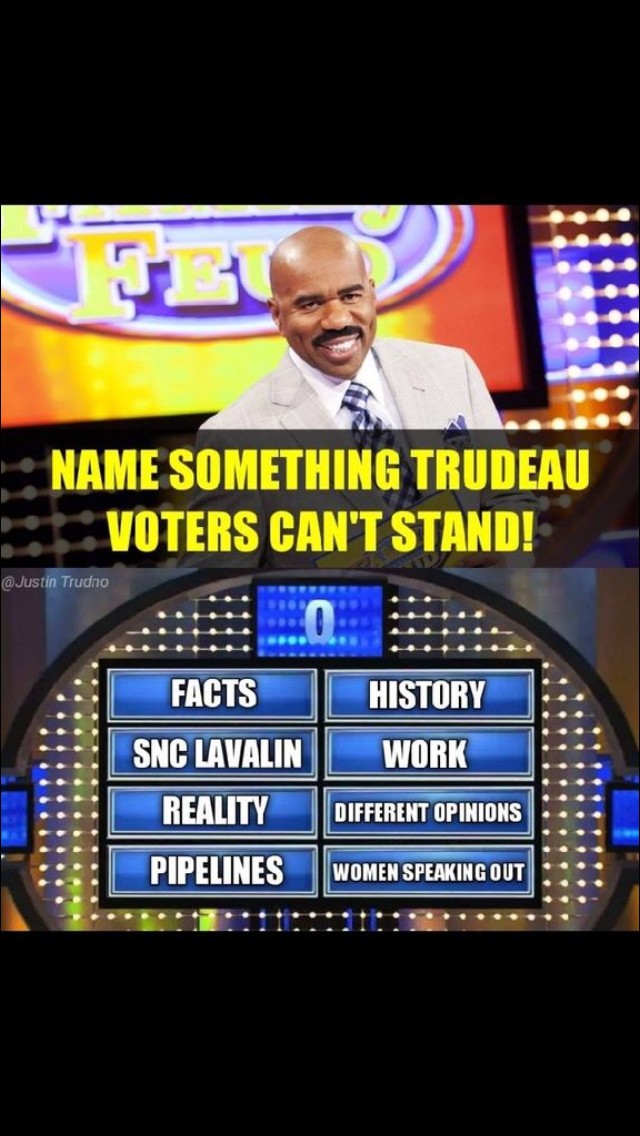

Yup that's how ugly this country really is. Liberals cant change the law, bribe the AG so they will use AB equalization money to save SNC.

https://www.bnnbloomberg.ca/quebec-tables-fifth-straight-balanced-budget-with-leftover-billions-from-liberals-1.1232745 Quebec tables fifth straight balanced budget with leftover billions from Liberals

https://www.bnnbloomberg.ca/quebec-tables-fifth-straight-balanced-budget-with-leftover-billions-from-liberals-1.1232745 Quebec tables fifth straight balanced budget with leftover billions from Liberals

Comment