This question is for Errol. Last week Farmlink came out with a 100% sold recommendation for 2018 canola, their reasoning is that they believe there is a real possibility of a canola embargo by the Chinese. Supposedly the Chinese are balking at unloading ships carrying Canadian canola, adding a little more paperwork and bureaucracy. There are also the usual suspects of a large bean supply in the U.S and new crop in S.A. Errol, what are your contacts saying about the possibility of a Chinese embargo in retaliation to this Huawei situation? The Chinese new year is upon us and not much happens during this time, is it possible that this will somewhat smooth out in a couple of weeks?, or is the short term damage irreversible?

Announcement

Collapse

No announcement yet.

China and canola

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Tags: None

-

2 thoughts come to mind.

1) What everyone knows isn't worth knowing. The market likely has already priced in much of the risk of that happening. Kneejerk reaction, most certainly, but prolonged, doubtfully.

2) Can China afford to restrict yet another source of oilseed and protein, they are running out of options to fill their needs already.

-

Misterjade . . . I'm not very helpful here. This is politics and a brewing technology war mixed together. If well-respected advisors see potential demand concerns, it could become a price issue if indeed China is digging in. But it can smooth out just as quickly as well. This is likely short-term demand damage, but would still impact 2018-19 carryout stocks. It is not irreversible (IMO) heading into the new crop year.Originally posted by Misterjade9 View PostThis question is for Errol. Last week Farmlink came out with a 100% sold recommendation for 2018 canola, their reasoning is that they believe there is a real possibility of a canola embargo by the Chinese. Supposedly the Chinese are balking at unloading ships carrying Canadian canola, adding a little more paperwork and bureaucracy. There are also the usual suspects of a large bean supply in the U.S and new crop in S.A. Errol, what are your contacts saying about the possibility of a Chinese embargo in retaliation to this Huawei situation? The Chinese new year is upon us and not much happens during this time, is it possible that this will somewhat smooth out in a couple of weeks?, or is the short term damage irreversible?

Technically however, canola remains in a downtrend (IMO) and in need of fresh demand and bullish news to spark the futures. Keep an eye on basis premiums that may come 'n go into late winter and early spring. Realize growers are eyeing $11/bu canola as a cash pricing target. Buyers may sweeten the basis pot on spot sales. Stay in touch with your buyers.

My apologies for a fairly useless response, but will keep the ears down . . . .

Comment

-

Our canola prices are likely the worst in the province. We’ve been at $10.25 for a while on average. This past wk one company came out with a .25 premium for a whopping day and a half, so I signed some up. Not sure what it will take for us to get to $11 here.

Comment

-

There is a huge decline in the Baltic Dry index in January. China’s economic slowdown slowing ocean freight demand. Some analysts suggest this is coming from lower coal demand. China may be cutting imports to an effort to prop up their domestic prices.

But it is a reflection on most commodities including soy, canola and palm oil shipments (IMO).

Comment

-

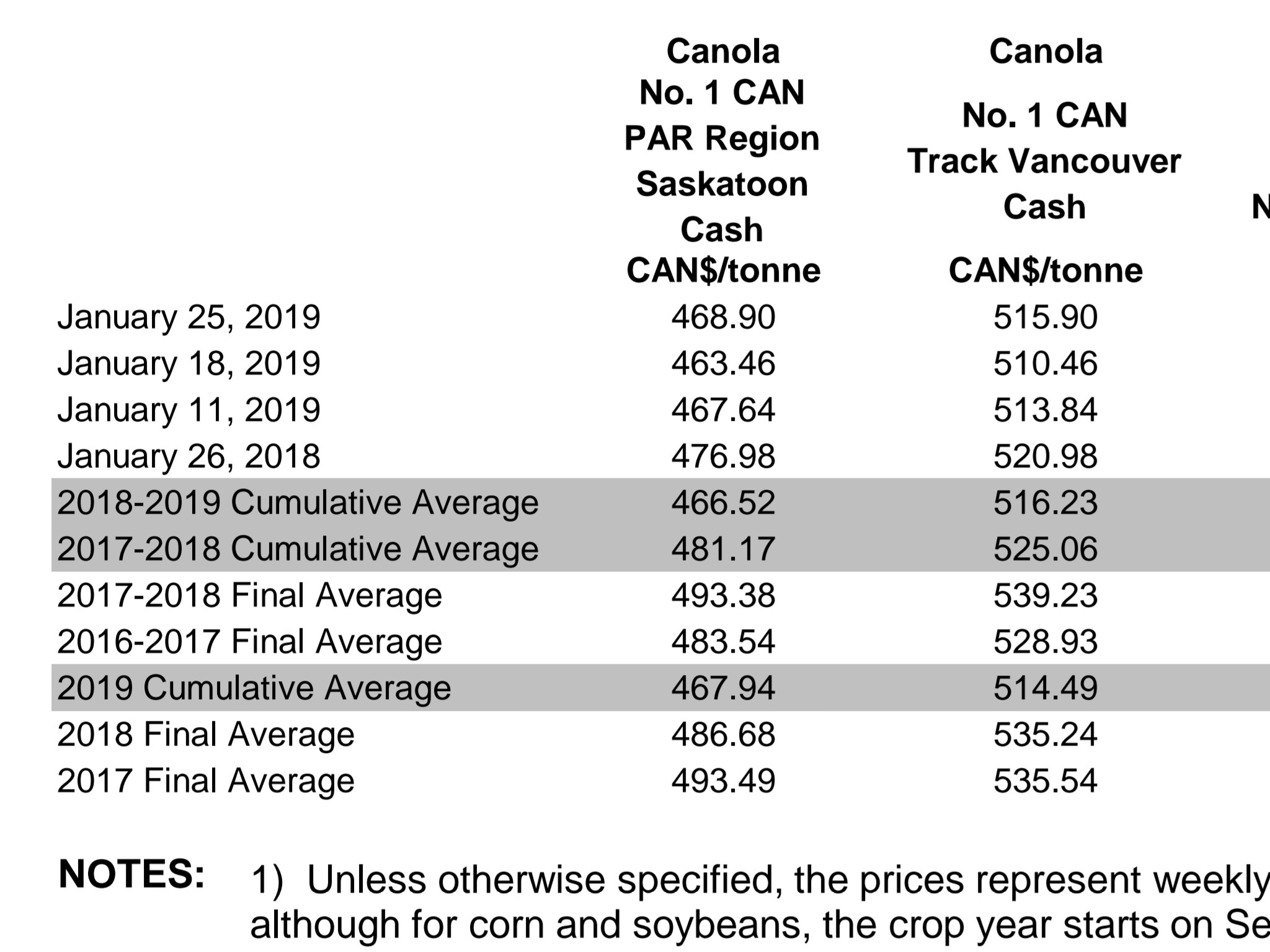

$515.90 = $11.70 "asking" at West Coast.

With basis included we are sure going to need some futures help getting to $12 farma gate. $529.10 net is $12.00.

One Oh One, can you do the math on the canola crush margin? But who really knows what a tonne of canola oil and meal sells for. Didnt they used to estimate it using soy oil and meal? Your best guess! COPA quit publishing it, imagine that Bucket, even though it was really only a guide it did give a bit of insight on how well the crushers were doing.

Canola carrots get dangled every once in a while for $11.00 out to June/July.

Too much politics affecting grain prices, not good! Canuck farmers are collateral damage from our own political leaders stupidity and high and mighty attitudes and other country's pissing matches. Heaven forbid the looney moves a cent higher!

Edit in: Yup Richard5, I'm just not "feeling" it this year. My gut is probably stronger than my heels this year. No common sense here, it's all physical and feelings marketing no thought process involved at all.Last edited by farmaholic; Feb 3, 2019, 22:01.

Comment

-

Did you at least replace the physical with paper? You're going to miss a huge opportunity in the futures and options market!Originally posted by wiseguySell er before she heats !

She's long gone, way out here !

Comment

-

Wiseguy, things are looking so good here that this year's crop is as good in the bin already!Originally posted by wiseguySell er before she heats !

She's long gone, way out here !

....because I'm not selling last year's until it reaches $_ _. _ _/bu.

Comment

-

Comment

-

Wiseguy...put your post back up!

"They are busy at the clubs right now"....??????

A bit early to be celebrating Chinese New Year(Feb 5th 2019)! What's your thoughts on 2019 being the year of the Pig. The Pig is the twelfth sign in the 12-year cycle of the Chinese zodiac.....and how does it affect grain prices. In your opinion.

Comment

-

101, I seem to remember it being even lower than that and alot higher.

So was the index kinda useless?

Comment

-

No, I wouldn't say it's useless, but it is necessary to look at the formula to figure out why it is moving higher or lower or why it is really high or low and decide whether that makes any difference to farmgate prices.

Oil content levels and basis for the seed, oil and meal make a difference to actual profitability

Comment

-

Originally posted by wiseguyHappy New Year Mr China man !

2019 year of the pig, an animal which synbolizes wealth !

Farma just a matter of time before you get your $ 12.00 a bushel !

Happy Gambling !

Chow !

This pig is barely treading water.

Greedy market pigs get slaughtered.

This little pig is selling canola and cried wee wee wee all the way home.

Because canola will reach $12 this year when...

Comment

- Reply to this Thread

- Return to Topic List

Comment