Originally posted by ajl

View Post

Announcement

Collapse

No announcement yet.

Dow Approaches 30,0000 points: What’s the point?

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

The Great Depression arose as a result of the crippling debt overhang from World War One. Germany and Russia were bankrupt and economically ruined. Britain and France struggled throughout the 20s to reckon with their debts by conspiring with the U.S. Federal Reserve to artificially suppress interest rates. The collapse in interest rates, however, created an artificial economic boom which could not be sustained. Contrary to popular belief, the Depression did not actually end until 1947. It was in that year that interest rates began to rise as the rate of return of the marginal business finally got above the rate of interest and an economic recovery could begin.

-

And the back-slapping of central bankers that they are the ‘good ol boys’ can stop anytime now.Originally posted by Austrian Economics View PostThe Great Depression arose as a result of the crippling debt overhang from World War One. Germany and Russia were bankrupt and economically ruined. Britain and France struggled throughout the 20s to reckon with their debts by conspiring with the U.S. Federal Reserve to artificially suppress interest rates. The collapse in interest rates, however, created an artificial economic boom which could not be sustained. Contrary to popular belief, the Depression did not actually end until 1947. It was in that year that interest rates began to rise as the rate of return of the marginal business finally got above the rate of interest and an economic recovery could begin.

Central bankers and failing old school Keynes economics (at the end of a business cycle) are largely the problem creating massive deficit spending that creates no economy and a whole lot of longterm pain. This will drag global standard-of-livings into the gutter through the 2020s IMO).

Comment

-

I think agriculture will pull us through. ....look at what Russia has done ....from customer to competitor in my lifetime....Originally posted by jazz View PostThat BMO guy disturbs me. How will Canada go on a bull run with 12% UE and set to rise, 2nd lockdown, all levels of govt budgets destroyed and our biggest export (oil) in the dumps.

Gotta tell you. ...Putin has vision...

Canada's leaders ....not so much....

Comment

-

The people who understand the value of money the most are those without any!

Although, I'm not saying those with it shouldn't worry about it's value or making it work as hard for them as possible.Last edited by farmaholic; Dec 2, 2020, 12:11.

Comment

-

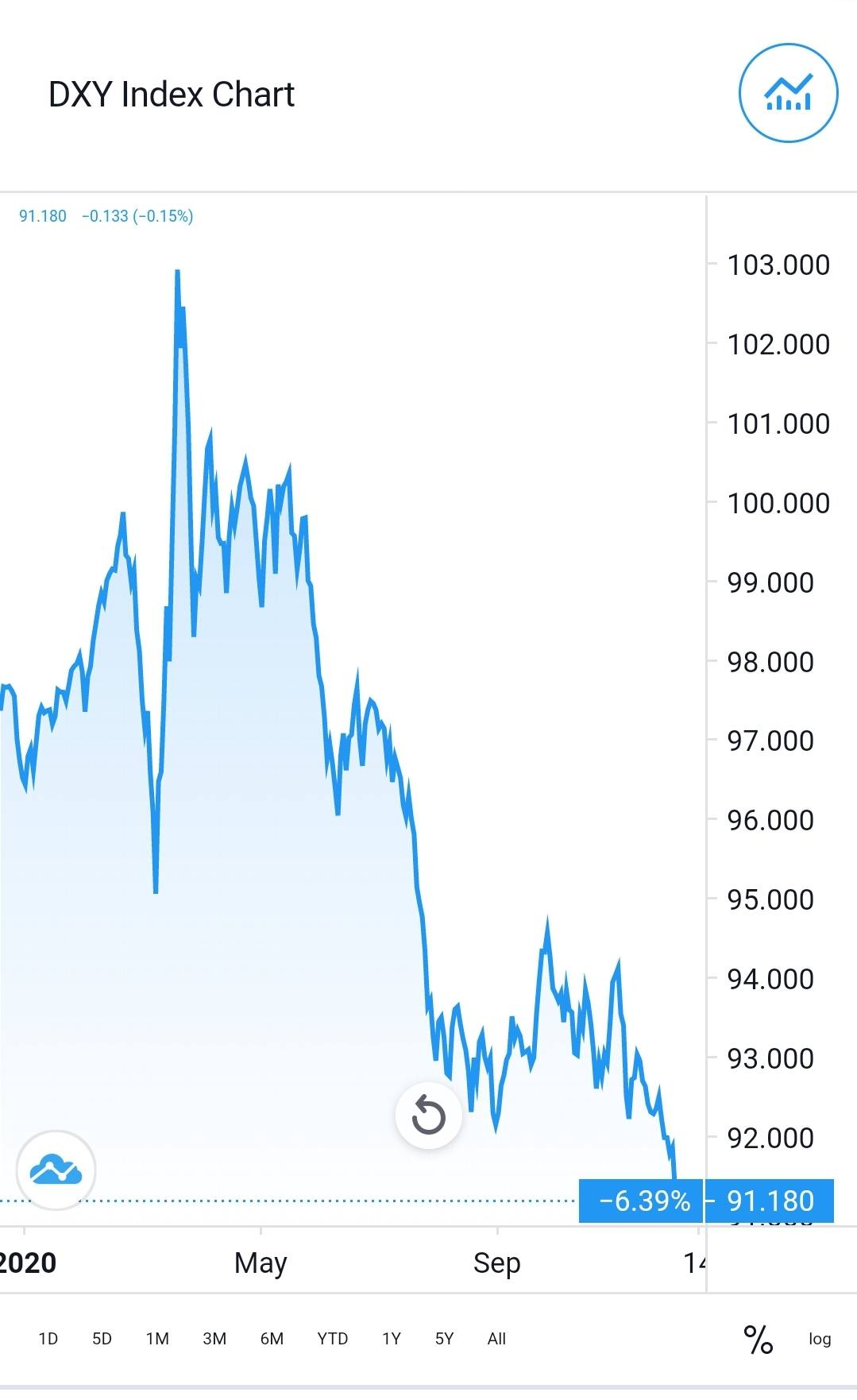

It would be interesting to see that USD chart overlaid with A chart showing the probability of a Biden win. Looks like a very good inverse relationship there. Read what you want into that observation.

Comment

-

The Euro which makes up over 50% of the USDX is enjoying a 30 month high against the USD, with a bit more room to rise yet.

Comment

-

This fact about says-it-all . . . . The U.S. money supply (M1) has now exploded by 55% since February.

35% of all U.S. dollars in-existence have been printed in just the past ten (10) months. And each massive injection triggers a reduced stimulus (money printing) response.

If flying at 30,000 feet and gauges were showing these types of vitals . . . start looking for the next airport real fast (IMO) . . . .

Comment

-

And velocity of M1 is plumbing all time lows... what gives? Seems they can print it, but they cant make people spend it.Originally posted by errolanderson View PostThis fact about says-it-all . . . . The U.S. money supply (M1) has now exploded by 55% since February.

35% of all U.S. dollars in-existence have been printed in just the past ten (10) months. And each massive injection triggers a reduced stimulus (money printing) response.

Comment

-

So of that 35% recently printed how much of that went directly into purchasing shares to pump the market.

If so does the US Treasury have a big stake in the market today?

Comment

-

The Fed now controls the stock market . . . that is why is the Dow is now 30,000 feet in-the-air but the plane now losing cabin pressure on failing stimulus. This is a Keynes economics meltdown in-progress (IMO).Originally posted by shtferbrains View PostSo of that 35% recently printed how much of that went directly into purchasing shares to pump the market.

If so does the US Treasury have a big stake in the market today?

Comment

- Reply to this Thread

- Return to Topic List

Comment