Originally posted by farming101

View Post

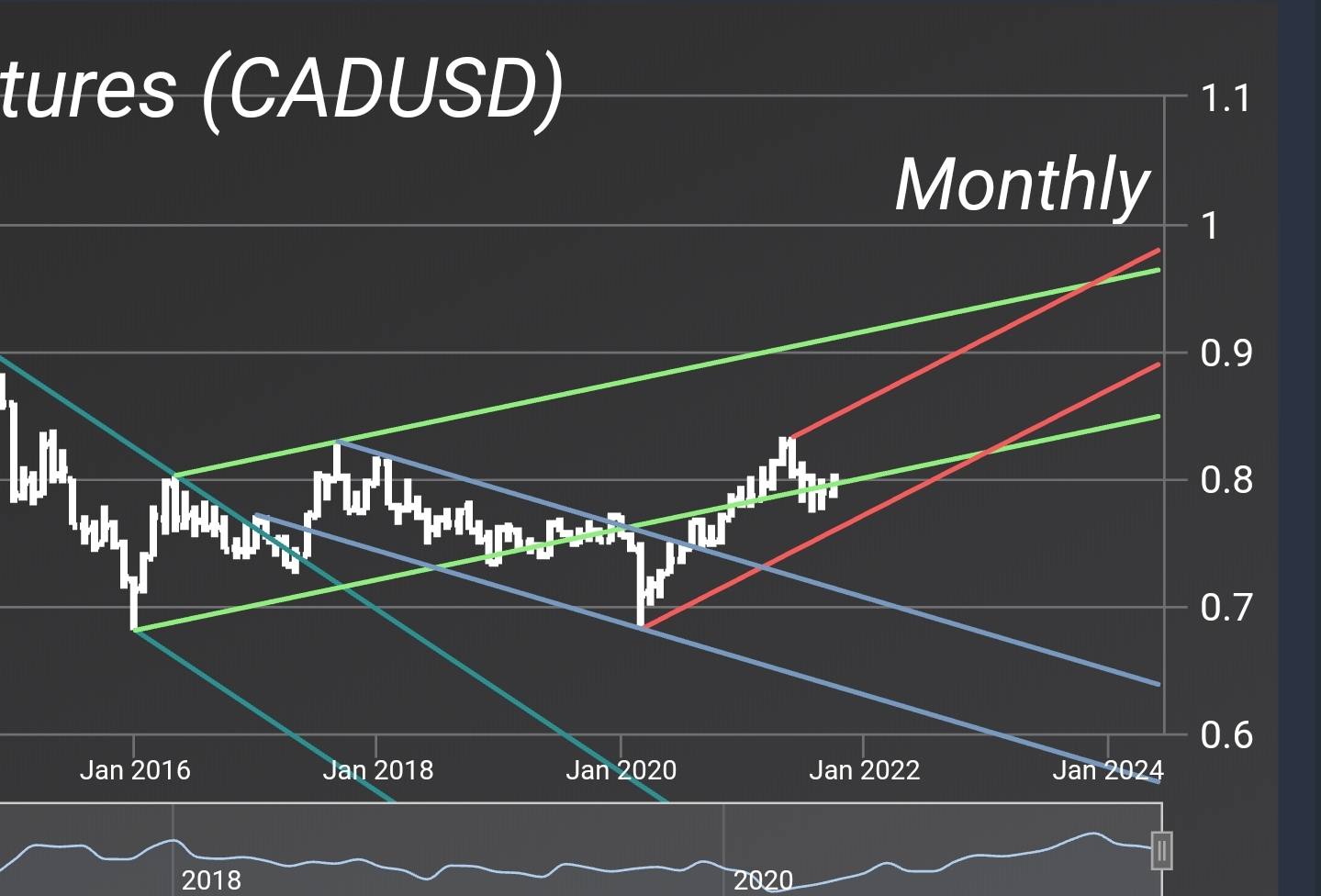

Best i can do from a tractor seat. But yes, we are on same page. I'll do a post when things slow down or snow flies, whichever comes first. Could still see a test of support, Nov shows a direction change. But im getting bullish rather then bearish and it's all commodity based. Looks like we'll be pumping oil for some time yet.

Comment