They arent going to get it back that way BP. Canadas debt to gdp ratio is not far off from what it was in the mid 90s and we all know what had to be done to get things back on track. That AAA rating is as good as toast.

Announcement

Collapse

No announcement yet.

Wasted 30 billion????

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

I wouldn’t be to quick to pay it back. Just another Wedge issue to keep the Government in power….. they will totally forgive all the cerb program money and audits in return for a vote in the next election. They will tell all those that got free money the Scary PIERRE is coming for you and will take it away maybe your first born will be taken as well. Lol

Comment

-

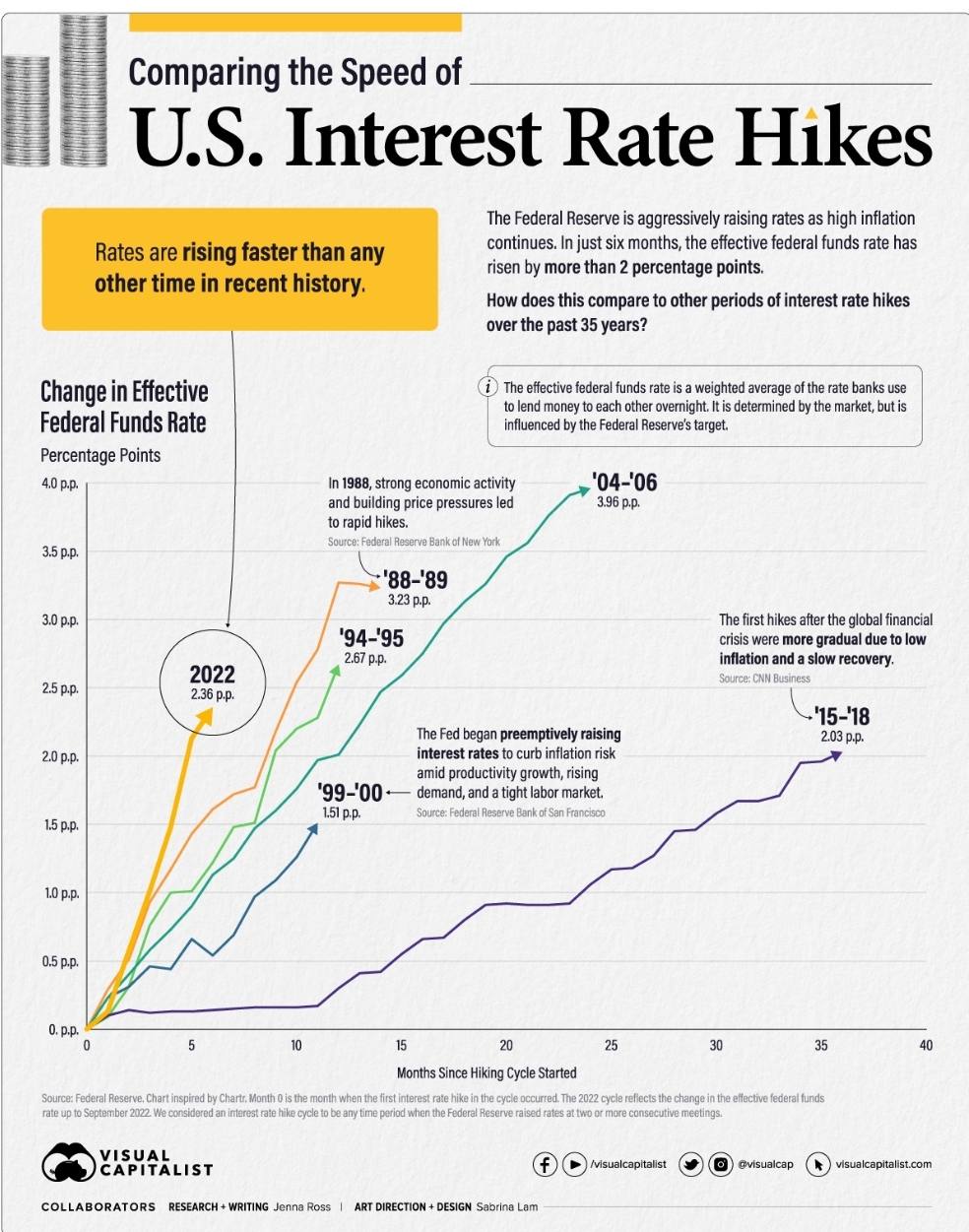

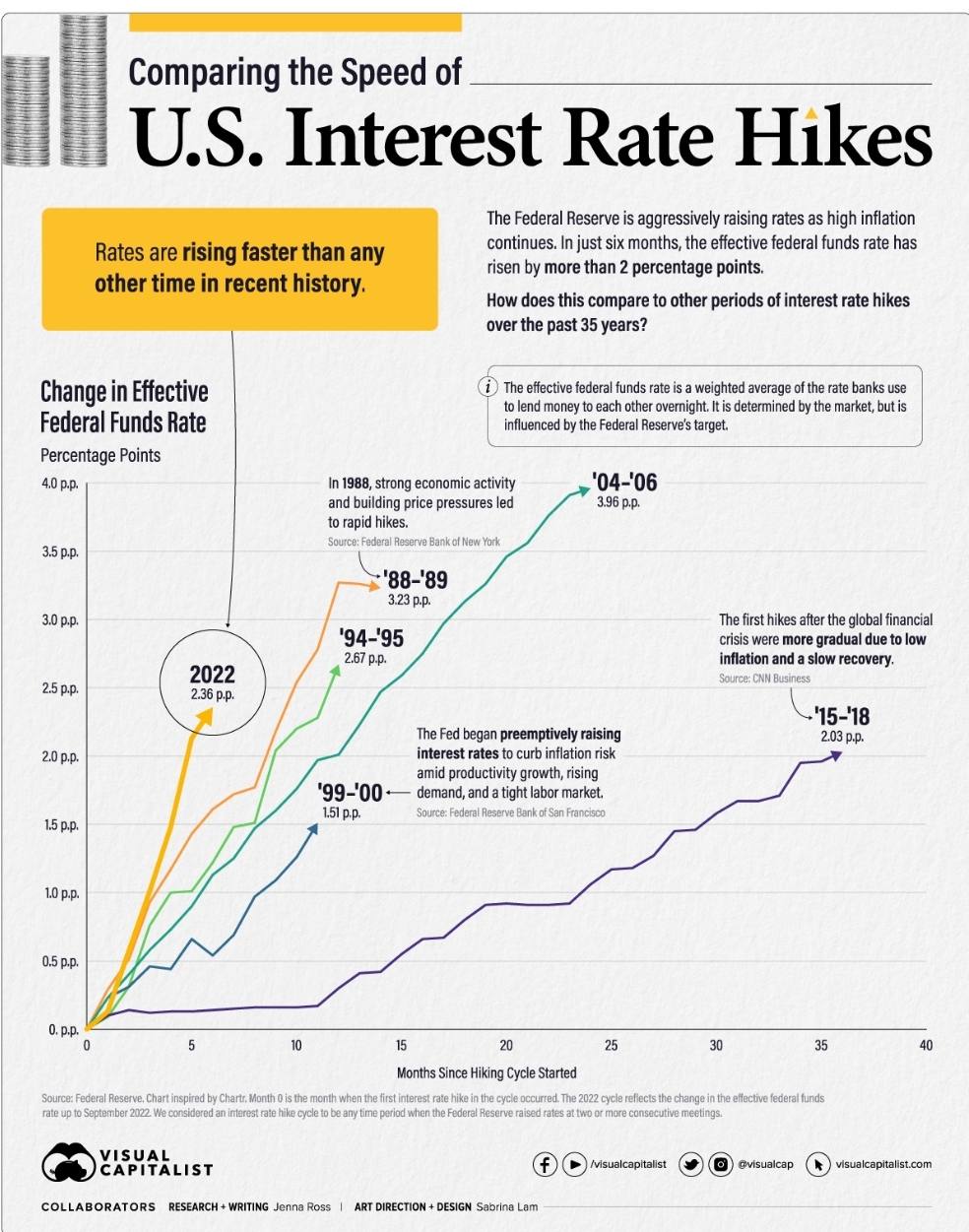

The privately controlled Bank of Canada masquerading as a crown corp with 'special rights' continuing with a 50 basis point hike yestarday. All according to plan like I called before even the 1st rate hike. There will be no letting off the gas until Canada itself is bankrupt.Last edited by biglentil; Dec 7, 2022, 14:55.

Comment

-

Isn’t a .5 increase letting off the gas from .75Originally posted by biglentil View PostThe privately controlled Bank of Canada masquerading as a crown corp with 'special rights' continuing with a 50 basis point hike yestarday. All according to plan like I called before even the 1st rate hike. There will be no letting off the gas until Canada itself is bankrupt.

Comment

-

Central banks are hiking at the fastest pace in history after many years of extremely loose monetary policy, and near zero percent rates. They created the everything bubble and are now popping it. The middle class is toast and will demand a solution from those that intentionally created the problem. The IMF will come to the 'rescue' and eliminate all debt and offer ubi in exchange for giving up property rights. Welcome to the great reset and the nwo. Rumour is April of 23.Originally posted by TASFarms View PostIsn’t a .5 increase letting off the gas from .75

Last edited by biglentil; Dec 7, 2022, 16:29.

Last edited by biglentil; Dec 7, 2022, 16:29.

Comment

-

Lots of farms feeding livestock when there wasn't enough packing plants to process them. Don't recall any cheap feed out there during this covid thing. Don't recall ANY farmers getting time off during covid still had to feed the world go to work sick or not keep machinery running open shops or not parts supply or not deliver grain to market or not access to office just slip grain ticket under door. Oh and not allowed to use restrooms or restaurants while hauling grain. Driving all over hells halve acre to get parts fun times .

Comment

-

Considering that rates should not of gone so low in the first place and the fact that they dragged their feet far too long before raising rates this is the results. Still think rates have a bit to go yet, but maybe at a slower pace.Originally posted by biglentil View PostCentral banks are hiking at the fastest pace in history after many years of extremely loose monetary policy, and near zero percent rates. They created the everything bubble and are now popping it. The middle class is toast and will demand a solution from those that intentionally created the problem. The IMF will come to the 'rescue' and eliminate all debt and offer ubi in exchange for giving up property rights. Welcome to the great reset and the nwo. Rumour is April of 23.

8

Nice to be able to put money into a GIC and get close to 4% instead of the .5% a year ago and gives investors a choice instead of the stock markets and crypto currencies.Last edited by Sodbuster; Dec 7, 2022, 19:03.

Comment

-

Best GIC rates are 5% for 1 yr in Canada. Current official CPI is 6.9%. For a loss of 1.9% on the purchasing power of your dollars in 1 years time, but its worst than that since the interst you received is taxable income.Originally posted by Sodbuster View PostConsidering that rates should not of gone so low in the first place and the fact that they dragged their feet far too long before raising rates this is the results. Still think rates have a bit to go yet, but maybe at a slower pace.

8

Nice to be able to put money into a GIC and get close to 4% instead of the .5% a year ago and gives investors a choice instead of the stock markets and crypto currencies.

Only in a funny money financial system would savers be punished in such a manner.

Comment

-

Most definitely true but sure beats the stock market being down close to 25% this year unless you invested in energy or metals.Originally posted by biglentil View PostBest GIC rates are 5% for 1 yr in Canada. Current official CPI is 6.9%. For a loss of 1.9% on the purchasing power of your dollars in 1 years time, but its worst than that since the interst you received is taxable income.

Only in a funny money financial system would savers be punished in such a manner.

Comment

- Reply to this Thread

- Return to Topic List

Comment