Originally posted by macdon02

View Post

Announcement

Collapse

No announcement yet.

A Game-Changing Crash . . . .

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Kind of a bit off topic but while watching this meltdown and trying to figure how to get through it with the least damage I ran in to this site;

https://www.reddit.com/r/wallstreetbets/ https://www.reddit.com/r/wallstreetbets/

Kind of crude and lewd but I find it very entertaining.

Check out and open the tabs for rules of posting. Might be something to look at.

Comment

-

This one often comes to mind:Originally posted by macdon02 View Post

This is the most important thing to keep in mind. Print it. Frame it. I suspect we are gonna get price action to suck in both sides. There's a new low coming. This coming week will be better to watch then participate.

Cheap is only half way down

Comment

-

Something to consider:

Allied Healthcare Products Inc. was up 1829% at one point on Friday over last week's closing price.

Closed this week up 975% from last week's close.

The company makes respiratory health products that are in short global supply.

It's just crappy investing and poor timing is all

Comment

-

-

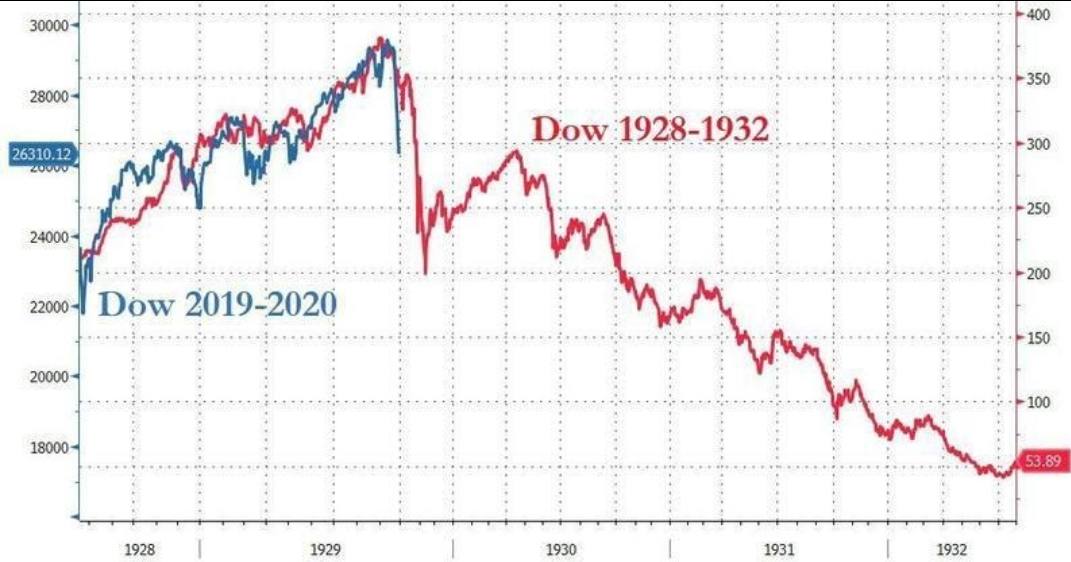

It is, but I seem to recall seeing eerily similar graphs presented comparing the depression era markets to the current situation quite regularly in recent decades. How often could one pick the right scale for the two, pick the appropriate starting point on the x and on the y axis, and make a very similar and ominous looking chart?Originally posted by TechAnalyst View PostA picture is worth a thousand words, great contribution macdon.

Not saying it isn't useful and possibly predictive, just that it likely provides a lot false positive correlations before the time it actually is useful.

And comparing the vertical scales, if today's market is expected to follow the same trajectory, it will fall to ~60% of its initial value, versus the depression where it fell to ~17% of its initial value(just roughly eyeballing the chart). Quite a difference.Last edited by AlbertaFarmer5; Mar 1, 2020, 09:13.

Comment

-

I should clarify my post. I am not cheerleading a repeat nor suggesting that we will follow the same path as closely as we have. I certainly hope for all our sake we don't go down that path.Originally posted by TechAnalyst View PostA picture is worth a thousand words, great contribution macdon.

What I was suggesting is that it helps put the dangers facing the market into perspective. That such an outcome should be considered in a risk assessment given some of the serious issues the world is facing.

Ignore history at our own peril.

Comment

-

They say 99% of all original ideas are wrong, so by default the correlation to '29 is likely a 1% possibility and there's a very good possibility it's "bear bait". It'll be interesting to watch the froth and doom and gloom if a new low is set. I have no opinion at present, I'm ok just watching for now. Gold is saying risk off. So we wait imo.

Comment

-

Part of the point I was trying to make, is that if you scale the two y axis on the same percentage, the current move would be 4 times smaller than it looks. Then, the visual correlation falls apart. And I assume that if you extended either back in time any further we would find that there is a reason why the charts start where they do.

Comment

- Reply to this Thread

- Return to Topic List

Comment