Was at a GrainCo meeting today that thinks there will be a 6mmt carry out. WOW, what is that? About 1/3 of annual Canadian production. Hard to soak up that much excess in the remaining domestic crush and export 18/19 marketing year, even the difference between a normal carry out and the current forecasted one.

There has been some real damage done. And I wouldn't hold my breath for a "major" rebound, even if dry conditions persist in parts of the Prairies, until we have access to the Chinese market, even then...

Scattered thoughts from a "Gut Marketer", who just might possess two traits that never served him well this year, "greed" and "obstinence". But take the China Doll affect out of the market and we'd be singing the chorus from the song sheet before her arrest. How is the reverse "ransom" working for you?

Maybe 101 would like to put some real numbers together(or other Industry player's opinion on carry out) in case my memory from the meeting is failing me. After a while the meetings seem to become blah blah blah, rah rah rah, blah blah blah, rah blah rah! ...information overload, here's your solution.

There has been some real damage done. And I wouldn't hold my breath for a "major" rebound, even if dry conditions persist in parts of the Prairies, until we have access to the Chinese market, even then...

Scattered thoughts from a "Gut Marketer", who just might possess two traits that never served him well this year, "greed" and "obstinence". But take the China Doll affect out of the market and we'd be singing the chorus from the song sheet before her arrest. How is the reverse "ransom" working for you?

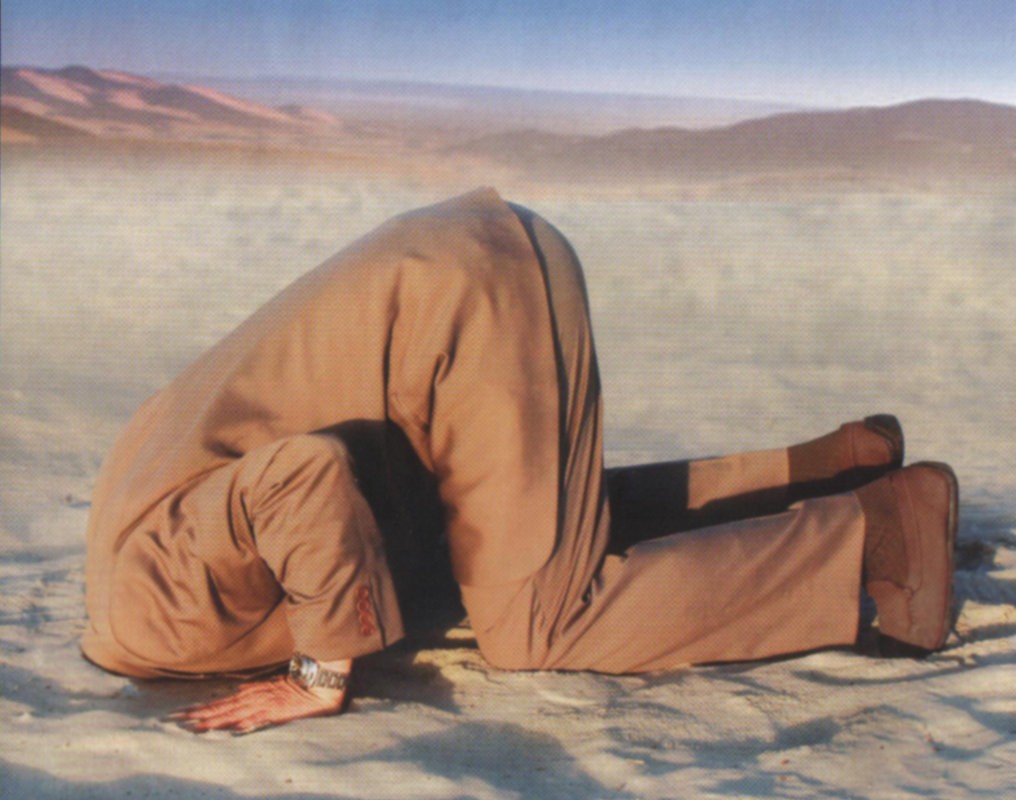

Maybe 101 would like to put some real numbers together(or other Industry player's opinion on carry out) in case my memory from the meeting is failing me. After a while the meetings seem to become blah blah blah, rah rah rah, blah blah blah, rah blah rah! ...information overload, here's your solution.

Comment