Sry got side tracked there. Inflation is the expansion of the money supply and a rising cpi is the symptom. The elephant in the room is the currency swap agreements being formed by the BRICS that 7 out 8 of the middle east oil producers have also signed onto. This is a massive geopolitical shift away from the petrodollar that has afforded the US fed the privilege to offload much of its inflation onto the rest of the world. No one nation could upend the mighty USD's reserve status, but when nations comprising over 50% of the world's population ditch the dollar they just might. Those dollars no longer needed in trade will come home to roost and as they do anything not bolted down will be up for grabs.

Announcement

Collapse

No announcement yet.

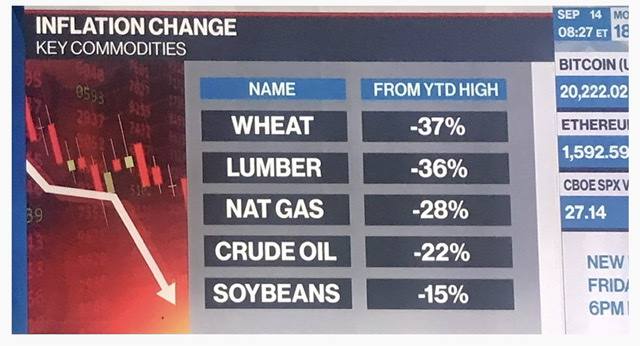

Inflation’s Collapse

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Very few understand thisOriginally posted by biglentil View PostSry got side tracked there. Inflation is the expansion of the money supply and a rising cpi is the symptom. The elephant in the room is the currency swap agreements being formed by the BRICS that 7 out 8 of the middle east oil producers have also signed onto. This is a massive geopolitical shift away from the petrodollar that has afforded the US to offload much of its inflation onto the rest of the world. No one nation could upend the mighty USD's reserve status, but when nations comprising over 50% of the world's population ditch the dollar they just might. Those dollars no longer needed in trade will come home to roost and as they do anything not bolted down will be up for grabs.

Especially woke leftist leaders like Trudeau or his journalist deputy PM … as in zero clueLast edited by furrowtickler; Sep 23, 2022, 16:34.

Comment

-

-

-

and every single thing we need to buy is up tremendously

I don’t give a hoot if Zuterberg just lost 71 billion, could give a ***

But where do we , the common people stand ???l

Where will your kids / and grandchildren be when , guess why not one penguin 🧠will be saved but your grandchildren eat Buggs FFS. Holy *** I can’t believe this garbageLast edited by furrowtickler; Sep 24, 2022, 00:28.

Comment

-

-

You said it all Furrow. We are doomed until the “Great Right Recoveryâ€.Originally posted by furrowtickler View PostMeanwhile in North America we have a two ring circus 🤡 lead by a drama teacher , a journalist here in Canada , and an 80 year old with dementia that has no clue wether to shit or go blind all focused on climate change and woke agendas

Comment

-

GBP Futures halted.

Pound Flash Crashes 500 pips To Record Low Amid Global FX Carnage As Things Start Breaking | ZeroHedge

If this can happen to the British Pound, it can happen to any currency.

Errol do you think deflation is their concern in the UK?Last edited by biglentil; Sep 26, 2022, 07:04.

Comment

- Reply to this Thread

- Return to Topic List

Comment