Originally posted by jazz

View Post

Announcement

Collapse

No announcement yet.

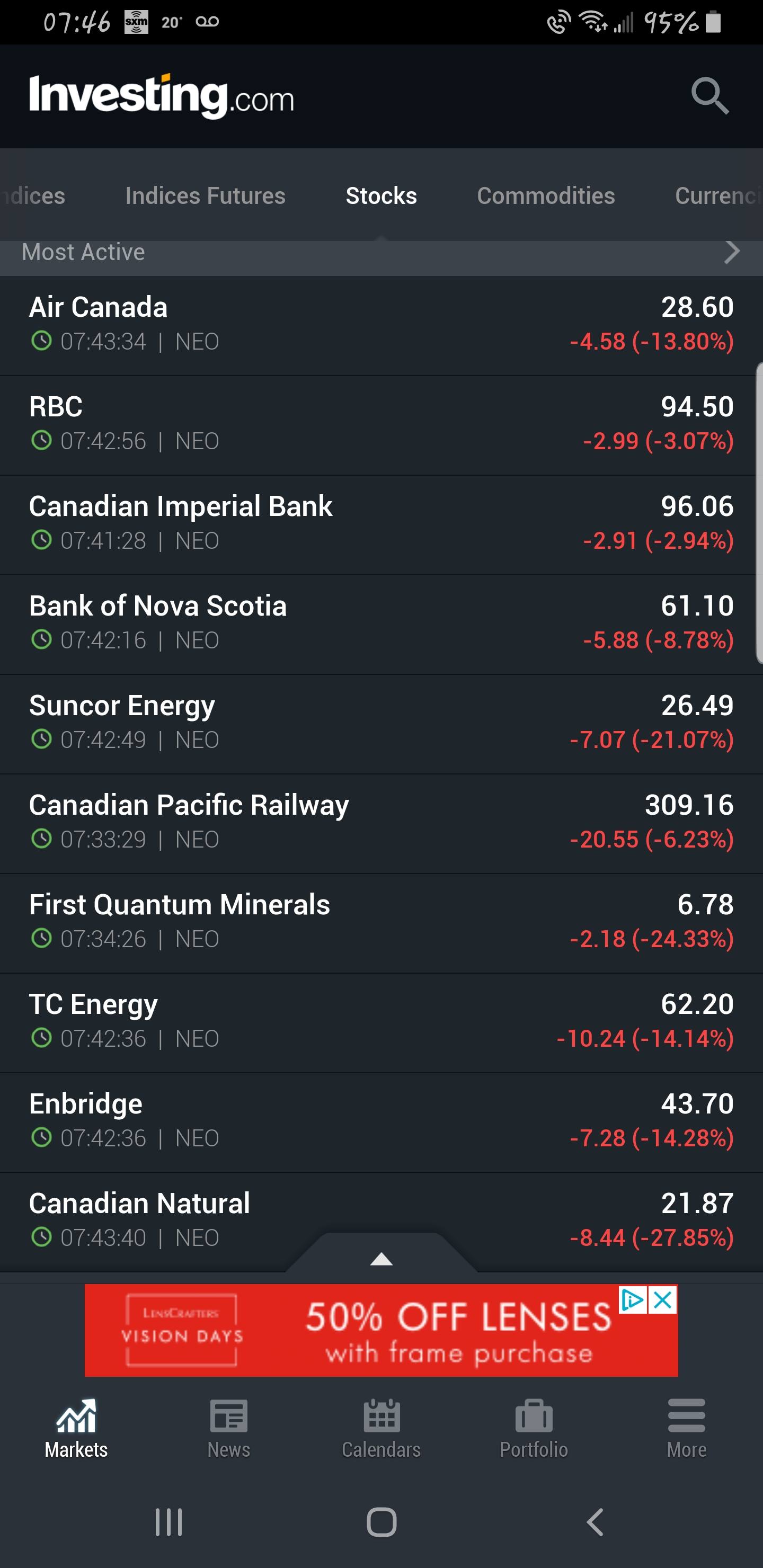

A Game-Changing Crash . . . .

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

Excellent.

Burn it all to the ground so the Phoenix of Western Canada can rise from the ashes.

But people must suffer and die for that to happen. Life isn't hard enough yet for the Western Liberal scumbag supporters yet. Hope TSX loses 75% of its value.

Comment

-

We are seeing the worst of human emotions right now . . . from the ridiculous race to Costco for toilet paper to 'git me out now' selling pressure right now in stocks and commodities. Human emotion is at its ripest. Markets are always right, but often driven by human emotion. And 'panic' right now is a short-lived emotion. Calmer minds eventually prevail and markets at that point . . . rebound. This will be no different (IMO).Originally posted by makar View PostOil recovered already, someone got rich overnight.

This drives markets both too high and then too low . . . . These markets are unpredictable, but I know dam sure that Costco will eventually stock toilet paper once again. Yes, (IMO) the stock market was due for a butt kicking. It is still pricey and can head lower yet. But for commodities, hang in there during these crazy times, there will be recoveries . . . maybe tomorrow or the next day, but prices can turn around once emotions settle down. My two-bits worth . . . .

Comment

-

So far today the Dow dipped to 23818.70, a level never seen before Nov 28, 2017. Think about it.

Comment

-

Lebanon said it would default on its dollar-denominated debt, intensifying the Middle Eastern state’s financial turmoil and setting up a possibly messy negotiation with foreign investors.

Beirut’s failure to honor its massive debt load was long expected and not related to the economic turmoil caused by*the coronavirus outbreak. But it comes at a time when the global financial system is on edge.

Lebanon said Saturday it would fail to pay back U.S. dollar denominated bonds with a face value of $1.2 billion due Monday, the first time the country has ever failed to pay its debt. It has another $700 million due in April and $600 million in June.

Comment

-

How fast are U.S. stock markets declining? . . . .

The S&P 500 is now down about 18% from all-time high posted on February 19, 2020. That was just 13 trading days ago. Here's a comparison of the 'sell-off speed' from past equity market meltdowns . . . .

Fastest for the S&P 500 from an all-time high to down 20%

* September/October 1929 = 42 days

* August to October 1987 = 55 days

* July to October 1990 = 87 days

This suggests we may be witnessing the quickest U.S. equity market meltdown in history.

Comment

-

You mean something that has a physical value like grain not something like thin air called bitcoin....Originally posted by ajl View PostSo is this the permanent end of 40+ years of fakenomics? There is a call for shock and awe stimulus by the usual useless taking heads like the IMF etc. Replacing the speculative economy with real growth and real jobs will be quite the undertaking.

Better question is how inputs can be going up....

Comment

-

Who is in the stock market Errol? Americans invest with their 401Ks, do you think they are running to computers every day and selling? Most Canadians are too broke to even own stocks. If you are $200 away from bankruptcy, stock picking is the least of your concerns.Originally posted by errolanderson View PostWe are seeing the worst of human emotions right now . . .

This looks like hedge and institutional selling aided by algos with mom and pop along for the ride (down).

Comment

-

US futures have been toying with limit down's in the last couple hours... They locked up just before midnight on sunday into monday. S&P 500 VIX futures are up 15%+ and climbing. Asian markets trimming another 4-7%.

Honest question...

How many more days before they suspend trading? Things are moving quickly!

Comment

- Reply to this Thread

- Return to Topic List

Comment