Thank you tom, and I agree. I definitely worded my last sentence wrong. I was trying to indicate how more than a decade of supposedly highly inflationary money printing since 2008 did not result in inflation during that entire period. And as you say, the criminally misguided green policies and resulting High energy prices are at the root of all current inflation. As I said in another thread, if all of this printed money had gone into assets which would increase our productivity, it wouldn't have had to be inflationary at all. Instead, huge sums were wasted on chasing unicorns

Announcement

Collapse

No announcement yet.

The bullish case

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

-

Not many people understand how the money supply is increased and the types of assets that create inflation.Originally posted by AlbertaFarmer5 View PostThank you tom, and I agree. I definitely worded my last sentence wrong. I was trying to indicate how more than a decade of supposedly highly inflationary money printing since 2008 did not result in inflation during that entire period. And as you say, the criminally misguided green policies and resulting High energy prices are at the root of all current inflation. As I said in another thread, if all of this printed money had gone into assets which would increase our productivity, it wouldn't have had to be inflationary at all. Instead, huge sums were wasted on chasing unicorns

Comment

-

-

Just watching this Peter Zeihan video.

Lots of info and stats about present and future fertilizer shortages.

One stat really jumps out. A list of almost 50 ag commodities, which according to him, for each of those, within the next year, 2 of the top five producers(countries) will have to stop producing because they can't get nitrogen fertilizer. Obviously this is an over simplistic assumption, production wouldn't "stop" even with no fertilizer, but the yield reductions would be drastic. Keeping in mind that he has a book to sell, so take any prognostications especially negative ones with a grain of salt.

The map at the 48 minute mark is worth noting.

Closing statement is that the inflation we have today will be the lowest we experience for at least the next 5 years.Last edited by AlbertaFarmer5; Jun 24, 2022, 00:33.

Comment

-

-

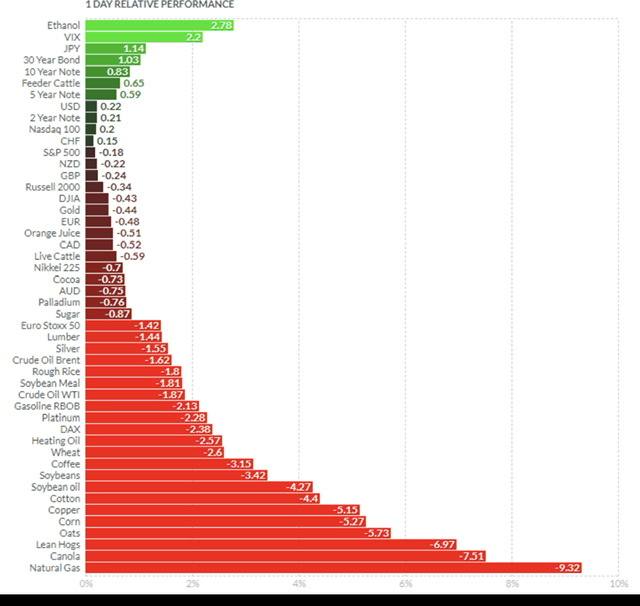

I’m sure this is da year for feeders to have a nice payday………. Same prediction I’ve had for three years already. Someday I’m gonna beat right……… maybe? ………… possibly? …….. please?Originally posted by Old Cowzilla View PostSo feeder cattle are still in the green so I still have a chance oh and we just got hail on my shitty canola crop a few minutes ago things are gonna change I can feel it

oh and we just got hail on my shitty canola crop a few minutes ago things are gonna change I can feel it

Doing last years canola math my 1,000 pounders this fall should be worth $3,800. My momma always says dream big or go home😎

Comment

-

The bear case: bad government intervention in the economy especially during covid has transferred almost all the wealth from the poor to the rich. We now have a situation where billions around the world face significant food insecurity. Alternative food sources, reduction in waste and outright starvation will be the result. This why canola has tanked. Poor folk can't buy $25 canola. Bring interest rates closer to a market price does slow down the wealth transfer from the poor to the rich so it is the right thing to do. I think central banking should be terminated and interest rates set in the market place away from politically motivated intervention. This would result in rates being much higher that they were.Last edited by ajl; Jun 24, 2022, 08:32.

Comment

-

- Reply to this Thread

- Return to Topic List

Comment