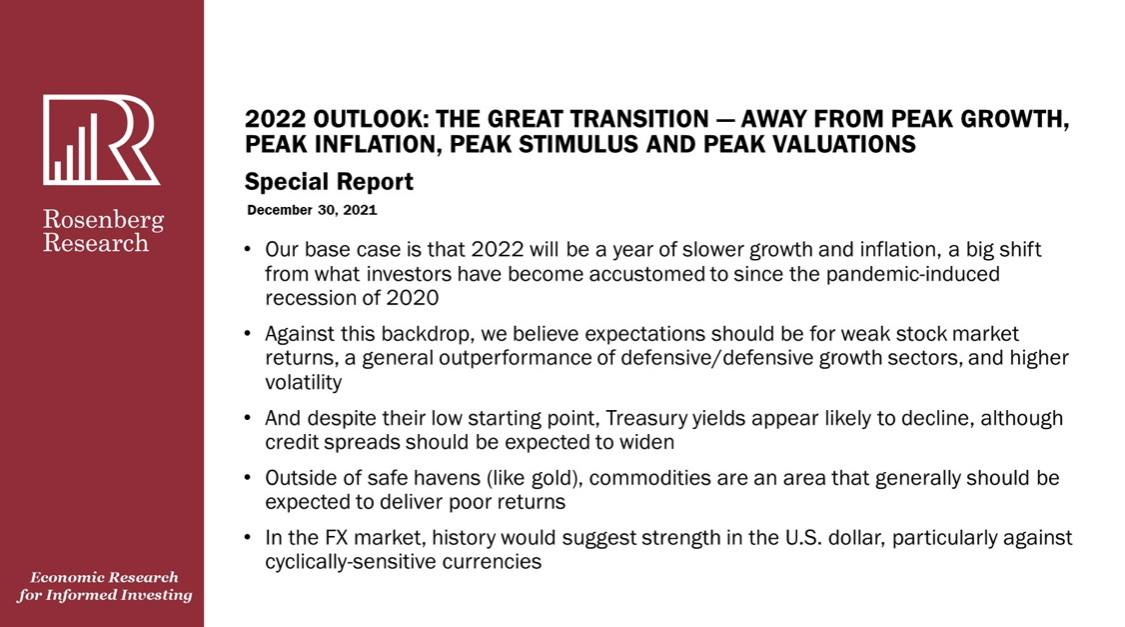

This is a report just released from David Rosenberg, well known Cdn economist.

THE GREAT TRANSITION — AWAY FROM PEAK GROWTH, PEAK INFLATION, PEAK STIMULUS AND PEAK VALUATIONS

To me, David is bang-on. We have seen peak gov't stimulus, valuations are stretched to the limit, inflation has topped out and economic growth, well it's tied almost entirely to gov't stimulus.

Mr. Rosenberg is politely saying the 'gravy train is over'. Personally believe there will be inflation, disinflation and deflation in 2022. Some asset classes will hold up well, some will buckle under the pressure. No level playing field here (IMO). There may be some stunning changing of the guard within the equity world as this inevitable transition gathers momentum.

In my view, some businesses will profit from the change, some simply won't be able to adjust. A weeding out of the herd and economic re-alignment. What are your thoughts?

THE GREAT TRANSITION — AWAY FROM PEAK GROWTH, PEAK INFLATION, PEAK STIMULUS AND PEAK VALUATIONS

To me, David is bang-on. We have seen peak gov't stimulus, valuations are stretched to the limit, inflation has topped out and economic growth, well it's tied almost entirely to gov't stimulus.

Mr. Rosenberg is politely saying the 'gravy train is over'. Personally believe there will be inflation, disinflation and deflation in 2022. Some asset classes will hold up well, some will buckle under the pressure. No level playing field here (IMO). There may be some stunning changing of the guard within the equity world as this inevitable transition gathers momentum.

In my view, some businesses will profit from the change, some simply won't be able to adjust. A weeding out of the herd and economic re-alignment. What are your thoughts?

Comment