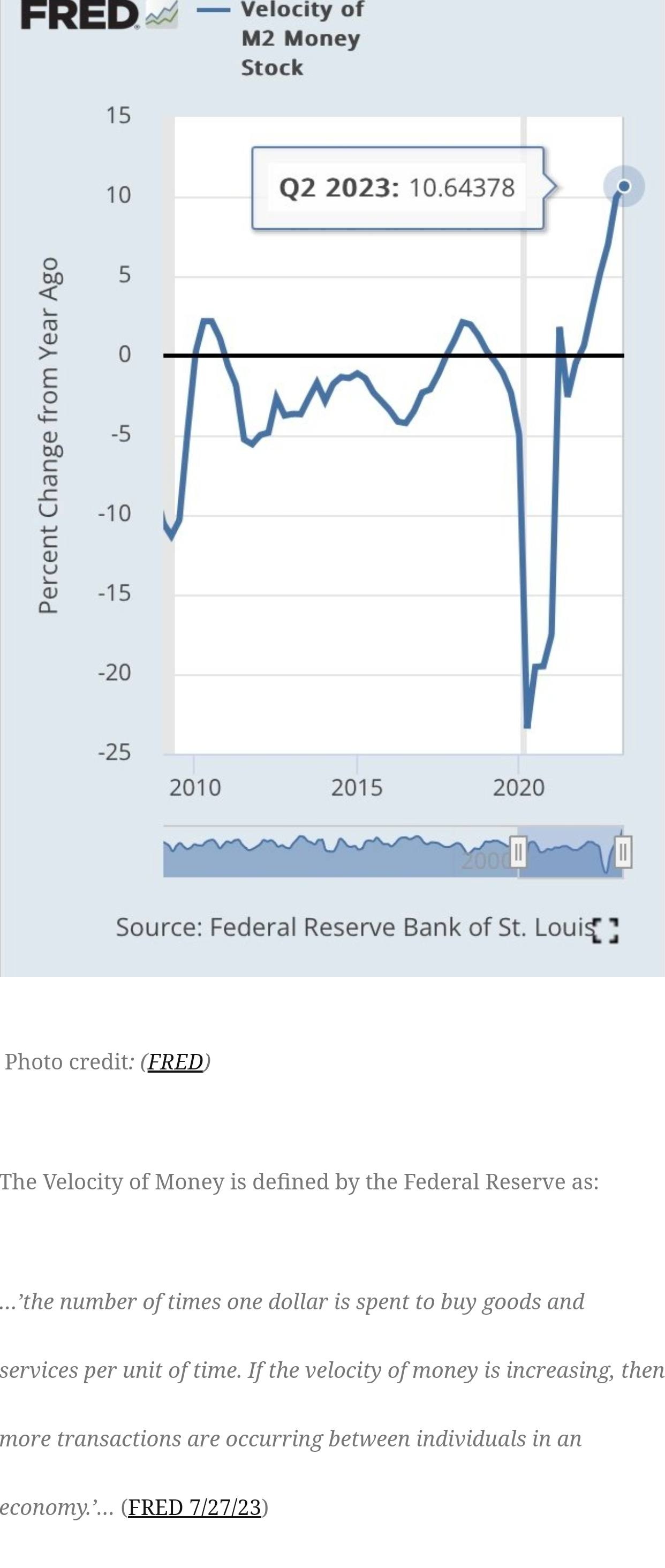

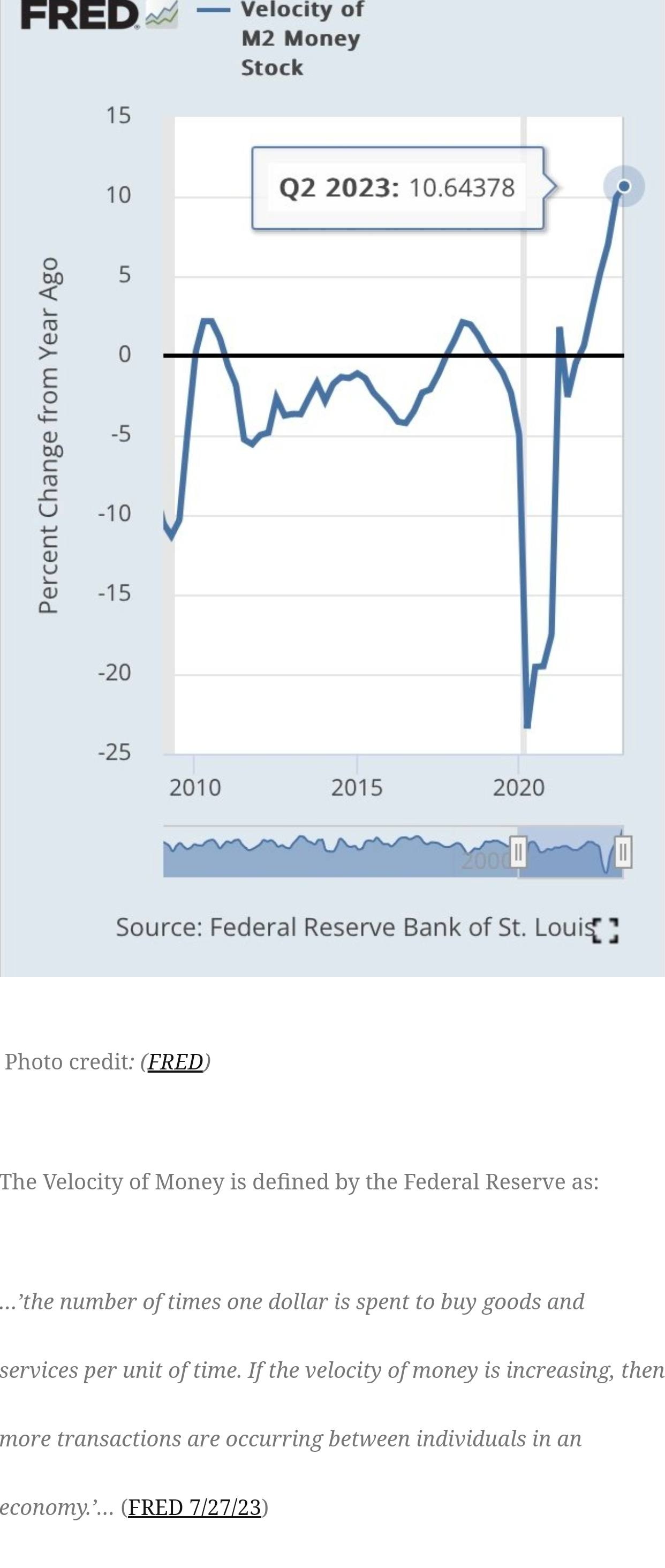

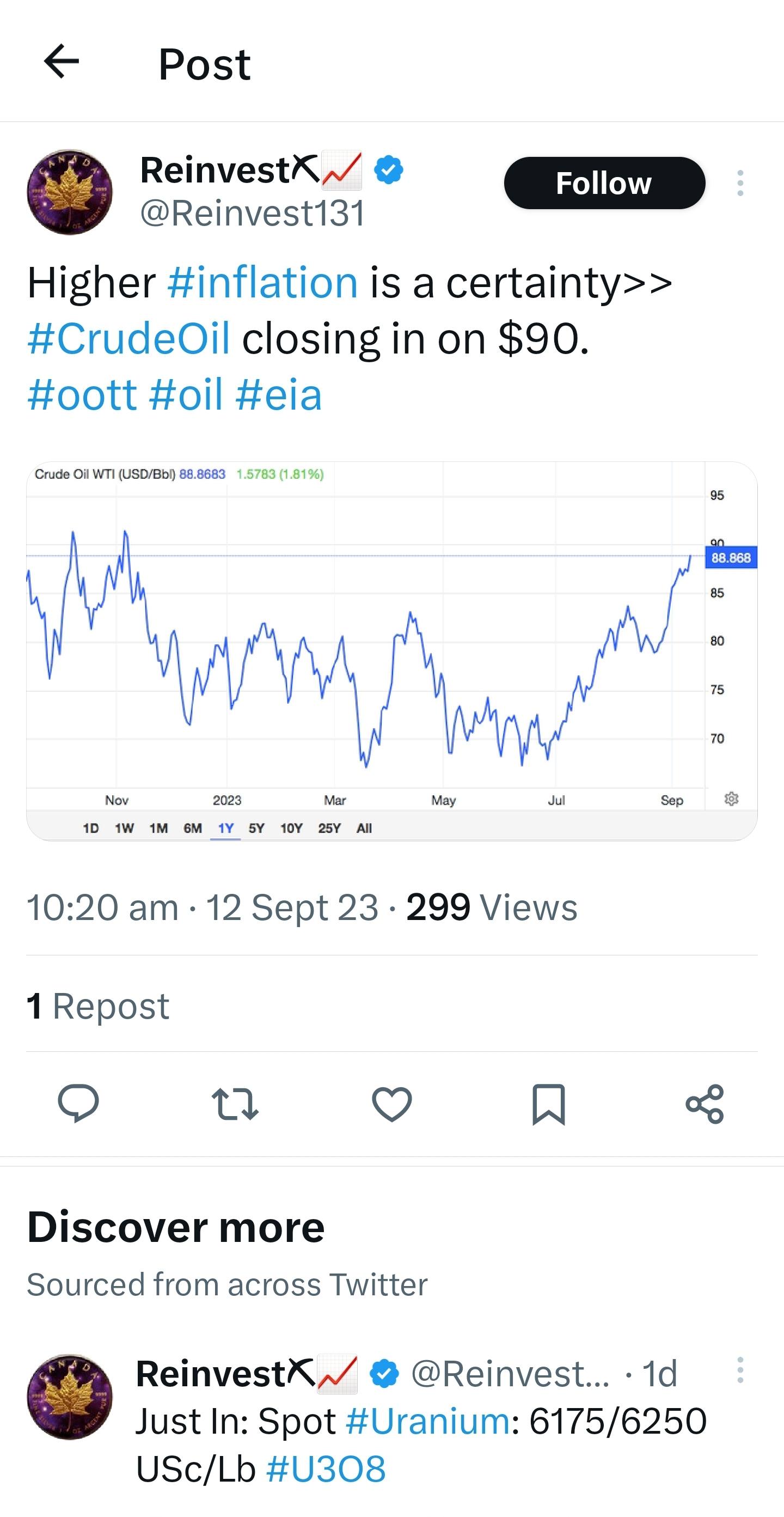

A rising cpi is the result of two main factors the inflation of the money supply and velocity. The fed just recorded the highest print of velocity ever of 10.9%. Strong velocity can be an indicator of a strong economy, but thats not the case. With the resent Fitch credit downgrade of the US and in anticipation of the Brics summit August 23rd dollars are being dumped. This may be the eye of the hyperinflationary hurricane, or more correctly a hyper CPI hurricane as a deluge of USD comes home to roost. No one wants to be caught holding a hot potato.

Comment