Originally posted by Old Cowzilla

View Post

Announcement

Collapse

No announcement yet.

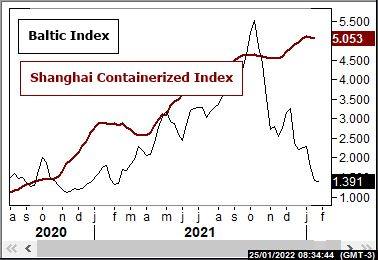

Ocean Freight Plunges

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

People running low on dough no Covid money or fuel and food cost getting in way of important purchases.

-

An observation; crude oil again appears to be hitting price resistance again.

Tiring market, signs of a possible price slide again. Fresh geo-political events needed to keep recent oil uptrend in place.

Cusp of another sell-off?

PS: VIX volatility index exploded doubling quickly in January, but now falling back again on reduced tensions.Last edited by errolanderson; Feb 1, 2022, 22:25.

Comment

-

Originally posted by errolanderson View PostAn observation; crude oil again appears to be hitting price resistance again.

Tiring market, signs of a possible price slide again. Fresh geo-political events needed to keep recent oil uptrend in place.

Cusp of another sell-off?

PS: VIX volatility index exploded doubling quickly in January, but now falling back again on reduced tensions.

Comment

-

So help me out here.....we have a falling cost of ocean shipping, we have current high commodity prices (gold, grains, other raw materials), we have high inflation pressure, we have the Feds (both here and in the US) talking about imminent interest rate hikes, all time high crop, labour and land input prices. Its damn tough to have a crystal ball, but there are lots smarter folks on here than I am.....what are the projections for crop prices for 2022 crop (assuming it is an average crop)? Thoughts folks?

Comment

-

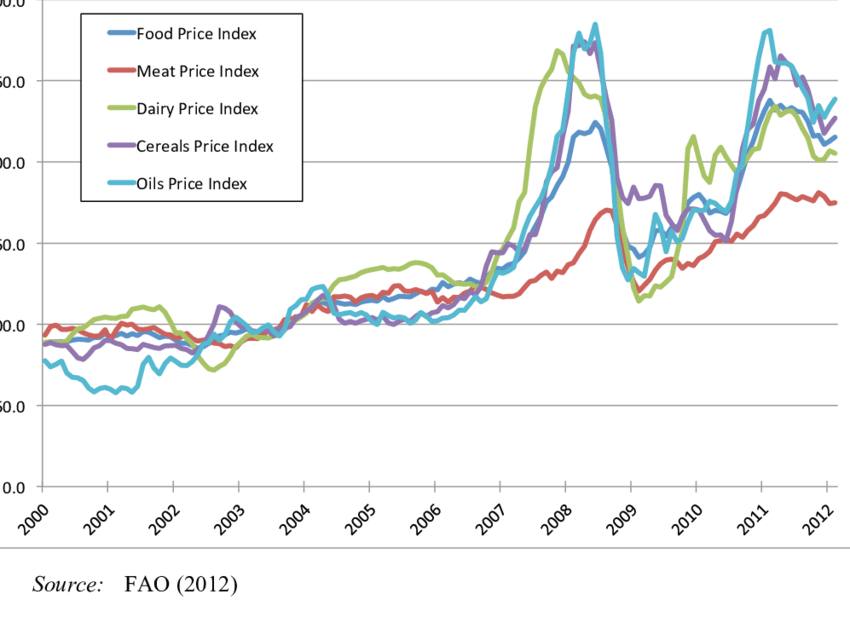

Assuming average crop, a repeat of the 2009 declineOriginally posted by NoBS View PostSo help me out here.....we have a falling cost of ocean shipping, we have current high commodity prices (gold, grains, other raw materials), we have high inflation pressure, we have the Feds (both here and in the US) talking about imminent interest rate hikes, all time high crop, labour and land input prices. Its damn tough to have a crystal ball, but there are lots smarter folks on here than I am.....what are the projections for crop prices for 2022 crop (assuming it is an average crop)? Thoughts folks?

Comment

-

Out-dated, inefficient U.S. ports . . . .

“The U.S. ports are responsible for approximately 80% of the global disruption,†said Otto Schacht, EVP of sea logistics for Kuehne+Nagel. “When you look at the Port of Los Angeles/ Long Beach, they make up the majority of the delays. A normal situation is when the indicator drops below 1 million TEU Waiting Days. You are at 12.07 million TEU Waiting Days.â€

An interesting observation. Supply chain crisis appears American-made . . . .

Comment

-

Shipping Rates are back down to 2015 levels, also known as the good ole days.

Shipping a container from China to the U.S. West Coast would be now cheaper than trucking the same container from Los Angeles to the Mid-West, let alone the East Coast.

This significant component of inflation / deflation is not apart of the U.S. CPI index.Last edited by errolanderson; Jan 12, 2023, 08:11.

Comment

-

Total Ocean Freight Collapse: Baltic Dry index peaking @ 5,550 points, now @ 530 points, 90% washout. This index covers 20 major global shipping routes for base commodities.

This signals a global commodity recession . . . . This recession may be far longer than the average 18 months as near-sighted central bank policy manipulation has set up the economy for a much harder and longer crash.

In my view, it may take 2 to 3 years before crawling out-of-this-massive-debt-mess with a changing-of-the-guard picking assets pennies-on-the-dollar. My opinion . . . .

Comment

-

So what excuse is there left for high urea prices in Canada. BDI has crashed, nat gas is low again, there has to be some excuse why fertilizer is still high.Originally posted by errolanderson View PostTotal Ocean Freight Collapse: Baltic Dry index peaking @ 5,550 points, now @ 530 points, 90% washout. This index covers 20 major global shipping routes for base commodities.

This signals a global commodity recession . . . . This recession may be far longer than the average 18 months as near-sighted central bank policy manipulation has set up the economy for a much harder and longer crash.

In my view, it may take 2 to 3 years before crawling out-of-this-massive-debt-mess with a changing-of-the-guard picking assets pennies-on-the-dollar. My opinion . . . .

Colonsay is shut down due to high inventories in the Potash market.

The only one left is the carbon tax and high diesel prices to move product in North America.

Logistics?

Comment

-

- Reply to this Thread

- Return to Topic List

Comment