A person should really consider that the Big likely hood that depression we are entering is intentionally being set up by the WEF and the US Fed… with backing from China.

Announcement

Collapse

No announcement yet.

DEFLATION: Comin-in strong

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Good news, fairly sharp drop in diesel prices in the past 24 hours. Futures breaking lower today . . . .

Comment

-

-

Consumer demand for goods and services falling-off-a-cliff . . . . Not looking good folks.

Governments and central bankers in la-la land and denial of the immense financial mess created . . . .

Comment

-

-

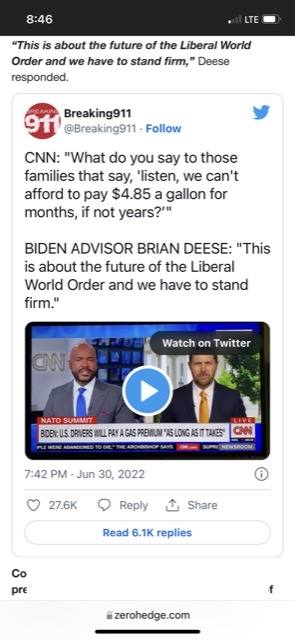

A significant portion of the population will not be able to afford their own transportation.

Some of them have been campaining for big changes.

Did they get what they wanted?

Comment

-

IMHO deflation doesn't kick in until we are back to prepandemic prices.

SO, until gas is somewhere back to 80cents a litre or less deflation hasn't cut in.

What benchmark would you use to figure deflation?

yesterday , last week, last year?

If the pandemic is what caused the inflation ( puke here ) then deflation can't really be said until we back to those levels.

I get a kick out of how they will raise prices with a phoney excuse then back them off a little knowing full well consumers believe they are getting a break.

For a decade Westons price fixed bread ( collusion - no fine BTW ) using Peter Mansbridge The National that grain prices had rose to cause the price of bread to go up. ( not true ) . The media never questioned bread prices when the price of wheat went back down.

And they actually did it again recently. With the price of wheat doubling , it doesn't justify a dollar a loaf increase but the consumer is naturally driven to say farmers are the culprit.

Farm groups don't even try to explain to consumers they are getting ripped off. When they should have an off the shelf rebuttal every time the media misinforms the public about rising grain prices.

FFS , gasoline never got to 2.07 a litre when oil was 150 a barrel and no one questions it. Why?

Because bobblehead Freeland says it a global problem...

Comment

-

This could be a deflationary tsunami incoming . . . .

Even OPEC is struggling to manipulate global oil prices with production cuts. Before you know it, there will be infighting within the cartel.

And central bankers . . . good grief . . . always looking backwards, not forward.

Comment

-

Noticed that this morning that with production cuts looming the price of oil has not changed. Once the revised data comes out we will find that we have been in recession for half a year already.Originally posted by errolanderson View PostThis could be a deflationary tsunami incoming . . . .

Even OPEC is struggling to manipulate global oil prices with production cuts. Before you know it, there will be infighting within the cartel.

And central bankers . . . good grief . . . always looking backwards, not forward.

Comment

-

To me, there are serious price pressures heading our way . . . .

Barchart is suggesting $5/bu corn and $10/bu beans. There is not a shortage in the world.

The financials are a complete train-wreck.

The consumer totally tapped-out. All the press wants to hear is; inflation, until it isn't, big-time. Deflation is real, even OPEC will get tuned-up. And the Fed , good grief. Has there been a worst Fed in the U.S.? My opinion . . . 2023 and 2024 will be hard-hit years of deflation and bankruptcies, rising unemployment and mergers and For sale signs.

The reporting of the financial press makes me ill, as a lot of people has been gulled into the ideas that this a just a normal downturn. It isn't . . . .

Comment

- Reply to this Thread

- Return to Topic List

Comment