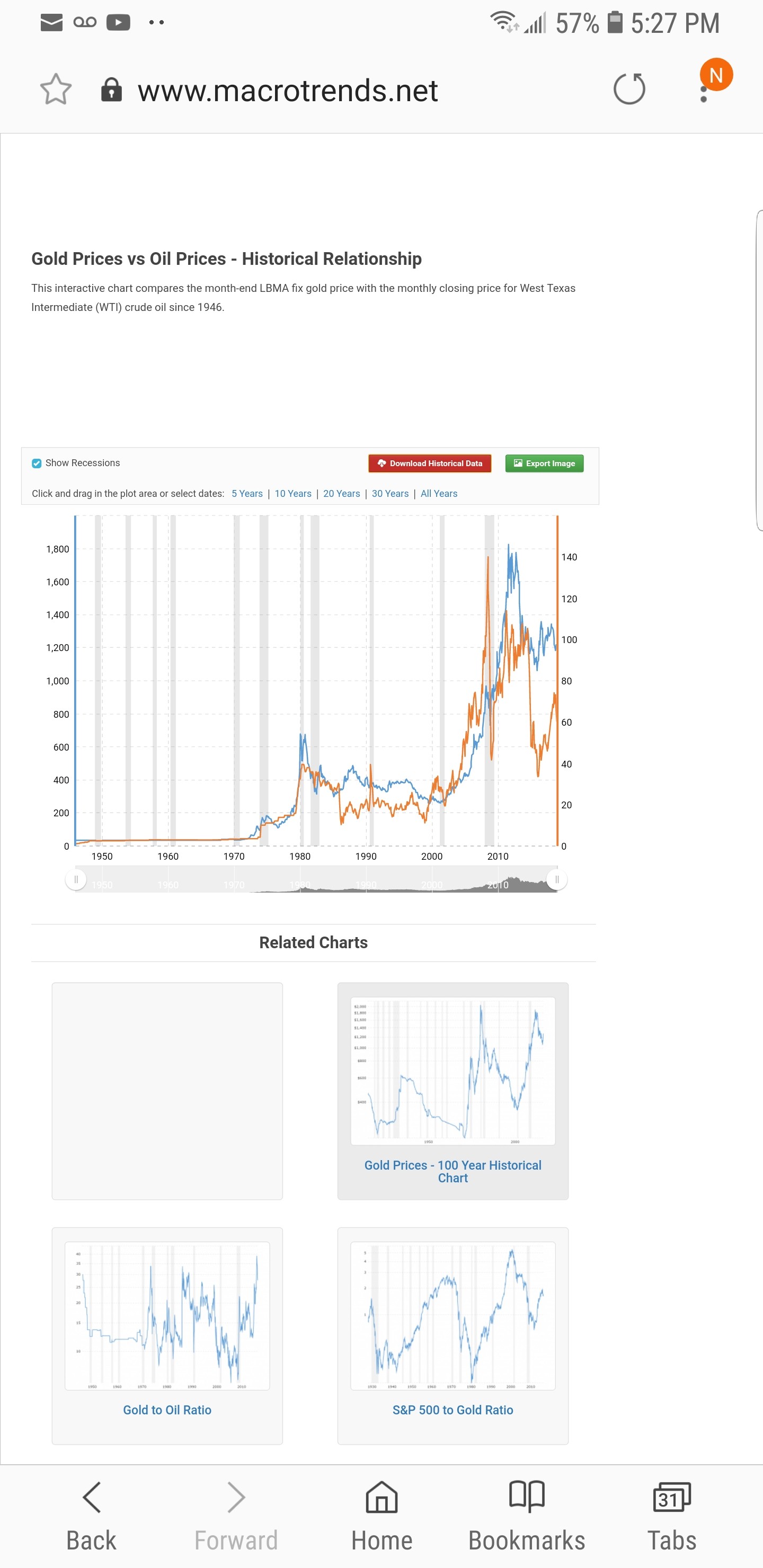

Eleven (11) straight trading sessions and counting that the king of commodity markets 'CRUDE OIL' have declined. This is now the longest consecutive daily decline in global oil prices . . . ever. WTI now breaking well below $60 per barrel. WCS oil struggling to stay above $20 per barrel.

This will intensify the current deflationary wave engulfing global commodity markets including ag, precious metals and industrials (IMO). Global trade is now clearly slowing with ample shipping capacity now on-the-sidelines.

U.S. Fed 'playing-up' the inflation story hiking rates in-order to again have 'some rope' to cut rates in the next downturn. Bank of Canada rate hikes couldn't come at a worst time (IMO) . . . .

This will intensify the current deflationary wave engulfing global commodity markets including ag, precious metals and industrials (IMO). Global trade is now clearly slowing with ample shipping capacity now on-the-sidelines.

U.S. Fed 'playing-up' the inflation story hiking rates in-order to again have 'some rope' to cut rates in the next downturn. Bank of Canada rate hikes couldn't come at a worst time (IMO) . . . .

Comment