Originally posted by biglentil

View Post

Announcement

Collapse

No announcement yet.

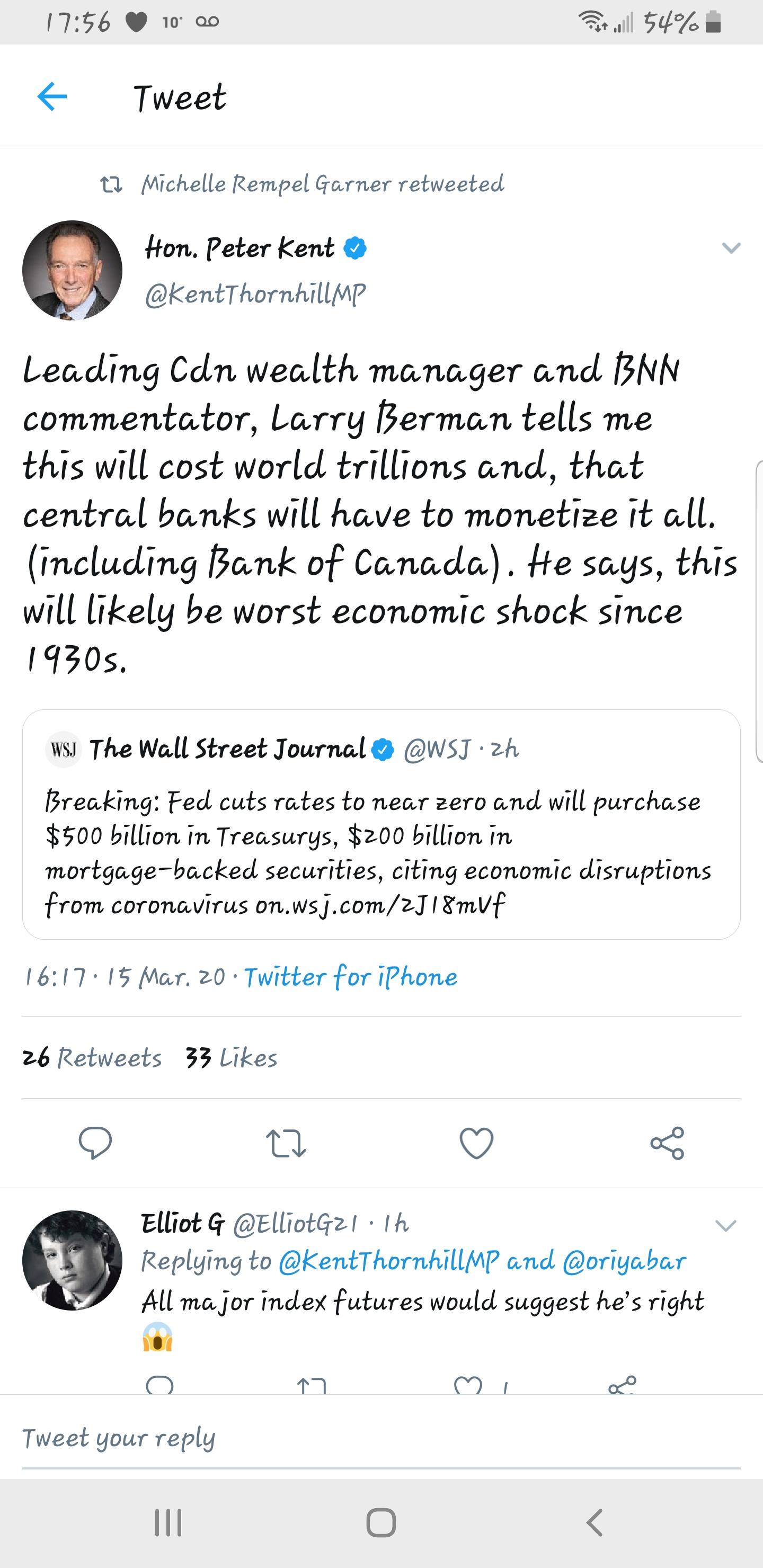

Federal Reserve cuts rates to zero and launches massive $700 billion QE

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

Massively negative interest rates will be necessary to arrest the fall in equities. Negative rates are already here in U.S. markets are you move a bit further out the yield curve.

Comment

-

The entire corporate debt bubble will implode . . . the Covid-19 virus is the fuse, the debt is the implosion. No sign of a bottom . . . .Originally posted by Austrian Economics View PostMassively negative interest rates will be necessary to arrest the fall in equities. Negative rates are already here in U.S. markets are you move a bit further out the yield curve.

Comment

-

I still don't understand the concept of negative rates in the real world.Originally posted by Austrian Economics View PostMassively negative interest rates will be necessary to arrest the fall in equities. Negative rates are already here in U.S. markets are you move a bit further out the yield curve.

That means the bank pays you to lend money to them?

Comment

-

No they pay you to borrow and you pay them on your savings. They may be forced to ban cash in such a scenario as they cant collect interest fees on it. Perfect time to ban cash as it's for your own safety blah blah blah. Misclick I dont like my own post.Originally posted by jazz View PostI still don't understand the concept of negative rates in the real world.

That means the bank pays you to lend money to them?Last edited by biglentil; Mar 16, 2020, 08:16.

Comment

- Reply to this Thread

- Return to Topic List

Comment