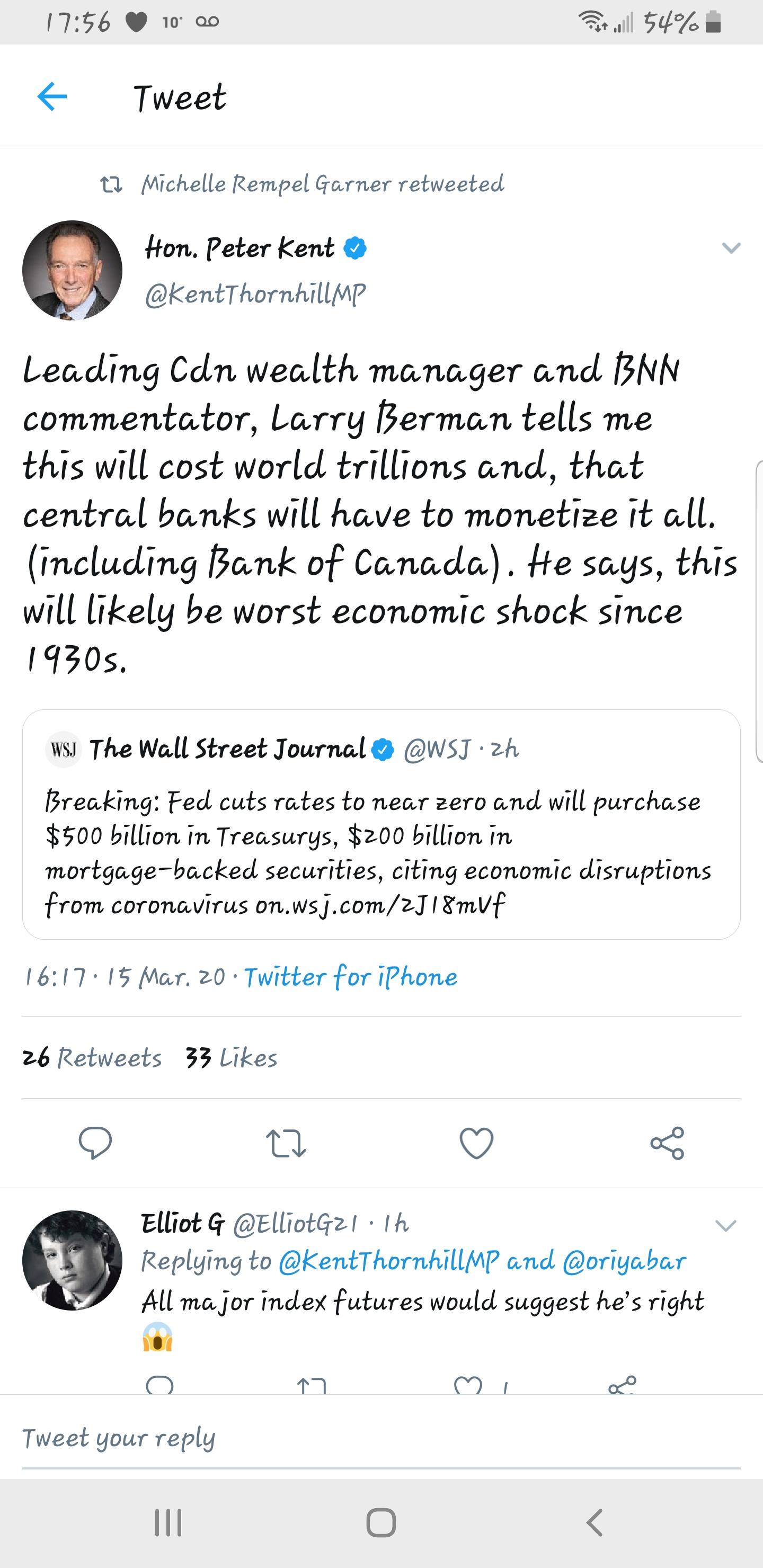

Federal Reserve cuts rates to zero and launches massive $700 billion quantitative easing program

In an emergency move Sunday, the Federal Reserve announced it is dropping its benchmark interest rate to zero and launching a new round of quantitative easing.

The QE program will entail $500 billion worth of asset purchases entailing Treasurys and mortgage-backed securities.

The Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,†cut interest rates to zero on Sunday and launched a massive $700 billion quantitative easing program to shelter the economy from the effects of the virus.

Facing highly disrupted financial markets, the Fed also slashed the rate of emergency lending at the discount window for banks by 125 bps to 0.25%, and lengthened the term of loans to 90 days.

The Fed also cut reserve requirement ratios for thousands of banks to zero. In addition, in a global coordinated move by centrals banks, the Fed said the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank took action to enhance dollar liquidity around the world through existing dollar swap arrangements.

The banks lowered the rate on these swap line loans and extended the period for such loans. Fed Chairman Jerome Powell is scheduled to hold a press conference via telephone at 6 pm eastern time. The actions by the Fed appeared to be the largest single day set of moves the bank had ever taken, mirroring in many ways its efforts during the financial crisis that were rolled out over several months. Sunday’s move includes multiple programs, rate cuts and QE, but all in a single day.

The quantitative easing will take the form of $500 billion of Treasurys and $200 billion of agency-backed mortgage securities. The Fed said the purchases will begin Monday with a $40 billion installment.

The Fed cut rates to a new range of 0% to 0.25% from 1% to 1.25% and said it would remain there “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.â€

Cleveland Fed President Loretta Mester was the lone no vote, preferring to set rates at 0.5% to 0.75%, which would have represented a 50 basis point, of half percentage point, reduction.

The Fed added in its statement that it “is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.â€

It appeared, though it was not entirely clear, that the meeting that took place will replace the regularly scheduled meeting of the Federal Open Market Committee.

The move follows several actions by the Fed over the past two weeks in which it enacted a 50 basis point emergency rate cut and expanded the overnight credit offering, or repo, for the financial system up to $1.5 trillion.

In an emergency move Sunday, the Federal Reserve announced it is dropping its benchmark interest rate to zero and launching a new round of quantitative easing.

The QE program will entail $500 billion worth of asset purchases entailing Treasurys and mortgage-backed securities.

The Federal Reserve, saying “the coronavirus outbreak has harmed communities and disrupted economic activity in many countries, including the United States,†cut interest rates to zero on Sunday and launched a massive $700 billion quantitative easing program to shelter the economy from the effects of the virus.

Facing highly disrupted financial markets, the Fed also slashed the rate of emergency lending at the discount window for banks by 125 bps to 0.25%, and lengthened the term of loans to 90 days.

The Fed also cut reserve requirement ratios for thousands of banks to zero. In addition, in a global coordinated move by centrals banks, the Fed said the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, and the Swiss National Bank took action to enhance dollar liquidity around the world through existing dollar swap arrangements.

The banks lowered the rate on these swap line loans and extended the period for such loans. Fed Chairman Jerome Powell is scheduled to hold a press conference via telephone at 6 pm eastern time. The actions by the Fed appeared to be the largest single day set of moves the bank had ever taken, mirroring in many ways its efforts during the financial crisis that were rolled out over several months. Sunday’s move includes multiple programs, rate cuts and QE, but all in a single day.

The quantitative easing will take the form of $500 billion of Treasurys and $200 billion of agency-backed mortgage securities. The Fed said the purchases will begin Monday with a $40 billion installment.

The Fed cut rates to a new range of 0% to 0.25% from 1% to 1.25% and said it would remain there “until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.â€

Cleveland Fed President Loretta Mester was the lone no vote, preferring to set rates at 0.5% to 0.75%, which would have represented a 50 basis point, of half percentage point, reduction.

The Fed added in its statement that it “is prepared to use its full range of tools to support the flow of credit to households and businesses and thereby promote its maximum employment and price stability goals.â€

It appeared, though it was not entirely clear, that the meeting that took place will replace the regularly scheduled meeting of the Federal Open Market Committee.

The move follows several actions by the Fed over the past two weeks in which it enacted a 50 basis point emergency rate cut and expanded the overnight credit offering, or repo, for the financial system up to $1.5 trillion.

Comment