Originally posted by Misterjade9

View Post

Announcement

Collapse

No announcement yet.

Crude Oil's Deflationary Trigger . . . .

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Maybe a couple of new pipelines could have helped alleviate the problem.

Too bad the "Anti-crowd" won't be the first to feel the pain. I challenge them to live without anything either made from or transported with oil derivatives....hypocrites.

Comment

-

Pipelines are 2 yrs away at best.

With today's politics, I don't see that happening.

Western Canada has been in a " Phantom Recession " for 2 yrs??? now.

Canadian economy shows strong growth but regionally it just keeps getting worse.

Was surprised to see job growth in last Sask report.

Comment

-

Most of the anti crowd funding is from billionaires in California. The Rockefeller group, Tides foundation have been very successful stopping pipelines in Canada.Originally posted by farmaholic View PostMaybe a couple of new pipelines could have helped alleviate the problem.

Too bad the "Anti-crowd" won't be the first to feel the pain. I challenge them to live without anything either made from or transported with oil derivatives....hypocrites.

It would be an excellent educational opportunity for an absolute shut down of natural gas flowing to BC. The looney hippies in BC would quickly appreciate the value of fossil fuels and pipelines.

Comment

-

There is no money in fallow. Payments need cash flow, fallow fields are a total liability. Mortgage, taxes, tractor hours, fuel, chemical. Legume seed, inoculant. Be prepared to take a $125.00/acre expense with no crop.Originally posted by ajl View PostExpect lower prices for the commodities you produce. Those have been in a clear deflationary trend for some time now. The most obvious example is canola in 2012 was $14USd per bushel. Today around $7.75 USD per bushel. Farmers tend to be all about inflation so they miss deflation when it is sitting in front of their nose. Input suppliers get this and collude on prices. As for getting screwed: yes and badly. The eighties were as bad as they were because farmers getting used to hyper inflation just could not see deflation in time and it wiped many out. Prices in loonie terms are irrelevant. Always convert to $USD for an indication. Looking at green fallow and sludging here in 2019.

Consider the fact that if the planted acres dont do well for drought or flood or frost you have even less volume of production to sell. Fallow can tip the scales the wrong way for a farm. Check with your lender, they may not be in favour of fallow.

Comment

-

-

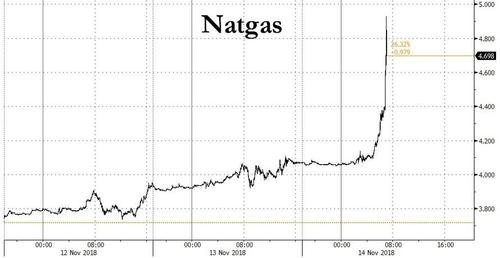

That chart is definitive proof that global warming must be serious. Why else would demand for gas go up just as winter starts? Obviously because everyone is running their AC driving up demand for gas fired electricity.Originally posted by biglentil View PostNo deflationary pressure on nat gas.

Comment

-

furrow, I’m concerned about the markets, concerned about ag, concerned about the trades, concerned about the housing market, concerned about families with heavy debt, the list goes on. Thankfully, Calgarians rejected the Olympic bid (IMO) . . . . There may be a huge setback for most everyone heading toward 2020.Originally posted by furrowtickler View PostSometimes it gets confusing with what is happening around the world as you point out Errol , no doubt oil is slipping. But we as farmers are still starring directly at ever increased costs , almost daily if you have priced out fertilizer over the past two weeks . Machinery continues to skyrocket... so is it the deflation that leads to inflation?? Kinda smart ass but reality simply does not reflect to what coming out of our pockets ???

So should we expect lower costs for fuel , fert , machinery?? Not increased costs ?

If lower , just how bad are we currently getting screwed?

Not mincing words, but we are heading toward a potential deep recession, driven by debt overload and credit market fallout. U.S. banks are now starting to feel the fallout. U.S. analysts are quick to blame Europe, but that may or may not be the whole story. Credit market fallout ie; liquidity is now on my radar.

North American growers will be faced with oversupply. This means a push toward bigger yields, but at lower prices. There will be rallies, but there will be disappointments. The dynamics of global commodities are shifting. Gov’t, bankers, politicians will not face up to deflation risks. Inflation stateside has only been driven by Trump’s tariffs skewing costs. This is not inflation (IMO).

Debt not longer drives economic growth. This means to me, the debt bubble has burst. I’m pissed at our leaders, there is simply little economic savvy, just can kicking policies that have now come home-to-roost.

Comment

- Reply to this Thread

- Return to Topic List

Comment