Originally posted by furrowtickler

View Post

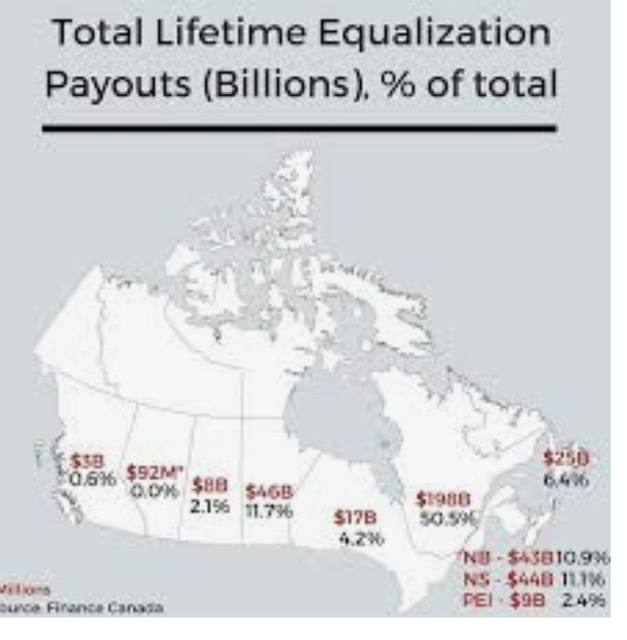

Alberta has generated far more GDP from natural resources per capita than any other province and has benefited greatly from resource revenue.

But they don't want to pay their fair share of federal taxes. They're special.

It sucks to be richest province per capita and have to pay federal taxes at the same rate as every other Canadian.

Comment