Originally posted by Austrian Economics

View Post

Announcement

Collapse

No announcement yet.

Fakeconomics . . . .

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

AE agree . . . credit system lock up is like krytonite to superman. But situation now had little comparison to 2008 (IMO). Central banks are already insolvent.Originally posted by Austrian Economics View PostThe biggest concern of any central bank is the solvency of the banking system. They really don't care if stocks (or gold) rise steeply in value. Their principal concern is to avoid having the credit system lock up, as it did in 2008 and again in early 2020. They will buy stocks (or more likely ETFs) if they think that by doing so they can avoid solvency problems with large companies and the banks that they borrow from. They won't do it just to see stocks go up.

The end game comes when the central banks have to absorb so much bad debt that they themselves become insolvent (liabilities dwarf assets).

The currency print button no longer has much affect. And the economy will no longer respond to artificial manipulation of the Fed protecting Wall Street at all cost. This had just widened the income gap at the expense of the middle class.

2021 may be known more for massive bankruptcies than any successful Fed rescue plan. Fakeconomics at-their-worst and a crash waiting to happen (IMO) . . . .

Comment

-

The gluttony of debt CB's have encouraged the masses to take on since 08, by suppressing rates, is coming home to lay waste. They don't see the insolvencies coming and think it's a liquidity crisis, fixable with more loans. The hoarding earlier this year was a trigger point, the line of thinking has changed among the population, they recognized govt could not protect. Savings rates are going up worldwide. This is not inflationary. Until main street banks start lending en mass this can't happen. Especially if the middle class is unsure of the future, they simply won't borrow. Here's the exulted Tiff telling Canadians to "borrow MOAR". He needs the inflation to deal with the debt govt has taken on. Gold and silver is running on its own here as it is signaling the world is broken and CB's are losing their grip. They look at BOJ and say i'll do what they did, the difference is it's never been attempted on a worldwide scale. Welcome to the utopia of zero productivity before the crash. Then what?

https://youtu.be/FoasstYYu4Q

Comment

-

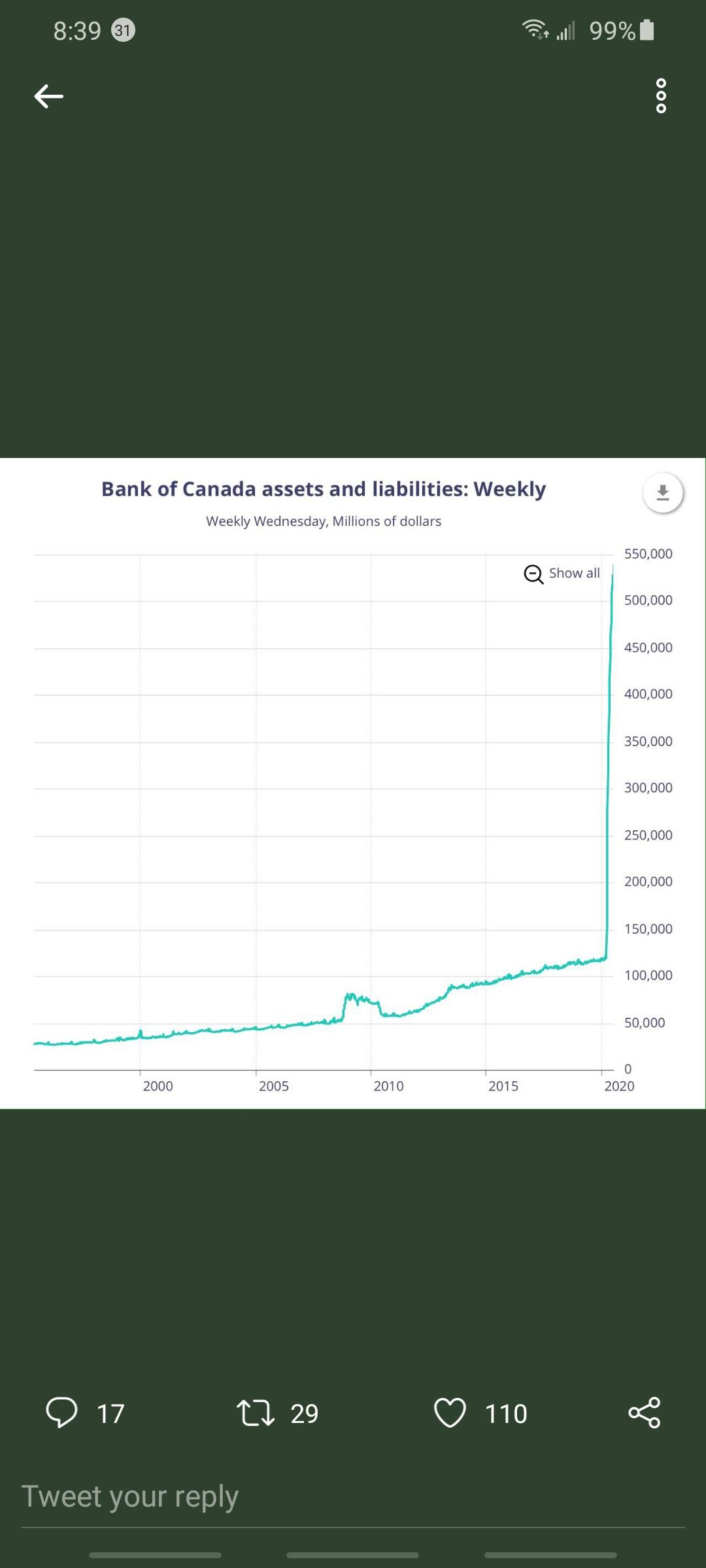

Bank of Canada. Represents total assets and also total liabilities and capital. https://www.bankofcanada.ca/rates/banking-and-financial-statistics/bank-of-canada-assets-and-liabilities-weekly-formerly-b2/ https://www.bankofcanada.ca/rates/banking-and-financial-statistics/bank-of-canada-assets-and-liabilities-weekly-formerly-b2/Originally posted by sumdumguy View PostAssets and Liabilities , where is this chart from?

Comment

-

Next week, reality strikes . . . .

U.S. 2nd quarter GDP is released. A poll by Marketwarch of economists suggests the American economy shrank by an incredible 33 percent.

The next worst GDP in history was 62 years ago, in 1958 when the American economy was hit by a 10 percent loss in the 1st quarter.

This news odda make the stock market rally with more Fed stimulus . . . .

Comment

-

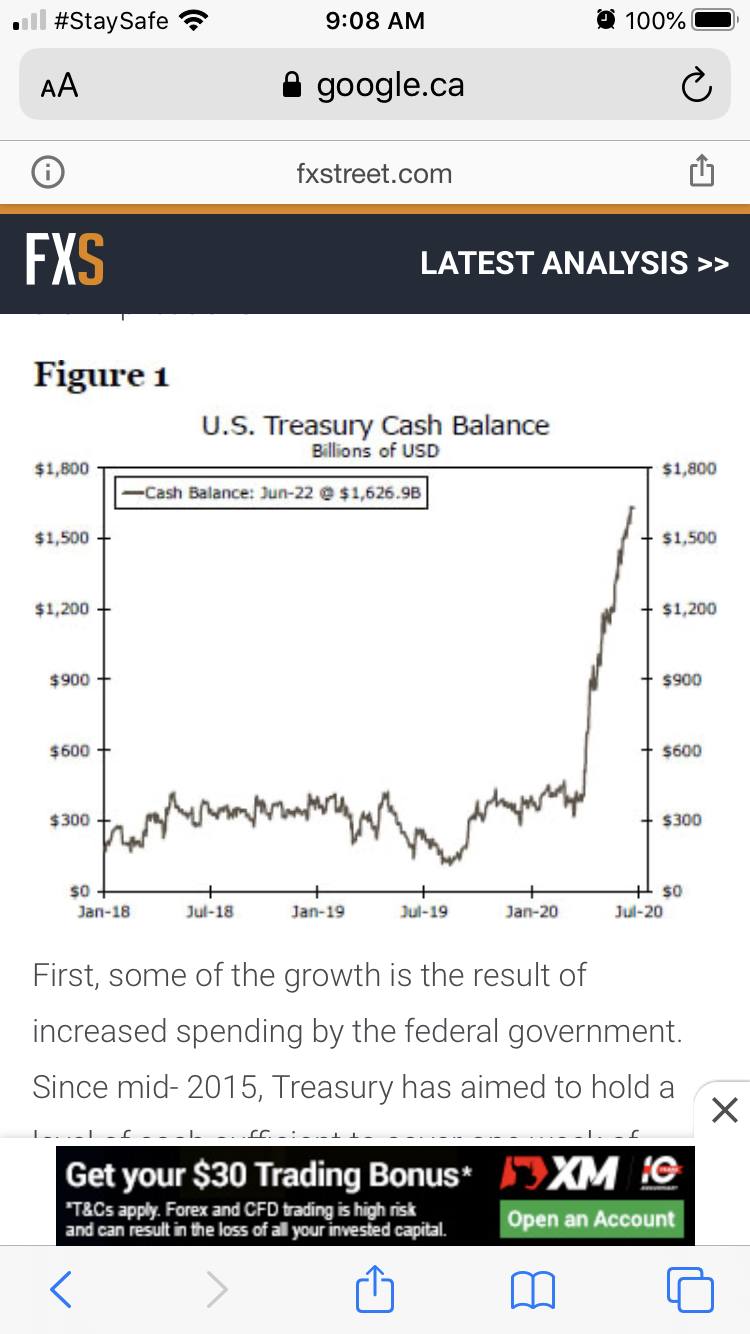

This chart of USD cash on hand tells me the FED is readying for something bigger to come. That chart of Bank of Canada is super scary. That looks the wheels fell off and we just don’t realize it yet. I’d say the rabbit hole is more like going off a cliff.

With the markets disconnected from reality and autumn approaching I’d suspect major fireworks before year end. How can this bounce past October?

Got guns? Got more guns?

Comment

- Reply to this Thread

- Return to Topic List

Comment