Last few years Morris has been SS on all parts under tank

Announcement

Collapse

No announcement yet.

Predictions and Observations

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

Guest

Guest -

Crestliner, you can substitute any year you want regarding events, but those who have ran their businesses in the above manner will survive and thrive without missing a beat.Originally posted by Crestliner View PostWatching events unfold at the end of 2023 into 2024 some observations in my opinion

The farmers who have done nothing but build up cash, pay debt down, and made

prudent purchases to add to their farms will have a chance to benefit from the reset that is coming. Low cost production operators will thrive and continue to grow.

Thoughts?

Risk to reward ratio and living within your means is what's needed to succeed.

Oh ya, did you drink a lot of cold Bud Lights this summer while listening to Led Zeppelin and Black Sabbath?

- Likes 1

Comment

-

Maybe getting picky in my older years but finding good used steel is getting harder. More and more equipment falls into the (project dept. ) before it can see the field . Then you end up bidding against all you other frugal farmers trying to get a bargin . Very time consuming .

. Very time consuming .

- Likes 1

Comment

-

Strap-in 2024 . . . . Power of U.S. Federal Reserve fades quickly. Money printing gig no longer effective. U.S. money supply crashes to 1930s levels as debt crisis implodes.

And for stock market investor relying on the Fed backstop for the party to roll on? Well, those days numbered. Fed power greatly diminished. Central bank rate cuts in-desperation to re-inflate.

Stock market has to live within its means, without manipulation, on its-own-merit. Liquidity crisis inevitable. My opinion . . . .

- Likes 2

Comment

-

Somebody piss in your beer Errol?!Originally posted by errolanderson View PostStrap-in 2024 . . . . Power of U.S. Federal Reserve fades quickly. Money printing gig no longer effective. U.S. money supply crashes to 1930s levels as debt crisis implodes.

And for stock market investor relying on the Fed backstop for the party to roll on? Well, those days numbered. Fed power greatly diminished. Central bank rate cuts in-desperation to re-inflate.

Stock market has to live within its means, without manipulation, on its-own-merit. Liquidity crisis inevitable. My opinion . . . .

Comment

-

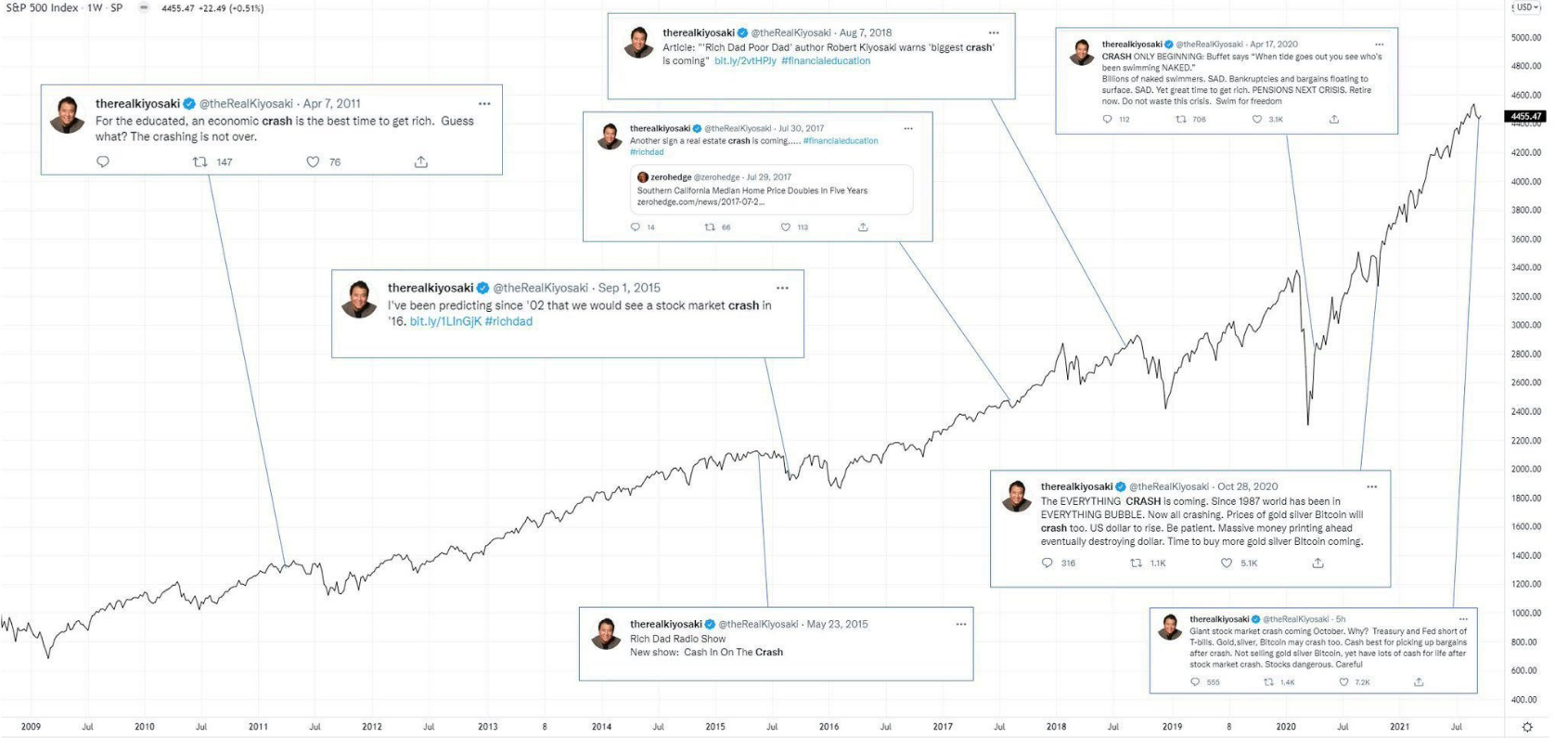

I saw this article about Robert Kiyosaki predicting a stock market crash every few months for years. It reminded me of someone.Originally posted by Hamloc View Post

Somebody piss in your beer Errol?!

- Likes 1

Comment

-

My apologies Errol but I wrote down the first thought that came to my mind after reading your post.

There are certain outlooks I share with Errol. The amount of debt piled on through and after Covid by governments is beyond reasonable. And I certainly agree at least Canada will be flirting with recession in the first 2 quarters of 2024. And I do think there is an overall bearish tone in the commodity markets. In response to Crestliners original post, it certainly looks like the highs were in at harvest for wheat. The elevator companies are certainly digging in their heals and trying to push the price down based on competition from cheaper wheat supplies like Russia and Ukraine. Canola is certainly undervalued in comparison to Soybeans in my opinion, regardless there seems to be little optimism for canola prices coming back. Land prices in my area still seem to have upward pressure and the price of farm equipment new or used makes no sense. Staying or being optimistic is difficult. But I consider myself very fortunate living in the country and I am thankful everyday when I look out my kitchen window.

- Likes 6

Comment

-

I did my thesis in University regarding the link between the price of wheat and the price of land. It seemed that the relationship showed a two year lag between the direction of wheat prices and the price of land. It wasn't a perfect relationship but something like over 80%.Originally posted by Hamloc View PostMy apologies Errol but I wrote down the first thought that came to my mind after reading your post.

There are certain outlooks I share with Errol. The amount of debt piled on through and after Covid by governments is beyond reasonable. And I certainly agree at least Canada will be flirting with recession in the first 2 quarters of 2024. And I do think there is an overall bearish tone in the commodity markets. In response to Crestliners original post, it certainly looks like the highs were in at harvest for wheat. The elevator companies are certainly digging in their heals and trying to push the price down based on competition from cheaper wheat supplies like Russia and Ukraine. Canola is certainly undervalued in comparison to Soybeans in my opinion, regardless there seems to be little optimism for canola prices coming back. Land prices in my area still seem to have upward pressure and the price of farm equipment new or used makes no sense. Staying or being optimistic is difficult. But I consider myself very fortunate living in the country and I am thankful everyday when I look out my kitchen window.

Remember this was in the age of the floppy disk, which many on here have never seen, let alone used.

I am sure a more sophisticated analysis would be able to better define the relationship between farm income and land prices.

- Likes 4

Comment

-

I think the closer you analysis these markets the more bearish one can get. I don't think i see any crop that is going to be worth more in Jan/Feb then it was in Dec.

I find the canola market interesting this year. It has been going down since July this summer but most growers find some reason to always stay bullish and ride it lower and lower. Yeah it may come back later but come back from what?

CAD continues to strengthen and will continue to put pressure on our grain prices as well. It may have another 2% to take from our prices but that one is a wild card. What isn't a wild card is demand and its truly terrible in some grains.

The issue though is what is positive in these markets? Land prices continue higher and higher and i just dont understand the disconnect from what you see in the grain markets and interest rates. What can you point to that makes one bullish.

- Likes 3

Comment

-

here's my average joe prediction

Higher interest rates last 12-16 months have pulled money into GICs and savings accounts, the popularity of cash etfs as well has been surprising. I am bullish on stocks if the rumours and forecasts of falling interest rates follow through. The high rates have pulled cash away from the stock market but that will reverse if investors can't get the 5-6% return on cash anymore. Crestliner's first post called for 8-10% interest but I really don't that's going to happen, there's too much debt in the world and the people in power know it would be a disaster if they let that happen.

commodities... I have no idea, I can't pick a direction, seems like it's gotta turn around at some point but I'm really not sure if it will before the 2024 crop is in the bin. could see 12 dollar canola before that happens. could rally into the new year. no idea. Best price was off the combine so far and there's a good chance it will stay that way.

land prices and rent will remain stable at the minimum. Despite all the complaining here on the forums there are still a lot of guys who can and will afford to lose money to increase their land base. Too much competition for a shrinking base of available land that's not locked up in generational BTOs and investment companies.

The prediction that 40% of farmers will leave soon.... That may be true but the land base those guys hold is not 40% of the farmland so it's not as impactful of a stat that it may seem. Have a few farms in my region who appeared to be shutting down with no successor... and suddenly one of the kids comes back home and is farming again.Last edited by Marusko; Dec 20, 2023, 12:13.

- Likes 1

Comment

- Reply to this Thread

- Return to Topic List

Comment