Originally posted by shtferbrains

View Post

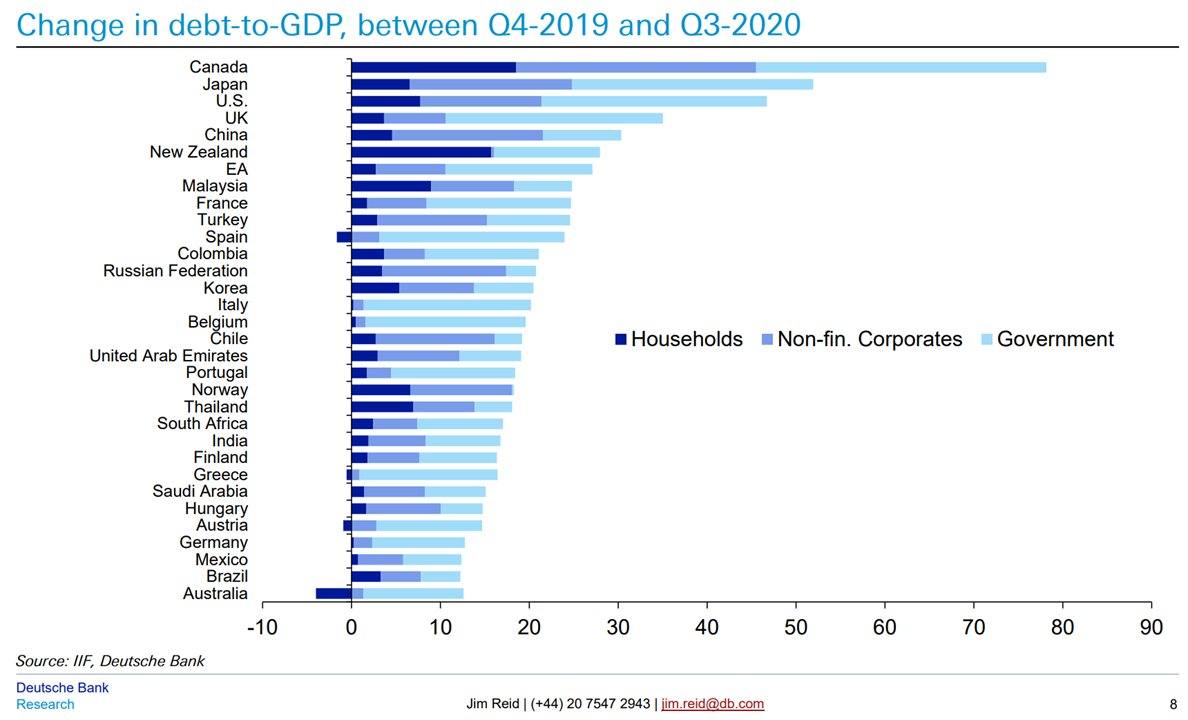

I saw on BNN a couple of days ago that the B of C is now buying around 50% of all bonds. The commentators expect that this bond buying will now taper off, but that's laughable. The last thing our fiat currency needs is a boost in interest rates. The whole purpose of the bond exercise is to buy enough bonds to keep the rate of interest at an absurdly low level. If you taper it, interest rates rise and the overloaded debt machine will throw a piston.

This exercise in financial incest works as long as the mushrooming debt can still be serviced. That requires ever declining interest rates, eventually ones in negative territory. That creates many problems, however, such as populating the economy with money-losing, unproductive zombie companies. Pension funds that either rely on fixed income or are forced into purchasing it become unsustainable. I'm sure Freeland believes that the government can just borrow trillions more and plug all the financial holes as they pop up.

I think the end game is when the holes pop up faster than even a central bank can respond. If you're going to make it known that every bad investment decision will be bailed out, you will create an avalanche of people and institutions demanding bailouts. At that point, the central bank becomes insolvent and the currency implodes. Look to peripheral economies like Turkey, Venezuela and Zimbabwe for an idea of what happens at that point.

Comment