Originally posted by chuckChuck

View Post

Announcement

Collapse

No announcement yet.

With green energy halt, UCP declares a moratorium on Alberta's reputation

Collapse

Logging in...

Welcome to Agriville! You need to login to post messages in the Agriville chat forums. Please login below.

X

-

But are they the cheapest at the point of consumption, anywhere in the world? So far they end up being the most expensive to the consumer. You have been unable to find even a single example to prove me wrong.

-

Majority of New Renewables Undercut Cheapest Fossil Fuel on Cost

https://www.irena.org/news/pressreleases/2021/Jun/Majority-of-New-Renewables-Undercut-Cheapest-Fossil-Fuel-on-Cost

The renewable projects added last year will reduce costs in the electricity sector by at least USD 6 billion per year in emerging countries, relative to adding the same amount of fossil fuel-fired generation. Two-thirds of these savings will come from onshore wind, followed by hydropower and solar PV. Cost savings come in addition to economic benefits and reduced carbon emissions. The 534 GW of renewable capacity added in emerging countries since 2010 at lower costs than the cheapest coal option are reducing electricity costs by around USD 32 billion every year.

Comment

-

Also my solar panels lowered my cost of electricity by nearly half.

https://www.iea.org/news/renewable-power-s-growth-is-being-turbocharged-as-countries-seek-to-strengthen-energy-security

Utility-scale solar PV and onshore wind are the cheapest options for new electricity generation in a significant majority of countries worldwide. Global solar PV capacity is set to almost triple over the 2022-2027 period, surpassing coal and becoming the largest source of power capacity in the world. The report also forecasts an acceleration of installations of solar panels on residential and commercial rooftops, which help consumers reduce energy bills. Global wind capacity almost doubles in the forecast period, with offshore projects accounting for one-fifth of the growth. Together, wind and solar will account for over 90% of the renewable power capacity that is added over the next five years.

The report sees emerging signs of diversification in global PV supply chains, with new policies in the United States and India expected to boost investment in solar manufacturing by as much as USD 25 billion over the 2022-2027 period. While China remains the dominant player, its share in global manufacturing capacity could decrease from 90% today to 75% by 2027.

Comment

-

Can you find an example of wind and solar making electricity cheaper for the consumer?

And in the example of your own solar panels, are you including the external costs your system puts onto the grid, which all other consumers are forced to subsidize? Are you including the capital costs? And what will those Capital costs be when you have to refinance them at todays interest rates?

Comment

-

Boy chuck has been busy scouring the IPCC propaganda.

There is no source of energy more dense and easily exploited than oil and gas. Not even nuclear comes close.

Wind and solar are the most diffuse and unreliable source of power imaginable. Its just that simple. And there is no where near the battery elements available on this planet to capture it. You think the oil sands pit mining is bad for the environment, imagine 1000s of those same mines across the planet looking for copper.

Its just pure delusion and chucks mind is gone.

Danny was right to pull the plug on these things. The one in Brooks has been shut down for 2 yrs and nobody has any money to pull the panels and supports. Took up a prime piece of real estate that could have been used for homes. Now its the biggest eyesore for miles. An orphan well is barely noticeable compared to this. My parents have one, its been capped, the land reclaimed around it so renters farm right up to it, oil company uses it as a disposal and my parents still get a cheque every year.

If solar was the boon thats been promised, you would see every homeowner rushing to install them on their roof. The adoption rate after like 25 yrs of pushing this stuff is miniscule.Last edited by jazz; Aug 6, 2023, 11:31.

Comment

-

Even better when pv manufacturing is completely reshored.Originally posted by chuckChuck View PostAlso my solar panels lowered my cost of electricity by nearly half.

https://www.iea.org/news/renewable-power-s-growth-is-being-turbocharged-as-countries-seek-to-strengthen-energy-security

Utility-scale solar PV and onshore wind are the cheapest options for new electricity generation in a significant majority of countries worldwide. Global solar PV capacity is set to almost triple over the 2022-2027 period, surpassing coal and becoming the largest source of power capacity in the world. The report also forecasts an acceleration of installations of solar panels on residential and commercial rooftops, which help consumers reduce energy bills. Global wind capacity almost doubles in the forecast period, with offshore projects accounting for one-fifth of the growth. Together, wind and solar will account for over 90% of the renewable power capacity that is added over the next five years.

The report sees emerging signs of diversification in global PV supply chains, with new policies in the United States and India expected to boost investment in solar manufacturing by as much as USD 25 billion over the 2022-2027 period. While China remains the dominant player, its share in global manufacturing capacity could decrease from 90% today to 75% by 2027.

For the sake of curiosity if the panels reduce your grid supplied power needs by 50% irrespective of govt programs will your panels pay before they wear out? I’ve looked into it with passing interest and seems interest free loans and incentives are needed to make it pay. At one time the same treatment was given to natural gas tie ins but now you pay the full shot and interesting how many propane tanks newer yard sites have. I can understand incentives just wonder at the end of the useful life of the array will there be another program or will homeowners leave them and go back to full grid power?

From my experiences owning varying qualities and sizes of pv’s you don’t buy junk and lifespan is 10 years. Think if you can keep them cool lifespan and power generating potential would be better.

Comment

-

Rising interest rates will be the death knell for solar and wind. Where all of the investment is upfront, do the calculations at 1% interest versus 8, or 10% interest over 30 years. They didn't make economic sense when interest rates were virtually zero. No they can't even come close to competing with reliable generation sources whose ongoing operating expenses are spread throughout their lifetimes, not in one lump sum at the beginning, requiring financing for their entire lifespan.Originally posted by WiltonRanch View Postseems interest free loans and incentives are needed to make it pay.

Comment

-

What a bunch of feeble and lame responses that still don't explain why a very large amount of new energy generation is coming from renewables. Even in Alberta of all places.

Danielle Smith blames Ottawa for moratorium on new wind and solar projects

Rob Drinkwater

Edmonton, alberta

The Canadian Press

Published 1 hour ago

Updated 47 minutes ago

Alberta Premier Danielle Smith says Ottawa is one of the reasons why her government has placed a moratorium on approving new wind and solar power projects, arguing the feds are preventing development of backup generation for renewable energy like natural gas.

Smith, whose government surprised the province’s renewable energy industry last week by announcing a six-month freeze on new projects greater than one megawatt, told her provincewide radio call-in program Saturday that backup plants powered by natural gas are needed for when wind isn’t blowing or the sun isn’t shining.

But, she said, the federal government doesn’t want Alberta to add any new natural gas electricity plants to the grid.

“So I’ve told them, how can I bring on additional wind and solar if I’m not able to secure the reliability of my power grid by being able to bring on natural gas peaker plants? That’s the heart of the problem,†Smith said.

“No one is proposing any new natural gas plants because the federal government has created so much uncertainty in the market.â€

Alberta risks losing billions in renewable energy investments with moratorium, companies say

The rationale was confusing for an energy market economist, as well as a representative of a renewable energy industry group, who said there isn’t a requirement in Alberta’s market for generators to be able to supply power 24-7.

“If somebody adds solar to the grid, you don’t need to add backup to compensate for it,†said Andrew Leach, a University of Alberta energy economist. “It just adds a source of cheap electricity for times when it is sunny outside.â€

“Essentially, you bring your power to the market every hour and see what it sells for.â€

Leach said it’s possible the addition of cheap wind and solar energy could discourage natural-gas powered projects by lowering the price of electricity. But he said the reverse is also true – that fossil fuel projects could discourage green ones.

He also said Alberta’s energy market, by law, operates on free and open competition.

Vittoria Bellissimo of the Canadian Renewable Energy Association said the province should remove impediments to energy storage projects, like tariffs that she said could treat storage providers the same as energy consumers or generators, as well as requiring them to buy energy when in fact they’re only storing it.

That way, she said green energy from solar and wind could be stored and released when it’s needed.

“The premier and others are under the impression that you have to have natural gas to make the system work, but you don’t. You need any type of resources that can time shift, and there’s lots of them out there,†she said.

In a statement Thursday when the moratorium on new projects was announced, the government said the Alberta Utilities Commission would initiate an inquiry into issues of development on agricultural land, effect on scenery, reclamation security, the role of municipalities and system reliability.

Alberta has been a leader in renewable energy development in Canada. In 2022, 17 per cent of its power came from wind and solar – exceeding the province’s 15 per cent goal.

Nathan Neudorf, minister of affordability and utilities, admitted the moratorium would be “a little bit of inconvenience now for the next few months†but was worthwhile to get things right for the long-term.

A representative of Rural Municipalities Alberta has said that while farmers and municipalities get tax and rent revenues from renewable energy, members are concerned about possible cleanup problems, similar to issues they’ve experienced with abandoned oil and gas wells. They’ve also said they’re concerned about agriculture being displaced.

Neudorf said he didn’t meet with industry before the announcement because of scheduling problems.

Smith told her radio audience on Saturday that a solar farm in her Brooks-Medicine Hat constituency in southern Alberta was covered for months with ice and snow, and wasn’t producing power.

“When we were in the winter, …several times the grid almost failed because we didn’t have enough power, and you can’t call up wind and solar on demand,†she said.

Leach countered that some solar projects are built in order to capture peak summer sunshine, and wondered why the province would intervene if they made economic sense for the landowners and power producers.

“When you stop and think about that for half a second it’s incredibly ironic because, of course, you’re not growing a lot of canola in the snow and ice, either.â€Last edited by chuckChuck; Aug 7, 2023, 06:50.

Comment

-

https://www.theglobeandmail.com/business/article-albertas-next-renewable-energy-challenge-places-to-store-the-power/

Alberta’s next renewable energy challenge? Places to store the power being generated

Jeffrey Jones

ESG and Sustainable Finance Reporter

Calgary

The Monarch, Vulcan and Coaldale solar farms in sunny southern Alberta started generating power last year, new entrants in a boom in renewables development that has changed the makeup of the provincial grid and may now may face a slowdown as the provincial government hits pause.

The projects were built by a joint venture of the Athabasca Chipewyan First Nation and Vancouver-based real estate and green-energy developer Concord Pacific Group at a cost of $140-million. They were designed to be much more efficient than they are today and are about to fulfill that promise.

The missing piece has been the ability to save up some of the power they generate. The partners are among six green-energy developers selected by the federal government to get funding, and will use the $45.8-million to add 15 megawatt, or 34 megawatt-hour, batteries to each solar farm.

This adds to a list of storage projects proposed by companies large and small in Alberta that tallies into the hundreds of millions of dollars and stands to play a major role decarbonizing the grid if government moves to slow the renewables industry do not derail proposals.

Terry Hui, Concord Pacific’s chief executive, said the batteries will allow the projects to feed the grid at almost all hours, smoothing out the well-known variability of solar generation. It’s expected to mean a 20-per-cent increase in output when commercial operations begin around the end of this year. The federal support and falling costs of the technology make it a solid proposition, he said.

“It’s good technology, but it was too expensive before. Now, with the government support and better battery technology that’s available, it makes a lot more sense,†Mr. Hui said in an interview.

There are now more than three dozen energy storage projects in the queue to be built in Alberta. Storage, in the forms of batteries, pumped hydro, compressed air and hydrogen, gets less attention than generation. With the province’s last coal-fired power plant slated to shut down in the coming months – seven years ahead of schedule – natural gas and renewables have made up the difference.

But are investments in danger? Industry proponents insist storage is key to Alberta moving to a low-carbon electricity network while helping to maintain its reliability. The technology helps smooth out the stop-and-start nature of wind and solar – the equipment is charged when power is generated, and feeds the grid when needed.

Alberta Premier Danielle Smith’s UCP government shocked the renewable energy industry last week, when it imposed a seven-month freeze on renewable project approvals. The government says it will use the time to review where projects can be built, how to ensure installations are cleaned up when they reach the end of their commercial lives and how the surge in wind and solar affects the grid. Industry supporters said the move is short-sighted and risks diverting investment capital to other jurisdictions.

Ms. Smith was already pushing back against Ottawa’s plan for a net-zero power grid by 2035, saying it would damage the provincial economy and pile massive costs onto consumers. She wants the province to shoot for a 2050 target instead.

The Alberta Electric System Operator (AESO) concluded last year that paths to decarbonization by 2035 all carry major risks because of policy uncertainty, the need for numerous regulatory approvals for projects, timelines for technology commercialization and potential supply chain problems. AESO estimates the cost of additional generation and transmission at $44-billion to $52-billion through 2041. Even then, it said, meeting a net-zero goal will require buying offsets to make up for emissions that can’t be abated.

The Pembina Institute disagrees. The energy and environment research body issued a report in June that said a net-zero grid is not just possible, but getting there will make the system more efficient and cost $27-billion to $28-billion less than under the AESO’s scenario. One of the keys will be a big buildup in energy storage capacity.

The AESO currently sees that capacity quintupling to 500 megawatts (MW) by 2027, but Pembina predicts a much steeper increase. Jason Wang, a senior analyst with the group, points out the system operator had previously been conservative forecasting renewables – their generation capacity is now at a level it did not expect for another decade. “We think the AESO has recognized that more batteries are coming than they previously expected, and that number will be beat again,†Mr. Wang said.

Adding up projects that have been financed and are waiting for regulatory approvals, capacity could climb to around 900 MW in the next two years, if they all get built, Mr. Wang said. That could put the province on track for Pembina’s most ambitious decarbonization scenario, one in which storage capacity equals a quarter of installed wind and solar capacity by 2035, and the grid hits net zero. Also key to the target: a greater proportion of renewable energy and expanded interties with British Columbia and Montana to boost capacity to import and export power.

AESO spokesperson Leif Sollid said the system operator, which has hosted an industry forum on storage for the past three years, can’t speculate on how the number of projects it expects could change over time, as it is driven by market interest.

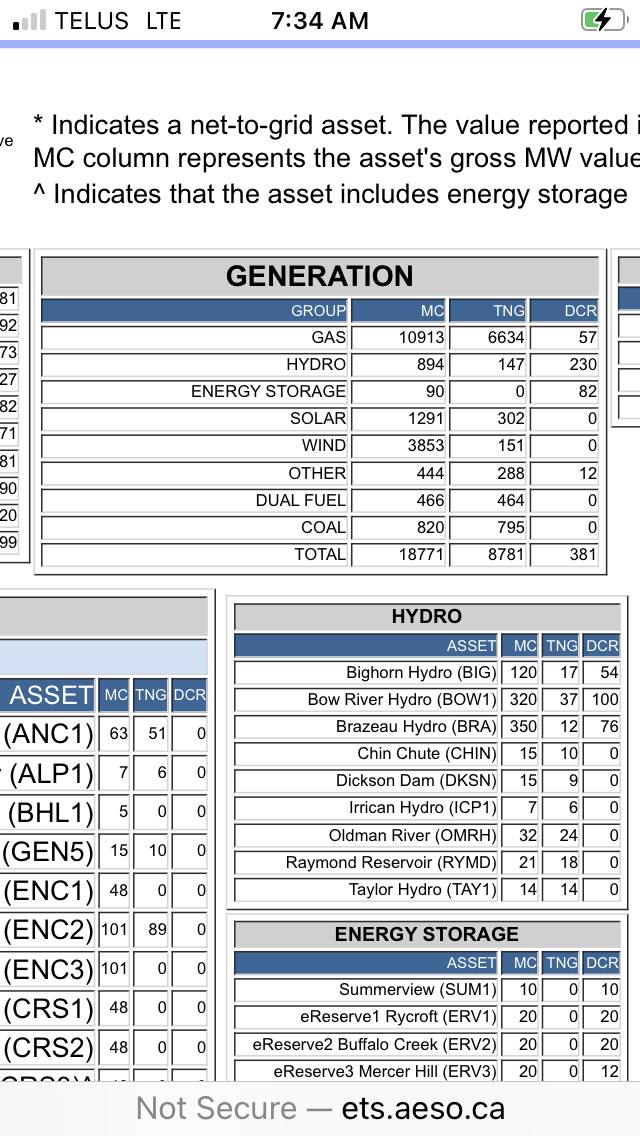

Alberta currently has about 100 MW of storage capacity in operation, 90 MW of which is tied to the grid. Energy Storage Canada, which represents the industry, sees 2,500 MW more in various stages of development.

“It’s unlikely that everything there will get built, but that’s just showing what’s in development and the interest now,†said Robert Tremblay, Energy Storage Canada’s policy manager. “I think as we go through to 2035, we’ll see a significant number of new projects emerge.â€

Currently there are 37 proposed storage projects at various stages of development, with in-service dates set for before October, 2026, according to AESO. Most are mated to new solar projects and some of the largest are being developed by Greengate Power Corp., Westbridge Renewable Energy Corp. and TC Energy Corp.

Seven are stand-alone, including a TransAlta Corp. battery project west of Calgary and a pumped hydro development in the Hinton-Edson region in the west-central part of the province. That system requires water reservoirs at different elevations, where the downward flow drives turbines when power is needed. It has the benefit of allowing for energy to be stored for days, rather than hours as with batteries. But it also requires large areas and the right topography.

Greengate built Canada’s largest solar farm near the town of Vulcan, Alta., and has another large project in the east of the province in the queue for regulatory approval, a 300 MW development with battery storage included. CEO Dan Balaban warns that the Alberta government’s decision to halt renewable power applications threatens to slow storage deployment, too.

“Energy storage is one of the lowest-cost and quickest-to-deploy solutions to address some of the grid stability and grid congestion issues that are being faced right now, and I think there’s a very strong future in theory for energy storage,†he said. “But there needs to be a framework to accommodate energy storage and encourage those projects to come onto the grid. This announcement puts a dark cloud over the entire industry until this is sorted out.â€

Yet Alberta’s growth has been part of a global trend. Battery storage deployment increased 52 per cent in 2022 from 2021, and the market could expand nearly six-fold, reaching US$72-billion by 2030 with a total capacity of 499.1 gigawatts, or 1,340 gigawatt-hours, according to Dublin-based Research and Markets. Meanwhile, the price per kilowatt hour has been on a steady decline as technology has improved......

Comment

-

Decarbonization isn’t the only benefit. As electric cars, heat pumps and other power-thirsty technology boosts electricity demand in the coming years, storage can also improve efficiency – pushing back some of the need to build major new transmission lines by sending extra juice into the parts of the network during times of high demand. Also, there has been so much renewable energy development in the windy and sunny southern part of Alberta that congestion is becoming a problem, so storage can provide a cushion.

Besides utility-size storage, there is also potential for smaller projects at the neighbourhood level designed to handle peak loads as electrification powers more of daily life, Mr. Tremblay said.

So far, grid-scale storage facilities not tied to individual generation projects have been slow to be built, partly because of a policy under which operators are charged the same as purchasers of power, and talks are now under way to change that. Enfinite Inc., which is owned by TD Asset Management, is an early entrant into the merchant storage game, with four projects now in operation in the province, and five more due online before the end of this year.

The company has been installing 20 MW banks of “Megapack†battery systems made by Tesla Inc. under a project it calls eReserve, to play a merchant role for the grid, said Jason White, Enfinite’s chief operating officer. He cautions that battery storage alone won’t get Alberta’s grid to net zero. But Enfinite’s strategy has been to push forward in the merchant storage business to gain the advantage of an early mover as conditions improve.

“People are kind of sitting back and waiting to see where things go. I think the ramp rate of energy storage in Alberta is not steep enough – it’s just not coming online as quickly as we probably could use it,†he said. “But that being said, I don’t think that storage is necessarily the silver bullet. It’s just a component of a new energy mix.â€

Comment

-

Chuck2, as usual the long blah blah of hypothetical cut and pastes. Looking at the AESO supply and demand page. On day 2 of virtually no wind production. As well if solar panels are charging batteries obviously it lower the numbers of houses it will power during the day. If they get to 25% storage capacity of solar and wind is that based on high production days or days like today? Wind is producing at 4.28% capacity right now. If you looked at capital costs is wind the cheapest source of generation right now? Hardly.

Comment

-

It takes a lot of Coal to make all of the low carbon solar panels and electric vehicle batteries and all of the raw products and components for the Green revolution. We can't afford to make them using low cost renewable energy.Originally posted by Hamloc View PostI see China is still building coal fired generation. Approved enough coal generation in the first 6 months of 2023 to power Western Canada.

As an added bonus, the Green revolution makes energy so expensive everywhere it is put into practice, that China continues to need increasing quantities of coal generation to power all of the industries forced into China's arms by prohibitive energy prices in all of the green countries where their solar panels are being installed.

It's a win-win for both China, and the coal industry.Last edited by AlbertaFarmer5; Aug 7, 2023, 17:05.

Comment

-

Yes absolute madness from the flat earther climate change deniers who think there is no problem with massive fossil fuel emissions!

Comment

- Reply to this Thread

- Return to Topic List

Comment