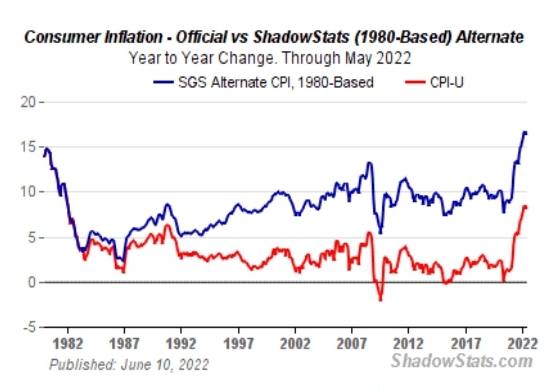

Dont worry the WEF Young Global Leaders like Newsom has the solution for inflation to cause more inflation, $17B in handouts. Jagmeet also on board with throwing gas on the fire. Its the controlled demolition of the dollar, no easier way to implement communism.

Comment