MARKETS PARTY LIKE THE 1920’s WITH THE ECONOMY OF THE 1930’s. Be aware of the potential for an incoming volatility shock. Printing money (stimulus) provides no lasting economy, rather deepens the incoming financial crisis and need for financial reset. ProMarket Wire, Calgary

Announcement

Collapse

No announcement yet.

Markets Party Like the 1920's with an Economy of the 1930's

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Tags: None

-

I think the grain markets need to party....as stated in the saskwheat release. ...6 dollar wheat in 1975 is equivalent to 26 bucks today....Originally posted by errolanderson View PostMARKETS PARTY LIKE THE 1920’s WITH THE ECONOMY OF THE 1930’s. Be aware of the potential for an incoming volatility shock. Printing money (stimulus) provides no lasting economy, rather deepens the incoming financial crisis and need for financial reset. ProMarket Wire, Calgary

Everything else in my life has been indexed ....except for the price I receive for my grain. ..

-

Many industries and sectors of the economy have been far harder hit than our grain industry. Grains have been a leader to the upside and profitability during these difficult times . . . .Originally posted by bucket View PostI think the grain markets need to party....as stated in the saskwheat release. ...6 dollar wheat in 1975 is equivalent to 26 bucks today....

Everything else in my life has been indexed ....except for the price I receive for my grain. ..

Comment

-

Do a comparison from 1975 and then rethink what you just said...Originally posted by errolanderson View PostMany industries and sectors of the economy have been far harder hit than our grain industry. Grains have been a leader to the upside and profitability during these difficult times . . . .

I doubt you are working for 2005 wages let alone 1975 wages which wouldn't be enough to fill your gas tank....

BTW oil prices are the same as 1975 and gasoline is 50 times the 1975 price at the pumps...

Comment

-

errol, the equities market decoupled with main street about 2 recessions ago. I dont expect this to reverse anytime soon. The average bloke owns a bit of the equities in their pensions and 401ks. The equities market is really a proxy for the 1% now. Wealth always concentrates at the top.

What you are seeing is stimulus cash finding its way into equities either by direct govt intervention or stock buy backs and dividend repurchases.

Comment

-

jazz . . . agree with you. But this doesn't mean that stocks forever go up on false economics protecting the wealthy. This is a Humpty Dumpty market if there ever was one (IMO) . . . .Originally posted by jazz View Posterrol, the equities market decoupled with main street about 2 recessions ago. I dont expect this to reverse anytime soon. The average bloke owns a bit of the equities in their pensions and 401ks. The equities market is really a proxy for the 1% now. Wealth always concentrates at the top.

What you are seeing is stimulus cash finding its way into equities either by direct govt intervention or stock buy backs and dividend repurchases.

Comment

-

Aren't governments and central banks keeping the equities stable/rising to protect the avg Joe&Jane 6-pack's IRA and RSP and their corporate pension???Originally posted by errolanderson View Postjazz . . . agree with you. But this doesn't mean that stocks forever go up on false economics protecting the wealthy. This is a Humpty Dumpty market if there ever was one (IMO) . . . .

The ultra rich are benefitting from government actions to avoid a crash, that would wipe out 70% of the citizens.

Comment

-

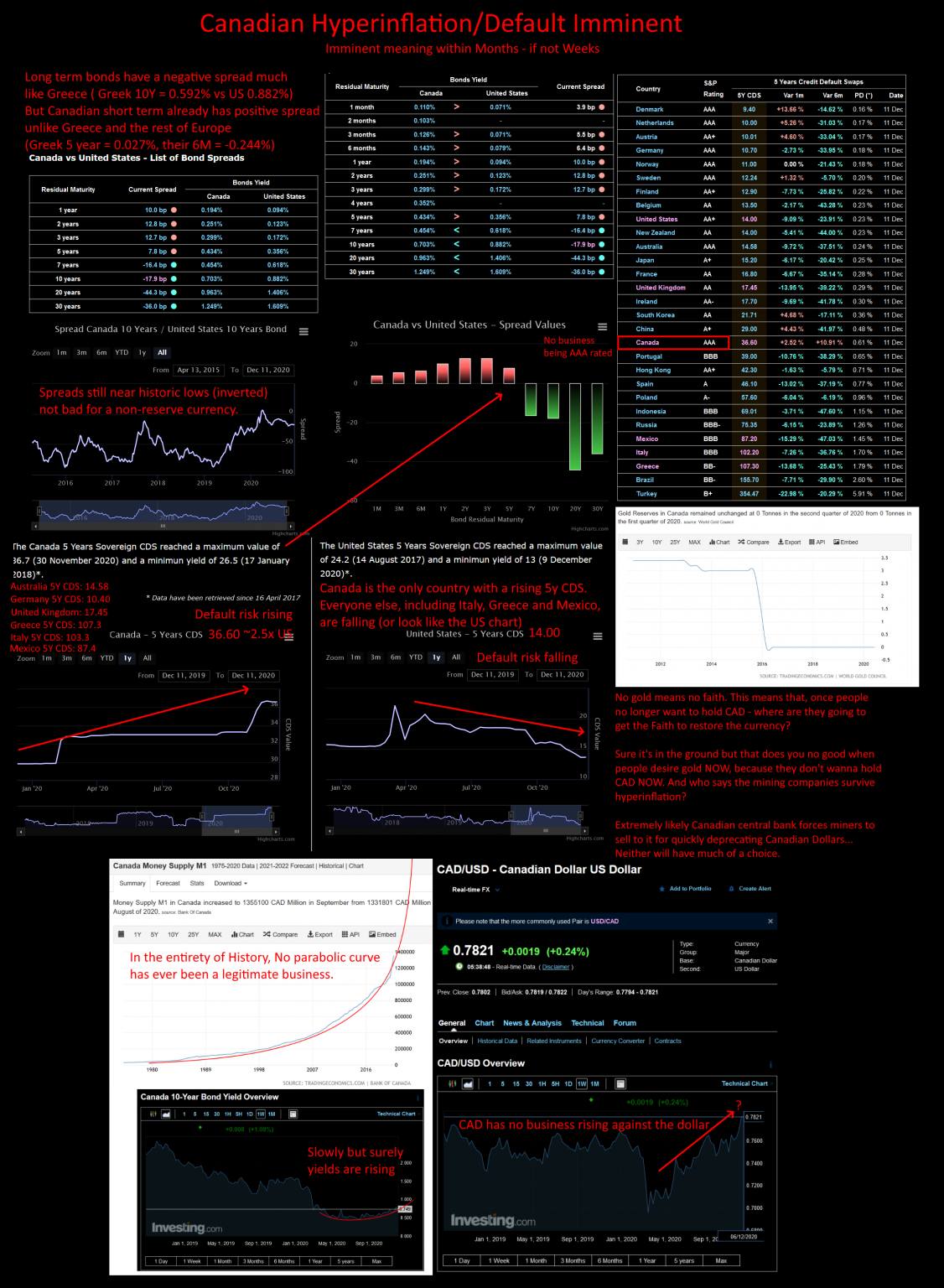

The MSM narrative of the deflationary boogeyman is equivalent of the Covid 19 boogeyman. Neither have any teeth. What we have is the 'crack up boom' facilitated by monetary expansion. It's equivalent to the ancient alchemaic pursuit to turn lead into gold, in modern day its the goal of turning freshly printed paper into prosperity. All attempts of the fiat monetary experiment fail miserably. The modern monetary theory that countries are embarking upon IS inflation on steroids, price inflation lags but always follows.Last edited by biglentil; Dec 30, 2020, 10:17.

Comment

-

It's surprising what can happen when interest rates go all the way back to zero. Remember the days when we were told that interest rates were well on their way to normalizing? Eighteen months ago that was all we heard from the mainstream financial gurus. That didn't last long.

Not that any of this is sustainable, but the primary purpose of zero percent interest is to allow governments to borrow incredibly vast amounts of capital with which to buy votes. This has the added bonus of boosting GDP numbers, as well as boosting real estate, equity and farmland values.

Those who are selling their real estate, equities and farmland appear to be doing quite well, but the buyers of these assets are getting squeezed. As the drop in interest charges gets converted into a bid on the asset, profit margins are following interest rates to zero. The phenomenon of Net Present Value is an inescapable fact of financial life.

When will this end? Central banks have staved off the collapse for the time being. But they're going to have to embrace negative interest to keep the collapse at bay. But that creates an economy with nothing but zombie businesses that consume more capital than they produce so at that point it's just a matter of figuring out how long it will take for the capital stock to go to zero.

Comment

- Reply to this Thread

- Return to Topic List

Comment