Originally posted by farmaholic

View Post

1. Japan

2. Greece

3. Sudan

4. Venezuela

5. Lebanon

6. Portugal

7. Italy

8. U.S.A.

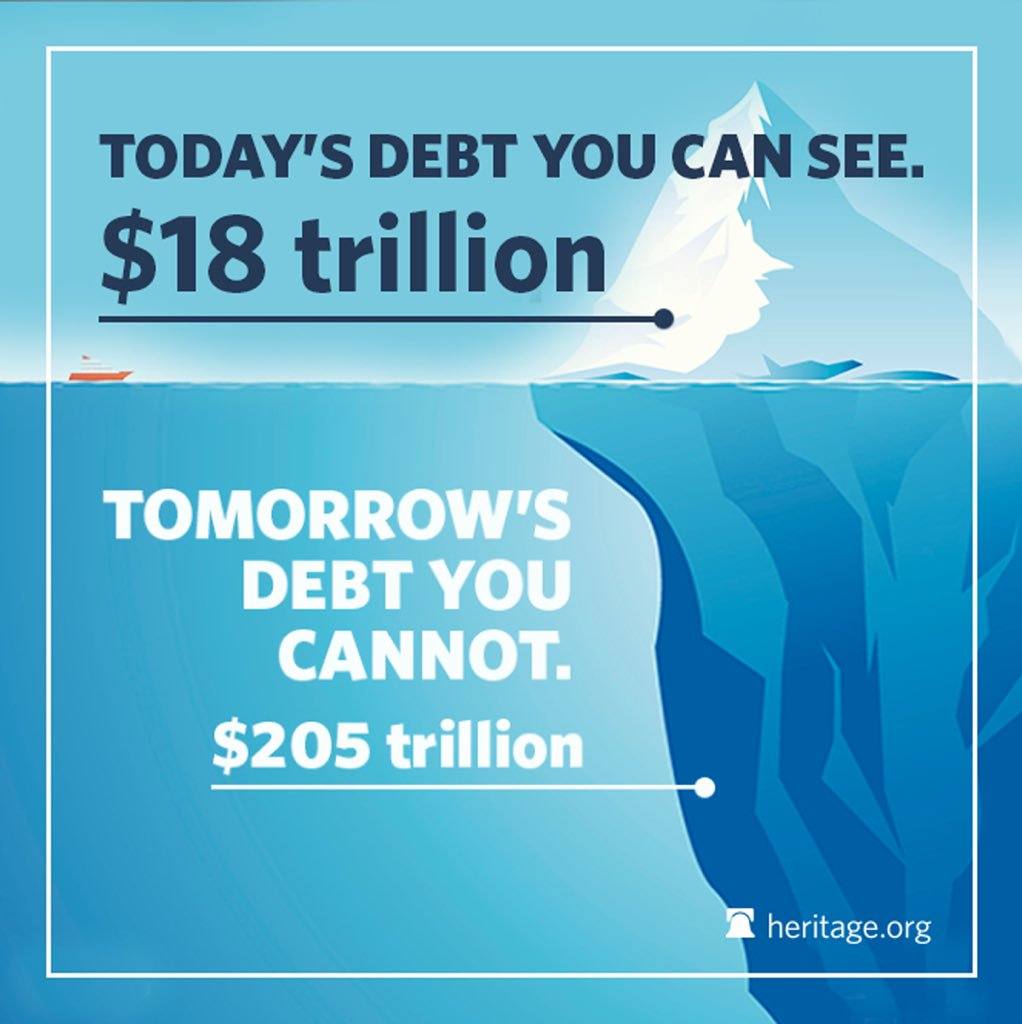

farmaholic . . . does debt matter and need to be serviced? . . . yes. We will all have a reality check and find out why (IMO). It will severely cost the next generation . . . our kids and their kids.

Comment