Sure tweety...

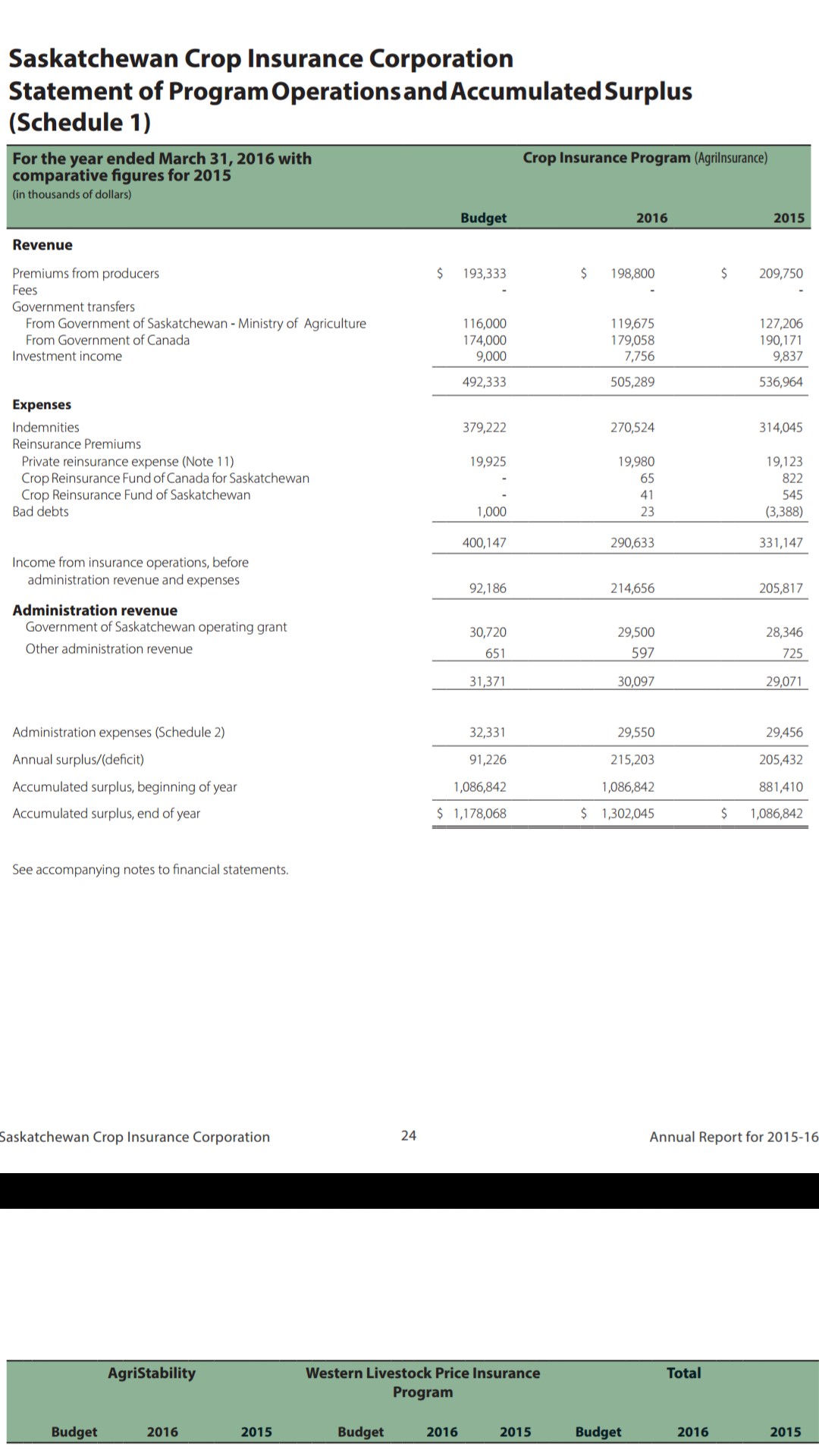

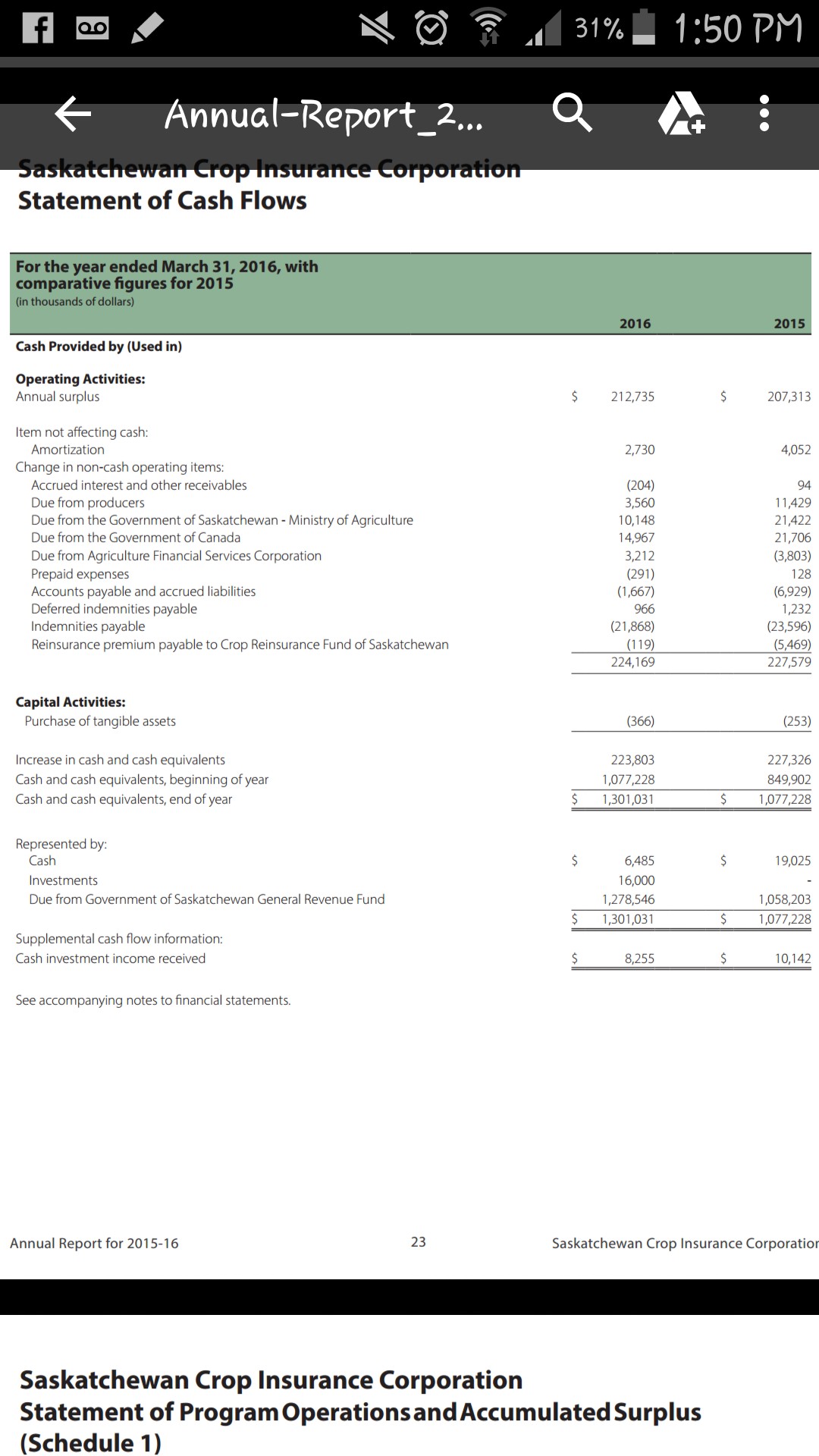

Except that the supposed 3rd we pay is actually more like a whole and plus some. SCIC actually provides money to the government... and not the other way around.

Farmer premiums pay into a profitable business (for the government)

Insurance doesn't need to be profitable but if it doesn't cover your expenses what's the point?

If you've been farming for 30 years growing crops on summer fallow and and little input expenses you get rewarded with low premiums and still decent for your management style coverage.

If you're a high input high production farmer and you started recently you get shorty coverage and rediculous premiums.

What am I missing here?

When 42 inches of rain floods out your crop or two hail storms in two weeks roll through your farm that's not really something you can plan for or manage through...

Except that the supposed 3rd we pay is actually more like a whole and plus some. SCIC actually provides money to the government... and not the other way around.

Farmer premiums pay into a profitable business (for the government)

Insurance doesn't need to be profitable but if it doesn't cover your expenses what's the point?

If you've been farming for 30 years growing crops on summer fallow and and little input expenses you get rewarded with low premiums and still decent for your management style coverage.

If you're a high input high production farmer and you started recently you get shorty coverage and rediculous premiums.

What am I missing here?

When 42 inches of rain floods out your crop or two hail storms in two weeks roll through your farm that's not really something you can plan for or manage through...

ayout ratio agristability pays out better than crop insurance.

ayout ratio agristability pays out better than crop insurance.

Comment