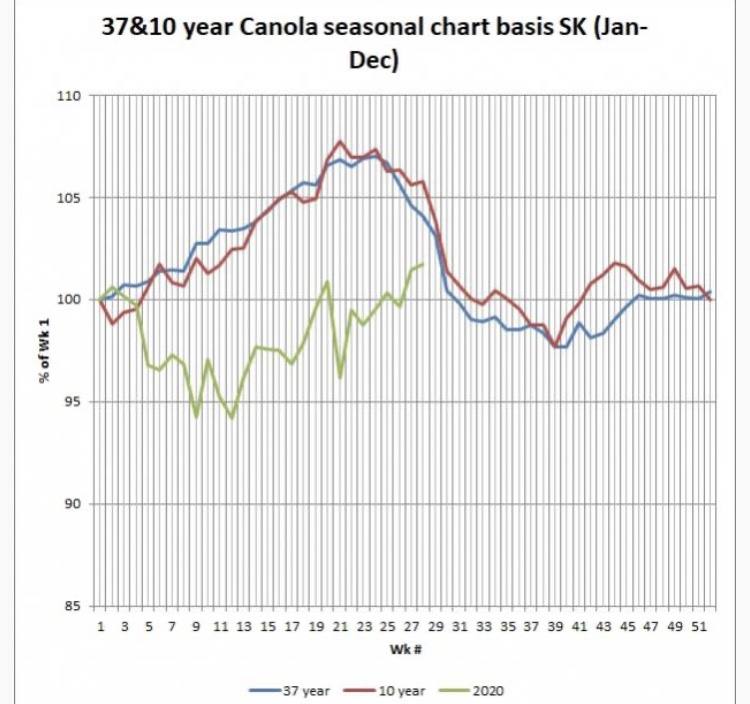

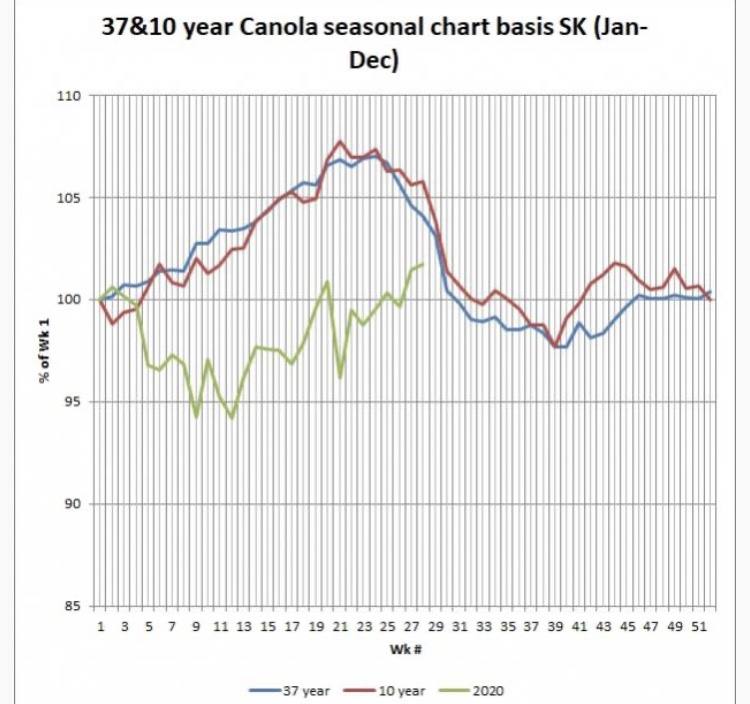

A few things that were noticed near the end of last July ,

The crop was being overestimated

Massive flooding in the main crop area in China was virtually unreported

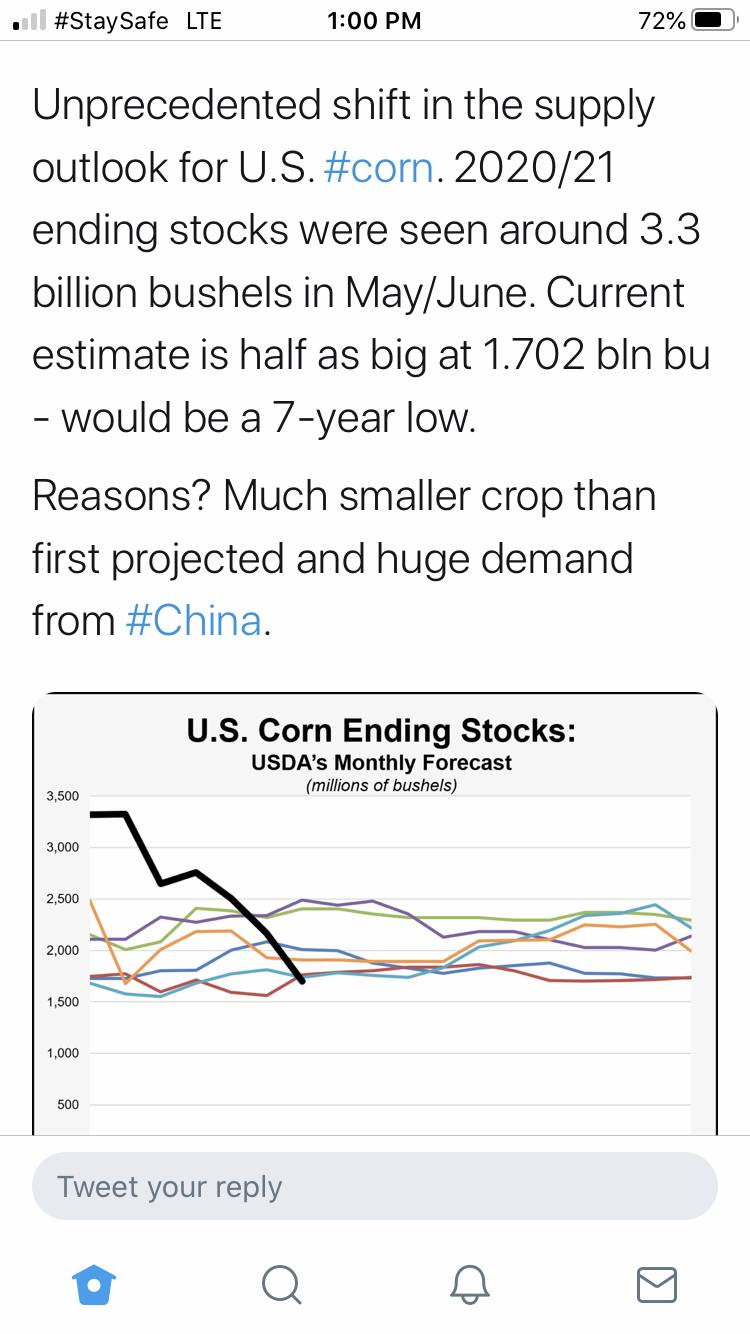

Soybean , corn and canola stocks were beginning to be proven overstated from previous years .

By August the heat took the bloom off over 1/2 the canola crop in western Canada . 5 bus off ?? Just a farmer guess

By mid October China had to finally start buying big .

Also this from 101 ..

Still I don’t think anyone anywhere could predict $15 canola and the big run up in corn and soy but the signs were there and prices stayed low for a long time .

Regardless, good to see reality hit and the market respond .

Also had to pay attention to canola crazy ... he was calling for a big upsurge in crop prices well before anyone .

No “paid experts†called any of the above, but the signs were being pointed out by several on here .... thankful for that ðŸ‘

The crop was being overestimated

Massive flooding in the main crop area in China was virtually unreported

Soybean , corn and canola stocks were beginning to be proven overstated from previous years .

By August the heat took the bloom off over 1/2 the canola crop in western Canada . 5 bus off ?? Just a farmer guess

By mid October China had to finally start buying big .

Also this from 101 ..

Still I don’t think anyone anywhere could predict $15 canola and the big run up in corn and soy but the signs were there and prices stayed low for a long time .

Regardless, good to see reality hit and the market respond .

Also had to pay attention to canola crazy ... he was calling for a big upsurge in crop prices well before anyone .

No “paid experts†called any of the above, but the signs were being pointed out by several on here .... thankful for that ðŸ‘

Comment