Announcement

Collapse

No announcement yet.

Red Lentil Analysis

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Tags: None

-

Thanks for this. An interesting read. Price discovery for lentils with no futures market and and price indications coming from markets in the third world make for an challenging project. It is encouraging to have markets for yellow peas in north America in the fractionation business and not totally feed or the off shore business. I would hope lentils goes this way at some point too. As we havent seen much of a run in red lentils since the early fall I too would hope to see some price increase. Normally I expect to see an increase after the fall harvest run and after buyers got in all the production contract stuff before prices go up. IMO reds have to compete with yellow peas and reds have sure been quite. When I see most all other lentil types in the high fifties and up , I kinda figure there should be more upside on the reds. I have never tracked the price spreads between say reds and estons ? It must be at least 10 - 12 cents these days. Pretty wide. For me 55 cents is a pretty good target for what we didn't move off the combine.

-

If you won’t sell red lentils off the combine and Australia has a big crop you are hopped. Buyers will buy some and offer a “decent†price to fill orders until Australia gets into harvest. That’s one reason I don’t like growing reds.Originally posted by jamesb View PostThanks for this. An interesting read. Price discovery for lentils with no futures market and and price indications coming from markets in the third world make for an challenging project. It is encouraging to have markets for yellow peas in north America in the fractionation business and not totally feed or the off shore business. I would hope lentils goes this way at some point too. As we havent seen much of a run in red lentils since the early fall I too would hope to see some price increase. Normally I expect to see an increase after the fall harvest run and after buyers got in all the production contract stuff before prices go up. IMO reds have to compete with yellow peas and reds have sure been quite. When I see most all other lentil types in the high fifties and up , I kinda figure there should be more upside on the reds. I have never tracked the price spreads between say reds and estons ? It must be at least 10 - 12 cents these days. Pretty wide. For me 55 cents is a pretty good target for what we didn't move off the combine.

Comment

-

The Turkish currency often has effect on lentil prices... Turkey last week lowered interest rates to combat 20% inflation... and their currency fell apart... no surprise...Originally posted by BTO780 View PostIf you won’t sell red lentils off the combine and Australia has a big crop you are hopped. Buyers will buy some and offer a “decent†price to fill orders until Australia gets into harvest. That’s one reason I don’t like growing reds.

Black Swan event?

Cheers

Comment

-

Wouldn’t they have to raise interest rates to lower inflation? Seems logicalOriginally posted by TOM4CWB View PostThe Turkish currency often has effect on lentil prices... Turkey last week lowered interest rates to combat 20% inflation... and their currency fell apart... no surprise...

Black Swan event?

Cheers

Comment

-

-

Wheatking;Originally posted by wheatking16 View PostThis is the link to my red lentil analysis.

https://klarenbachspecialcropsreport.substack.com/p/red-lentil-analysis

[ATTACH]9277[/ATTACH]

Based on your chart and analysis, overall what is your prediction for red lentil prices. Obviously nothing is certain, but are you more inclined to say we are going to see better prices, same prices, or worse prices? Today's price of $.45 isn't terrible but higher is better. With all the rain in Aussie, I wonder what quality looks like there?

Comment

-

Going with his one fictional concern, WHO would be it. Why is on John.Originally posted by agstar77 View PostBeing the Einstein that you are , could you tell everyone who is trying to install the new world order and why?

Lentils don't like the area. Too wet and they fall flat from disease. Too dry, they won't pod. We have no other conditions, so lentils are not a fit.

Comment

-

That is a good question.Originally posted by OvernOut View PostWheatking;

Based on your chart and analysis, overall what is your prediction for red lentil prices. Obviously nothing is certain, but are you more inclined to say we are going to see better prices, same prices, or worse prices? Today's price of $.45 isn't terrible but higher is better. With all the rain in Aussie, I wonder what quality looks like there?

As I wrote in my newsletter, I am bullish above 52 and bearish beneath that level.

Looking at the chart below, I outlined a thesis with two potential scenarios marked by the pink and blue arrows.

Often in strong bull markets, the 0.236 fib retracement will provide support for a continuation higher.

Looking closely at the chart below, you can see a slight bounce in the vicinity of the 0.236 fib level and what looks like a completed head and shoulders pattern.

Usually, I will tighten up the chart to a lower timeline to provide more detail; however, it has been a long day, and I don't have it in me tonight. I will likely do so when I publish an update to the Red Lentil Analysis later this week.

If I held my long red position off the high, I would likely have exited upon the break of the new low and completion of the head and shoulders pattern.

Assuming that I am still long, I will assess how the price reacts at each fib level.

My two potential scenarios are based on observations of 1000's of charts and represent anticipated price action.

The pink scenario has the price dropping to the 0.382 fib level, then a bounce to the 0.236 fib before falling to the 0.500 fib level at 37.

The blue scenario had the price falling to the 0.618 fib level and the previous supply at 30-31.

This chart could be forming a 4th Elliot Wave, and the 0.500 or 0.618 fib level could be the low before a new ATH.

IF this happens, we still do not know WHEN. It could be this winter or ten years from now. 4th Waves usually take the longest to form.

Keep in mind that I will reassess at each fib level, and my thesis is subject to change with new information.

Once I get comfortable with my processes, this analysis can be expected in the free Klarenbach Special Crops Report.

I hope that you subscribe and follow along.

https://klarenbachspecialcropsreport.substack.com

Last edited by wheatking16; Nov 28, 2021, 18:52.

Comment

-

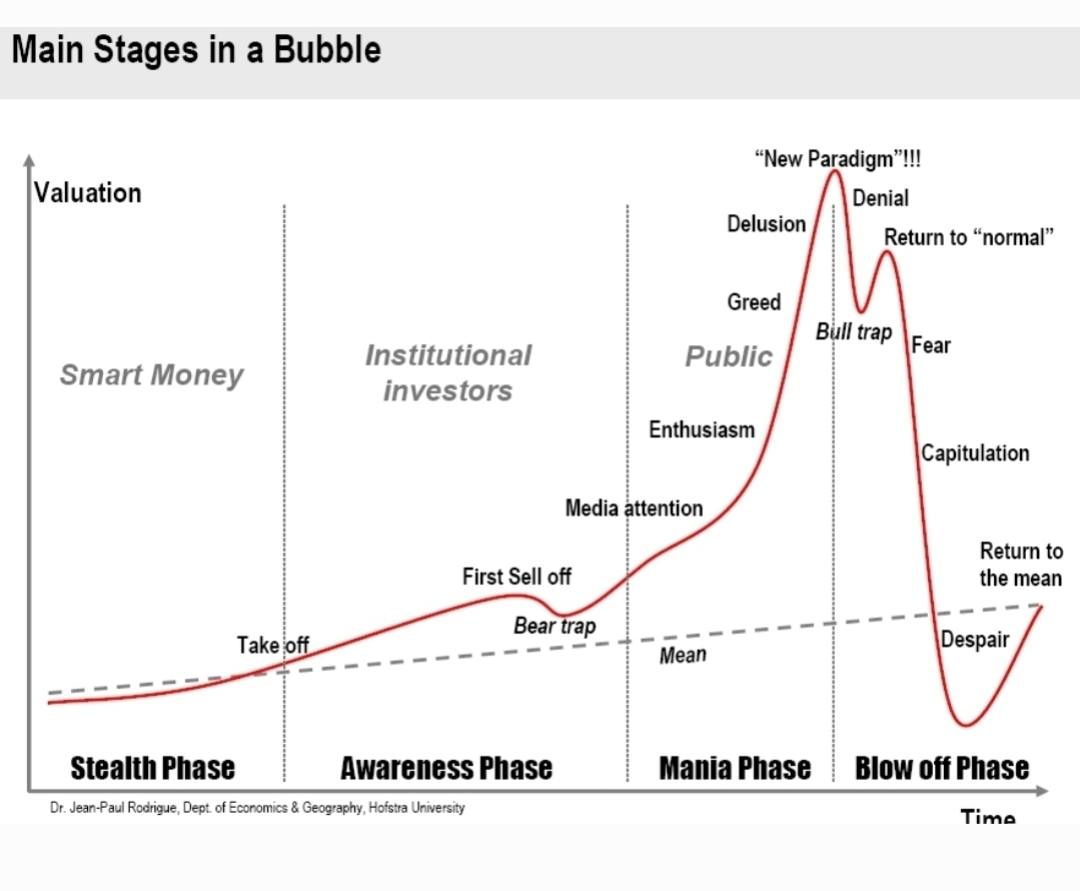

Originally posted by GohnJaltNot that I think the lentils are necessarily in a speculative bubble, but they did run hot and I find this chart useful when I see that type of parabolic action. In a typical secario we would see a 'return to normal', however we could see prices rally past the recent high due to variant fear and the anticipation of variant induced inflation.

I like this. You got me thinking about this being a Hyperwave.

If that is the case, then 20 will be realized again in the future.

Comment

- Reply to this Thread

- Return to Topic List

Comment