She’s going to be a rude awakening. Canada squashed every opportunity to be an energy giant, now the Western World will suffer. Trudeau says , No, we can’t help Europe and we aren’t about to try either. Little green nose in the air.

Announcement

Collapse

No announcement yet.

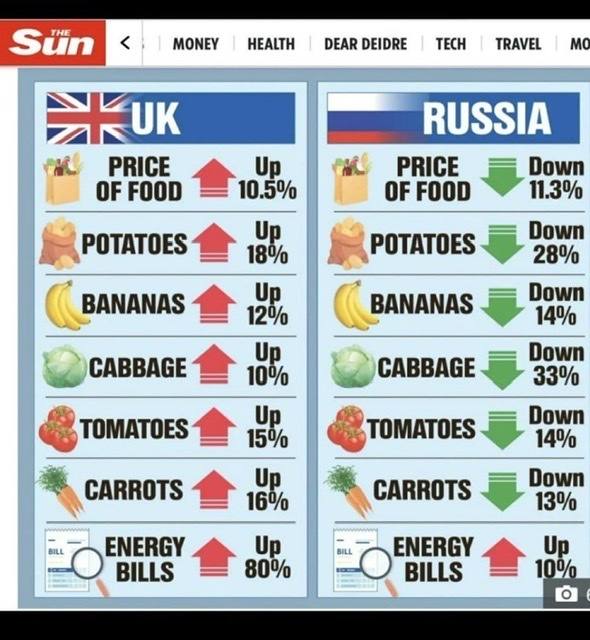

Inflation’s Collapse

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

-

Meanwhile in North America we have a two ring circus 🤡 lead by a drama teacher , a journalist here in Canada , and an 80 year old with dementia that has no clue wether to shit or go blind all focused on climate change and woke agendas

Comment

-

Major weakness in deferred crude oil contracts . . . Sept 23 contract just broke below $74 per barrel. Deflationary pressures now lighting-up-the-scoreboard . . . .

Comment

-

It looks rough.Originally posted by errolanderson View PostMajor weakness in deferred crude oil contracts . . . Sept 23 contract just broke below $74 per barrel. Deflationary pressures now lighting-up-the-scoreboard . . . .

72 incoming.Last edited by wheatking16; Sep 23, 2022, 07:15.

Comment

-

Costco saying their shipping costs have come down considerably and they will pass-on to the consumer.

Diesel, parts, fertilizer sticky, but asset prices appear coming down, some quickly. Fed has blown it (IMO). Too aggressive with hikes, economy now in meltdown. Consumerism will take a huge hit, maybe that's good news.

Comment

- Reply to this Thread

- Return to Topic List

Comment