Glad it’s seeding season …. Time to not worry about the world around us for a few weeks

Announcement

Collapse

No announcement yet.

24 Hours

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

Maybe a world war causing concern with people with money on how much they should spend and where. Mother's day supper was 20% more than a year ago but compared to what I have spent on the farm lately that was a bargin.

Comment

-

Would that cash be "in or out" of the financial institutions?Originally posted by errolanderson View PostDebt defaults will force asset liquidation.

All financial sectors are tumbling. Stocks, bonds, cryptos under severe pressure . . . only place to hide right now is cash (in my view). Cash on-the-sidelines now has value.

My two-bits . . . .

Comment

-

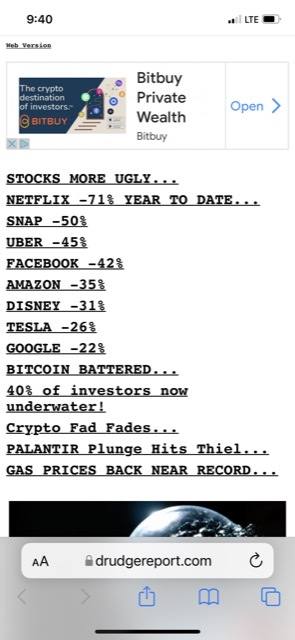

How to describe today’s stock market SWOON? PLUNGE? CRASH?

S&P 500 index breaks below 4,000 points.

This is the outcome of excessive money printing (for the past 13 years) by central bankers artificially jacking asset prices higher without true productivity, earnings or innovation. Markets are now spiralling on failing central bank Keynesian economic policy that may take years-to-repair. Inflation has taken-a-hit . . . .

Comment

-

Colour me skeptical that this is anything existential. Its a bear market. They always go down like a rock. The challenge is to figure out which is bounce and which is bottom.

Comment

-

-

In your opinion where does it end? Or how is it resolved?Originally posted by errolanderson View PostU.S.dollar just tested a 20-year high.

Treasury yields surging.

Bitcoin has just lost 50 percent of its value since last November highs

Precious metal price meltdown.

NASDAQ diving. Equities / bonds swoon.

Massive hedge fund losses.

Credit markets under-siege.

Foreclosures/bankruptcies about to ramp-up.

Inflation has peaked.

Keynesian economics crashing-to-reality.

Welcome recession . . . .

Comment

-

I think the reality of “things†not needed when inflation destroys the middle class .

You can’t live without food but everything on that list is basically a luxury and not needed like Facebook, Netflix and others . So losing value in something that was way way overvalued does not concern most average Joes …. But food and fuel do .

Not surprising at all , when you demolish the disposable income of the middle class this is the result .Last edited by furrowtickler; May 9, 2022, 21:56.

Comment

- Reply to this Thread

- Return to Topic List

Comment