Could someone please pinpoint a time in history when an economy was working perfectly?

Announcement

Collapse

No announcement yet.

The Death of Inflation

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

50s and 60s. Mid 90s?Originally posted by farming101 View PostCould someone please pinpoint a time in history when an economy was working perfectly?

https://wolfstreet.com/2021/03/19/i-truly-believe-that-we-the-rich-will-emerge-from-this-crisis-stronger-and-better-as-we-the-rich-have-done-so-often-before-jerome-powell-in-wsj-op-ed/

Very illustrative in that article the massive wealth gap that has been created by money printing.

-

Comment

-

Wouldn't that require a definition of "working perfectly"?Originally posted by farming101 View PostCould someone please pinpoint a time in history when an economy was working perfectly?

And take into consideration regionality?

In my humble view, I would offer that the best overall time that any nation at any time has ever known was within our lifetime.

Has there been - ever - another society in the history of this earth that has had more conveniences, more improvement over the preceding generation, more luxury, better food and better opportunity than what our generation grew up with?

Not stating a fact here, just asking. For myself. :-)

What are the parameters of measurement?

Edit: I would add that the less government interferes with an economy, the better things run.

What do we see today, in that regard?Last edited by burnt; Mar 27, 2021, 08:07.

Comment

-

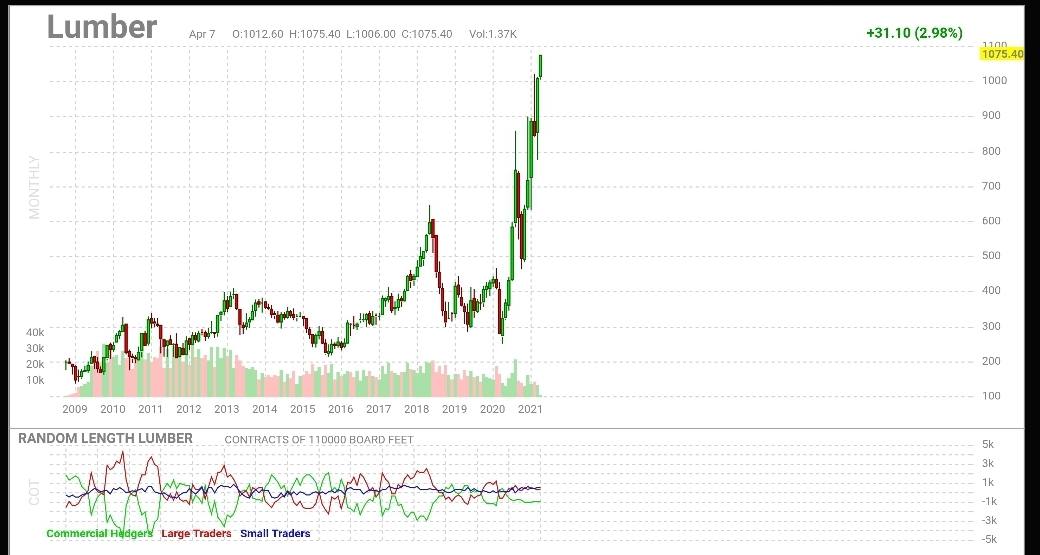

Errol, I think its time to revisit this. The last few months have told the story of whats coming.

Trillions printed up and more to come under Biden. More money has been printed up in the last yr than in all the yrs prior combined. Fed reserve has stopped reporting M2 because its so massive and growing exponentially every day.

And this time, unlike the 70s, the money has a 3 fold effect. First trying to engineer a great reset for the climate hoax, secondly people getting direct payments and buying scarce goods and services that havent rebounded from covid or even buying stocks and lastly with fiat money crashing in value, there is an entire group of retail and institutional speculators trying to park it in real assets to preserve wealth. Homes, cars, equipment, collectables, commodities, value stocks.

And at the same time the fed has to hold the 10yr at low levels so they are buying bonds and MBS on the other end.

This has to be the most risky and dangerous economic experiment since Weimar.

Comment

-

Weimer 1922 six months prior to hyperinflation, we have all 5 of the same markers present in our current economic environment necessary for hyperinflation. Off the top of my head the five markers are rapidly expanding monetary supply, high levels of debt, markets based on speculation not investment for productivity, corruption (crony capitalism check), and growing centralization of control. Many millionaires made in 1922 many became trillionaires 1923. So wealthy infact some would heat their homes with wheelbarrows full of money.Originally posted by jazz View PostErrol, I think its time to revisit this. The last few months have told the story of whats coming.

Trillions printed up and more to come under Biden. More money has been printed up in the last yr than in all the yrs prior combined. Fed reserve has stopped reporting M2 because its so massive and growing exponentially every day.

And this time, unlike the 70s, the money has a 3 fold effect. First trying to engineer a great reset for the climate hoax, secondly people getting direct payments and buying scarce goods and services that havent rebounded from covid or even buying stocks and lastly with fiat money crashing in value, there is an entire group of retail and institutional speculators trying to park it in real assets to preserve wealth. Homes, cars, equipment, collectables, commodities, value stocks.

And at the same time the fed has to hold the 10yr at low levels so they are buying bonds and MBS on the other end.

This has to be the most risky and dangerous economic experiment since Weimar.Last edited by biglentil; Apr 13, 2021, 09:34.

Comment

-

Money printing doesn’t lead to hyperinflation. Case in-point: Japan. Japan has no inflation and a lost generation of wealth.

Fed Chair Powell's 60 Minutes segment on Sunday just shows how fearful central bankers are of incoming deflationary risks (IMO). They can't say the word. Powell suggested that U.S. inflation is very tenuous . . . that 2%, if touched may not hold long. That is an understatement in my view.

We are just one stock market correction away from a major devaluation of assets that have been artificially supported by money printing. There is simply no substance or long-term footing for inflation given the magnitude of government and personal debt loads.

The only way out of this is; "the piper eventually gets paid" . . . and that translates into pennies on the dollar.

Comment

-

Biglentil I too have a project that has been put on the backburner. I'm looking about 40% higher build cost this spring compared to last summer when I was making plans. Piss on it I'll wait! Countless people I have talked to are in the same boat. The pendulum always swings too far to the detriment of the market then bounces back the other way.

Comment

-

Guest

Guest

me too , **** those *** mills

pricks are wrecking highways with their 84mt loads cause they can't get by hauling 64mt like everyone else

and then gouging the shit out of us on OSB, lumber, plywood , etc.

**** those greedy bastards , they will get their day

like $50+ for a sheet of OSB,$100 for plywood

hope they starve

thought trudeau said price gouging would not be tolerated during Covid?????????Last edited by Guest; Apr 13, 2021, 13:25.

Comment

- Reply to this Thread

- Return to Topic List

Comment